Rite Aid 2013 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2013 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The primary drivers of our impairment charges are each store’s current and historical operating

performance and the assumptions that we make about each store’s operating performance in future

periods. Projected cash flows are updated based on the next year’s operating budget which includes the

qualitative factors noted above. We are unable to predict with any degree of certainty which individual

stores will fall short or exceed future operating plans. Accordingly, we are unable to describe future

trends that would affect our impairment charges, including the likely stores and their related asset

values that may fail their recoverability test in future periods.

To the extent that actual future cash flows differ from our projections materially, because of the

reasons discussed above, certain stores that are either not impaired or partially impaired in the current

period may be further impaired in future periods. A 100 basis point decrease in our future sales

assumptions as of March 2, 2013 would have resulted in an additional fiscal 2013 impairment charge of

$13.0 million. A 100 basis point increase in our future sales assumptions as of March 2, 2013 would

have reduced the fiscal 2013 impairment charge by $4.0 million. Changes in our discount rate of 50

basis points would not have a material impact on the total impairment recorded in fiscal 2013.

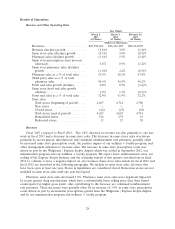

Lease Termination Charges: Charges to close a store, which principally consist of continuing lease

obligations, are recorded at the time the store is closed and all inventory is liquidated, pursuant to the

guidance set forth in ASC 420, ‘‘Exit or Disposal Cost Obligations.’’ We calculate our liability for

closed stores on a store-by-store basis. The calculation includes the discounted effect of future

minimum lease payments and related ancillary costs, from the date of closure to the end of the

remaining lease term, net of estimated cost recoveries that may be achieved through subletting

properties or through favorable lease terminations. We evaluate these assumptions each quarter and

adjust the liability accordingly. As part of our ongoing business activities, we assess stores and

distribution centers for potential closure. Decisions to close or relocate stores or distribution centers in

future periods would result in lease termination charges for lease exit costs and liquidation of

inventory, as well as impairment of assets at these locations.

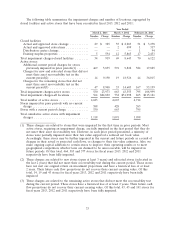

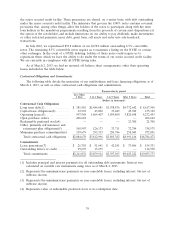

In fiscal 2013, 2012 and 2011, we recorded lease termination charges of $46.0 million, $48.1 million

and $95.8 million. These charges related to changes in future assumptions, interest accretion and

provisions for 14 stores in fiscal 2013, 23 stores in fiscal 2012, and 52 stores and one distribution center

in fiscal 2011.

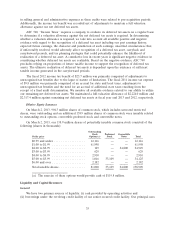

Interest Expense

In fiscal 2013, 2012, and 2011, interest expense was $515.4 million, $529.3 million and

$547.6 million, respectively. The reduction in interest expense in fiscal 2013 compared to fiscal 2012 is

primarily due to one less week in the current year. The reduction in interest expense in fiscal 2012

compared to fiscal 2011 is primarily due to favorable interest rates resulting from our March 2011

Tranche 3 Term Loan refinancing and the August 2010 refinancing of our Tranche 4 Term Loan

partially offset by the impact of the fifty-third week.

The annual weighted average interest rates on our indebtedness in fiscal 2013, 2012 and 2011 were

7.1%, 7.4% and 7.5%, respectively.

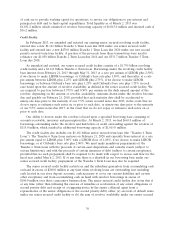

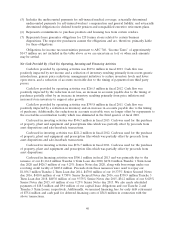

Income Taxes

Income tax benefit of $110.6 million, income tax benefit of $23.7 million and income tax expense

of $9.8 million, has been recorded for fiscal 2013, 2012 and 2011, respectively. Net Income for fiscal

2013 included income tax benefit of $110.6 million primarily comprised of adjustments to unrecognized

tax benefits for the appellate settlements of the Brooks Eckerd IRS Audit for the fiscal years

2004 - 2007 and the Commonwealth of Massachusetts Audit for fiscal years 2005 - 2007 as well as for

the lapse of statute of limitations. The appellate settlements as well as the majority of the lapse of

statue of limitations is offset by a reversal of the related tax indemnification asset which was recorded

34