Qantas 2011 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2011 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE QANTAS GROUP 18

for the year ended 30 June 2011

Review of Operations continued

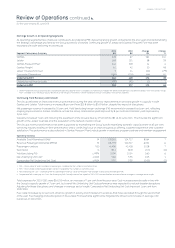

Capital Expenditure Supported by Strong Balance Sheet and Operating Cash Flows

Operating cash ows grew to $. billion, an increase of per cent on the prior year result of $, million. This reects the Group’s growth in

earnings and improvements in working capital.

The Group invested $. billion in capital expenditure during the year. This includes the purchase of aircraft, progress payments on future

deliveries, and continued investment in customer product and infrastructure.

Qantas Group cash was $. billion at June , a decrease of $ million from June . This reects the use of cash to fund

a number of aircraft purchases and the deconsolidation of $ million of cash held in Jetset Travelworld Group.

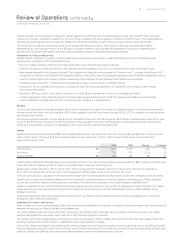

Cash Flow Summary

$M

$M

Change

$M

Change

%

Cash at beginning , ,

Operating cash ow , ,

Investing cash ow (,) (,) ()

Financing cash ow

Effect of foreign exchange on cash () –() ()

Cash at year end , , () ()

The Group’s balance sheet, operating cash ows and capital position remain strong. A conservative approach to capital management and

strengthening Operating cash ows provide ongoing exibility to support capital expenditure and other funding requirements, while supporting

an investment grade credit rating. At June the Group’s gearing ratio was per cent.

Debt and Gearing Analysis

Net debt$M , ,

Net debt including off balance sheet debt$M , ,

Equity (excluding hedge reserves) $M , ,

Net debt to net debt and equity ratio : :

. Includes fair value of hedges related to debt and aircraft security deposits.

. Includes non-cancellable operating leases. Non-cancellable operating leases are a representation assuming assets are owned and debt funded and are not consistent with the

disclosure requirements of AASB: Leases.

. Gearing ratio is Net debt to net debt and equity (including balance sheet debt from operating leases excluding hedge reserves).

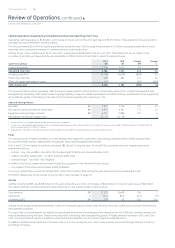

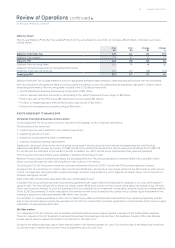

Fleet

The Qantas Group remains committed to a eet strategy that supports its objectives of two strong complementary brands and provides

for long-term eet renewal, simplication and growth, whilst retaining signicant exibility.

At June the Qantas Group eet comprised aircraft. During the year, aircraft ( purchased and nine leased) were newly

entered into service:

— Qantas – four Airbus As, one A-, ve Boeing B-s and one Bombardier Q

— Jetstar, including Jetstar Asia – A-s, two A-s

— Qantas Freight – one B- Freighter

In addition, the Group added nine aircraft through the acquisition of the Network Aviation Group:

— Two Fokker Fs and seven Embraer EMB Brasilia

The Group retired three owned aircraft (two B-s and one B-) during the year and returned one leased B-.

For further details refer to the Qantas Group Aircraft in Service table on page .

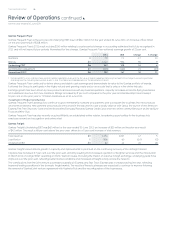

Qantas

Qantas’ Underlying EBIT was $ million for the year ended June , an increase of $ million on the prior year result of $ million.

The result is per cent above the prior year, driven by a per cent increase in total revenue.

Total revenue $M , ,

Seat factor %. . (.) ()

Underlying EBIT $M

Qantas achieved signicant improvements in yield on increased capacity ( per cent). Revenue recovery continued across both international

and domestic business.

The result was achieved despite the signicant operational and nancial challenges of the disruptions to the A eet, weather events and

natural disasters during the year. These events impacted scheduling and disrupted thousands of ights between November and June

. The total nancial impact of weather events and natural disasters on the Qantas segment was $ million.

In addition, Qantas faced signicant increases in the cost of fuel during the year, which were partially recovered through fare price and fuel

surcharge increases.