Rite Aid 2013 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2013 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.March 2, 2013, a 50 basis point variance in the credit adjusted risk free interest rate would have

affected pretax income by approximately $2.3 million for fiscal 2013.

Income taxes:

We currently have net operating loss (‘‘NOL’’) carryforwards that can be utilized to offset future

income for federal and state tax purposes. These NOLs generate significant deferred tax assets which

are currently offset by a valuation allowance. We regularly review the deferred tax assets for

recoverability considering the relative impact of negative and positive evidence including our historical

profitability, projected taxable income, the expected timing of the reversals of existing temporary

differences and tax planning strategies. The weight given to the potential effect of the negative and

positive evidence is commensurate with the extent to which it can be objectively verified. We establish a

valuation allowance against deferred tax assets when we determine that it is more likely than not that

some portion of our deferred tax assets will not be realized. There have been no significant changes in

the assumptions used to calculate our valuation allowance over the last three years. However, changes

in market conditions and the impact of the acquisition of Brooks Eckerd on operations have caused

changes in the valuation allowance from period to period which were included in the tax provision in

the period of change.

We recognize tax liabilities in accordance with ASC 740, ‘‘Income Taxes’’ and we adjust these

liabilities when our judgment changes as a result of the evaluation of new information not previously

available. Due to the complexity of some of these uncertainties, the ultimate resolution may result in a

payment that is materially different from our current estimate of the tax liabilities.

Litigation reserves: We are involved in litigation on an on-going basis. We accrue our best estimate

of the probable loss related to legal claims. Such estimates are based upon a combination of litigation

and settlement strategies. These estimates are updated as the facts and circumstances of the cases

develop and/or change. To the extent additional information arises or our strategies change, it is

possible that our best estimate of the probable liability may also change. Changes to these reserves

during the last three fiscal years were not material.

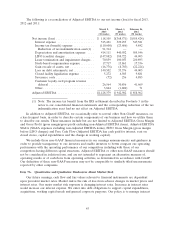

Adjusted EBITDA and Other Non-GAAP Measures

In addition to net income determined in accordance with GAAP, we use certain non-GAAP

measures, such as ‘‘Adjusted EBITDA’’, in assessing our operating performance. We believe the

non-GAAP metrics serve as an appropriate measure to be used in evaluating the performance of our

business. We define Adjusted EBITDA as net income (loss) excluding the impact of income taxes (and

any corresponding reduction of tax indemnification asset), interest expense, depreciation and

amortization, LIFO adjustments, charges or credits for facility closing and impairment, inventory write-

downs related to store closings, stock- based compensation expense, debt retirements, sale of assets and

investments, revenue deferrals related to customer loyalty programs and other items. We reference this

particular non-GAAP financial measure frequently in our decision-making because it provides

supplemental information that facilitates internal comparisons to the historical operating performance

of prior periods and external comparisons to competitors’ historical operating performance. In addition,

incentive compensation is based on Adjusted EBITDA and we base certain of our forward- looking

estimates on Adjusted EBITDA to facilitate quantification of planned business activities and enhance

subsequent follow-up with comparisons of actual to planned Adjusted EBITDA.

44