Rite Aid 2013 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2013 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 2, 2013, March 3, 2012 and February 26, 2011

(In thousands, except per share amounts)

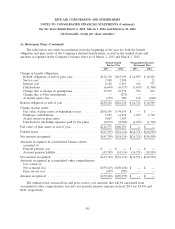

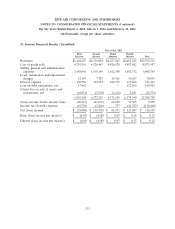

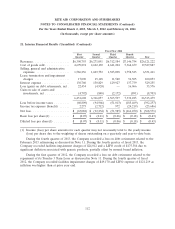

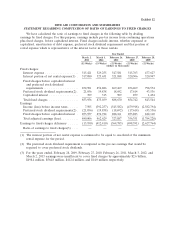

19. Supplementary Cash Flow Data

Year Ended

March 2, March 3, February 26,

2013 2012 2011

Cash paid for interest (net of capitalized

amounts of $399, $315 and $509) ........ $ 482,145 $ 528,894 $ 464,456

Cash (refund) payments for income taxes, net . $ (776) $ 4,913 $ 4,907

Equipment financed under capital leases .... $ 7,906 $ 7,052 $ 4,622

Equipment received for noncash consideration $ 3,285 $ 3,616 $ 3,476

Preferred stock dividends paid in additional

shares ............................ $ 10,528 $ 9,919 $ 9,346

Non-cash reduction in lease financing

obligation ......................... $ — $ — $ —

Accrued capital expenditures ............. $ 45,456 $ 45,454 $ 37,557

Gross borrowings from revolver ........... $1,117,000 $2,654,000 $1,511,000

Gross repayments to revolver ............. $ 588,000 $2,546,000 $1,563,000

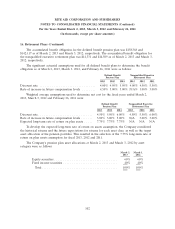

20. Related Party Transactions

There were receivables from related parties of $23 and $77 at March 2, 2013 and March 3, 2012,

respectively.

As of March 2, 2013, the Jean Coutu Group owned 178,401,162 shares (19.0% of the voting power

of the Company) of common stock. On April 17, 2013, the Jean Coutu Group announced that it had

sold 72,500,000 of its 178,401,162 shares of Rite Aid’s common stock. As a result of such sale, the Jean

Coutu Group was required to cause one of its designees to immediately resign from Rite Aid’s board

of directors and accordingly, Michel Coutu resigned from Rite Aid’s board of directors effective

April 17, 2013. At this level of ownership, the Jean Coutu Group (and, subject to certain conditions,

certain members of the Coutu family) have the right to designate one of the nine members of the

Company’s board of directors, subject to adjustment for future reductions in its ownership position in

the Company.

The Company had a financial advisory services agreement with Leonard Green & Partners, L.P. to

pay a monthly fee of $12.5 plus out-of-pocket expenses which was terminated in fiscal 2012. The

Company paid fees of $38 and $163 for financial advisory services and expense reimbursements of $67

and $151, in fiscal 2012 and fiscal 2011, respectively.

110