Qantas 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE QANTAS GROUP 62

for the year ended 30 June 2011

Notes to the Financial Statements continued

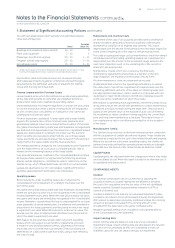

— Amendments to IAS Presentation of Financial Statement –

Presentation of Items of Other Comprehensive Income makes a

number of changes to the presentation of other comprehensive

income, including presenting separately those items that would be

reclassied to prot or loss in the future and those that would

never be reclassied to prot or loss and the impact of tax on

those items. The amendments are generally to be applied

retrospectively. The amendments, which become mandatory for

the Qantas Group’s June Financial Statements, will only

impact the presentation of other comprehensive income in the

Consolidated Statement of Comprehensive Income

— IFRS Consolidated Financial Statements introduces a new

approach determining which investees should be consolidated.

IFRS Joint Arrangements requires a joint arrangement to be

partially consolidated when the parties have rights and obligations

for underlying assets and liabilities. IFRS Disclosures of Interests

in Other Entities contains revised disclosure requirements for entities

that have interest in subsidiaries, joint arrangements, associates

and/or unconsolidated structured entities. IAS Separate Financial

Statements carries forward the existing accounting and disclosure

requirement for separate nancial statements with some minor

clarications. IAS Investments in Associates () makes limited

amendments to interest in associates and joint ventures and how

to account for changes in interests in joint ventures and associates.

IFRS Fair Value Measurement explains how to measure fair value

when required to by other accounting standards. The amendments

are generally to be applied retrospectively. The above amendments,

which become mandatory for the Qantas Group’s June

Financial Statements, are not expected to have any impact

1. Statement of Signicant Accounting Policies continued

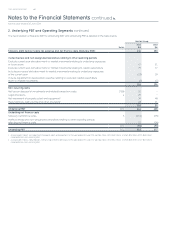

2. Underlying PBT and Operating Segments

A UNDERLYING PBT

Underlying PBT is the primary reporting measure used by the Qantas Group’s chief operating decision-making bodies, being the Executive

Committee and the Board of Directors, for the purpose of assessing the performance of the Group.

The primary reporting measure of the Qantas Group’s operating segments is Underlying EBIT. Underlying EBIT excludes net nance costs

from Underlying PBT as these costs are managed centrally and are not allocated to operating segments. Refer to Note (D) for a detailed

description of Underlying PBT and a reconciliation of Statutory EBIT to Underlying EBIT and Underlying PBT.

B DESCRIPTION OF OPERATING SEGMENTS

The Qantas Group comprises the following main operating segments:

. Qantas – representing the Qantas passenger ying businesses and related businesses

. Jetstar – representing the Jetstar passenger ying businesses, including Jetstar Asia and the investment in Jetstar Pacic Airlines Aviation

Joint Stock Company

. Qantas Frequent Flyer – representing the Qantas Frequent Flyer customer loyalty program

. Qantas Freight – representing the air cargo and express freight businesses

Costs associated with the centralised management and governance of the Qantas Group, together with certain items which are not allocated

to business segments, are reported as Corporate/Unallocated.

Fuel and foreign exchange hedge gains/losses are allocated to segments based on the timing of underlying transactions.

Intersegment revenue has been determined on an arm’s length basis or a cost plus margin basis depending on the nature of the revenue.

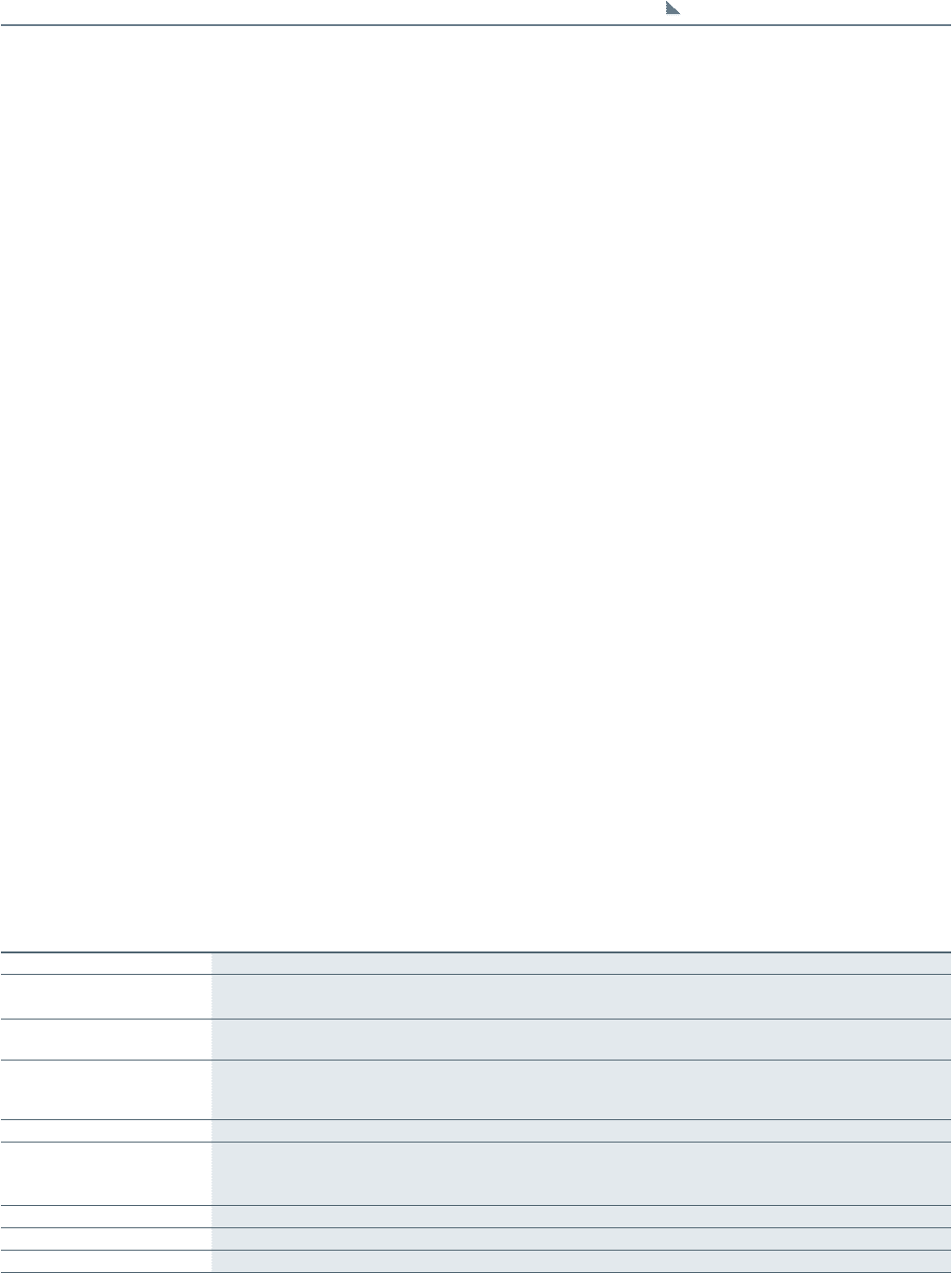

C ANALYSIS BY OPERATING SEGMENT

$M Qantas Jetstar

Qantas

Frequent

Flyer

Qantas

Freight

Jetset

Travelworld

Group

Corporate/

Unallocated Eliminations

Consolidated

Underlying

REVENUE AND OTHER INCOME

External segment revenue , , , , ,

Intersegment revenue , (,) –

Total segment revenue

and other income , , , , (,) ,

Share of net prot/(loss)

of associates and jointly

controlled entities () – – – –

EBITDAR, () ,

Non-cancellable operating

lease rentals () () –() – – ()

Depreciation and amortisation(,) () () () () () () (,)

Underlying EBIT ()

Underlying net nance costs ()

Underlying PBT

. As a result of the merger of Jetset Travelworld Group with Stella Travel Services as described in Note (B), Jetset Travelworld Group is no longer an operating segment as

of October . Consequently, the results of the Jetset Travelworld Group segment for the year ended June represent the results for the period from July

to September . From October , the equity accounted result of the Group’s investment in Jetset Travelworld Group is included in the Qantas segment.

. EBITDAR (Underlying earnings before income tax expense, depreciation, amortisation, non-cancellable operating lease rentals and net nance costs) includes $ million (Qantas

$ million and Jetstar $ million) representing the full year impact of the change in estimates for major cyclical maintenance costs for operating leased aircraft as described in Note (C).

. Depreciation and amortisation includes $ million (Qantas $ million and Jetstar $ million) representing the full year impact of the change in residual value estimates for passenger

aircraft as described in Note (C). Additionally, it includes $ million (Qantas $ million and Jetstar $ million) representing the full year impact of the change in estimates for major cyclical

maintenance costs for operating leased aircraft as described in Note (C).