Rite Aid 2013 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2013 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13APR201302373847

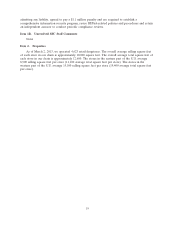

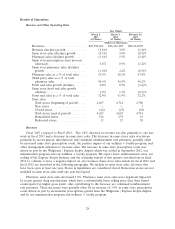

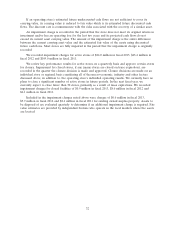

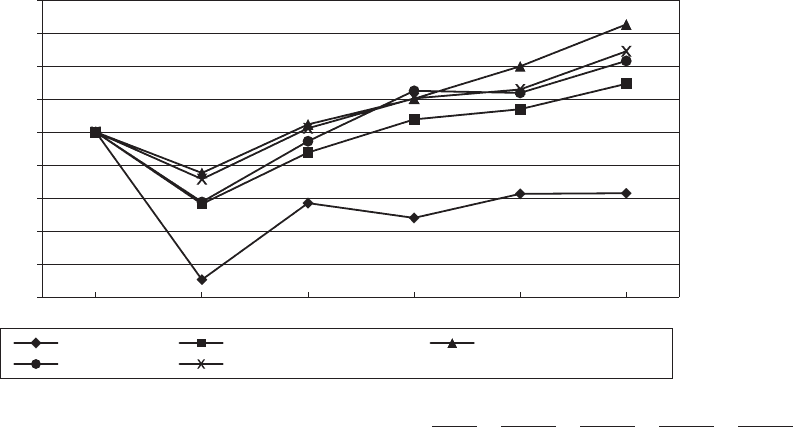

STOCK PERFORMANCE GRAPH

The graph below compares the yearly percentage change in the cumulative total stockholder return

on our common stock for the last five fiscal years with the cumulative total return on (i) the Russell

1000 Consumer Staples Index, (ii) the Russell 2000 Consumer Staples Index, (iii) the Russell 1000

Index, and (iv) the Russell 2000 Index, over the same period (assuming the investment of $100.00 in

our common stock and such indexes on March 1, 2008 and reinvestment of dividends).

For comparison of cumulative total return, we have elected to use the Russell 2000 Consumer

Staples Index, consisting of 66 companies, and the Russell 2000 Index. In the past we used the Russell

1000 Consumer Staples Index and the Russell 1000 Index but we feel this is a better comparison of the

company to a peer group of similar sized companies. The Russell 2000 Consumer Staples Index is a

capitalization-weighted index of companies that provide products directly to consumers that are

typically considered nondiscretionary items based on consumer purchasing habits. The Russell 2000

Index consists of the smallest 2000 companies in the Russell 3000 Index and represents the universe of

small capitalization stocks from which many active money managers typically select.

STOCK PERFORMANCE GRAPH

Comparison of 5 Year Cumulative Total Return

Assumes Initial Investment of $100

March 2013

3/1/2008 3/3/2012 3/2/20132/26/2011

0.00

160.00

120.00

140.00

100.00

80.00

60.00

40.00

20.00

2/28/2009 2/27/2010

180.00

Russell 1000 Consumer Staples IndexRussell 1000 IndexRite Aid Corporation

Russell 2000 Index Russell 2000 Consumer Staples Index

2009 2010 2011 2012 2013

RITE AID CORP .............................. 10.49 56.93 47.94 62.55 62.92

Russell 1000 Index .............................. 56.39 87.59 107.68 113.87 129.28

Russell 1000 Consumer Staples Index ................ 75.19 104.65 120.22 139.89 165.28

Russell 2000 Index .............................. 57.62 94.46 125.03 123.76 143.17

Russell 2000 Consumer Staples Index ................ 71.47 102.31 120.44 125.83 149.00

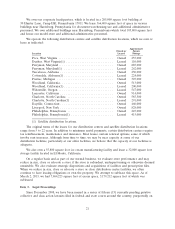

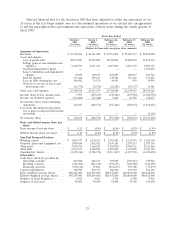

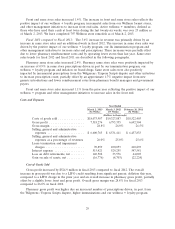

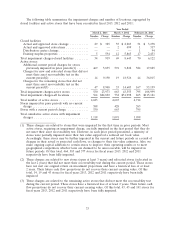

Item 6. Selected Financial Data

The following selected financial data should be read in conjunction with ‘‘Management’s

Discussion and Analysis of Financial Condition and Results of Operations’’ and the audited

consolidated financial statements and related notes.

24