Rite Aid 2013 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2013 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Front end same store sales increased 1.4%. The increase in front end same store sales reflects the

positive impact of our wellness + loyalty program, incremental sales from our Wellness format stores,

and other management initiatives to increase front end sales. Active wellness + members, defined as

those who have used their cards at least twice during the last twenty-six weeks, was over 25 million as

of March 2, 2013. We have completed 797 Wellness store remodels as of March 2, 2013.

Fiscal 2012 compared to Fiscal 2011: The 3.6% increase in revenue was primarily driven by an

increase in same store sales and an additional week in fiscal 2012. The increase in same store sales was

driven by the positive impact of our wellness + loyalty program, our flu immunization program and

other management initiatives to increase sales and prescriptions. These increases were partially offset

due to lower pharmacy reimbursement rates and by operating fewer stores than last year. Same store

sales trends for fiscal 2012 and fiscal 2011 are described in the following paragraphs.

Pharmacy same store sales increased 2.4%. Pharmacy same store sales were positively impacted by

an increase of 0.9% in same store prescriptions driven in part by our immunization program, our

wellness + loyalty program and inflation on brand drugs. Same store sales were also positively

impacted by incremental prescriptions from the Walgreens / Express Scripts dispute and other initiatives

to increase prescription count, partially offset by an approximate 1.7% negative impact from new

generic introductions and lower reimbursement rates from pharmacy benefit managers and government

payors.

Front end same store sales increased 1.1% from the prior year reflecting the positive impact of our

wellness + program and other management initiatives to increase sales in the front end.

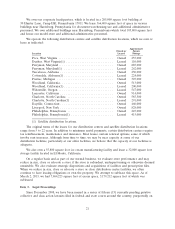

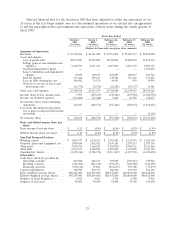

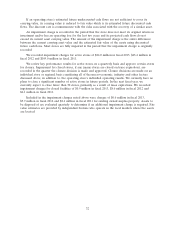

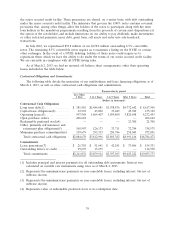

Costs and Expenses

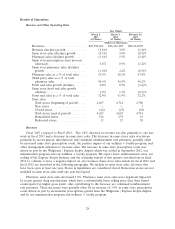

Year Ended

March 2, 2013 March 3, 2012 February 26, 2011

(52 Weeks) (53 Weeks) (52 Weeks)

(Dollars in thousands)

Costs of goods sold ............... $18,073,987 $19,327,887 $18,522,403

Gross profit .................... 7,318,276 6,793,335 6,692,504

Gross margin ................... 28.8% 26.0% 26.5%

Selling, general and administrative

expenses ..................... $ 6,600,765 $ 6,531,411 $ 6,457,833

Selling, general and administrative

expenses as a percentage of revenues 26.0% 25.0% 25.6%

Lease termination and impairment

charges ...................... 70,859 100,053 210,893

Interest expense ................. 515,421 529,255 547,581

Loss on debt retirements, net ........ 140,502 33,576 44,003

Gain on sale of assets, net .......... (16,776) (8,703) (22,224)

Cost of Goods Sold

Gross profit increased by $524.9 million in fiscal 2013 compared to fiscal 2012. The overall

increase in gross profit was due to a LIFO credit resulting from significant generic deflation this year,

compared to a LIFO charge in the prior year and an overall increase in pharmacy gross profit, partially

offset by a slightly lower front end gross profit. Overall gross margin was 28.8% for fiscal 2013

compared to 26.0% in fiscal 2012.

Pharmacy gross profit was higher due an increased number of prescriptions driven, in part, from

the Walgreens / Express Scripts dispute, higher immunizations and our wellness + loyalty program.

29