Qantas 2011 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2011 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

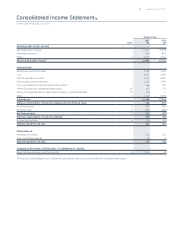

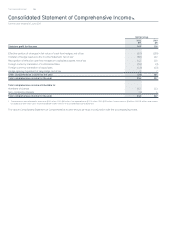

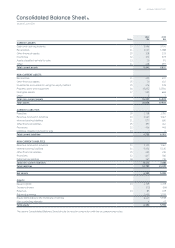

THE QANTAS GROUP 42

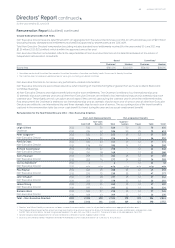

for the year ended 30 June 2011

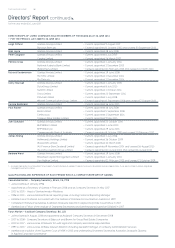

. Ms Hrdlicka was appointed to the role of Group Executive Strategy and Technology effective February and her key contract terms are outlined on page .

. The remuneration for Mr Kella is disclosed above as Mr Kella is among the ve highest paid senior managers of Qantas. Mr Kella departed from the Qantas Group on July as

a mutually agreed termination. Mr Kella did not receive a termination payment, nor did he receive a payment in lieu of notice.

As a “good leaver”, Mr Kella was entitled to participate in the / STIP which is disclosed in the remuneration tables as a Cash Incentive.

Mr Kella was entitled to good leaver treatment on restricted equity effective July . This involved the following:

– Releasing the restriction on , shares awarded under the / STIP

– Lapsing , Rights under the - LTIP with , Rights remaining on foot and subject to achievement of performance hurdles at the end of the three year performance period

– Lapsing , Rights under the - LTIP with , Rights remaining on foot and subject to achievement of performance hurdles at the end of the three year performance period

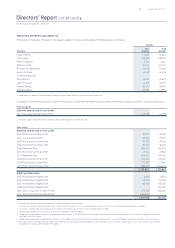

Mr Joyce’s “at target” remuneration is $,,, comprising FAR of $,,, an “at target” STIP opportunity of $,, (that is,

% of FAR), and an “at target” LTIP opportunity of $,, (that is, % of FAR). This pay level is set by the Board with reference to median

“at target” pay for CEOs of companies in the S&P/ASX.

Mr Joyce’s reported pay in is $,,, which is % below his “at target” remuneration level.

It is $,, or % higher than his reported pay in / (which itself was $, lower than his / reported pay).

The sizeable increase observable in his reported pay for / does not represent an increase in actual earnings for Mr Joyce during

the year, but is a direct consequence of the Board’s decision in / not to pay a cash bonus and to entirely defer Mr Joyce’s STIP

award into restricted shares.

Had a cash bonus been paid it would have had a smoothing effect on Mr Joyce’s remuneration (increasing his reported pay in /

and reducing his reported pay in /).

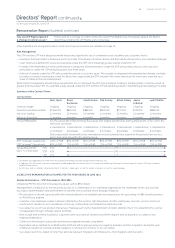

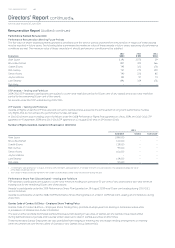

Remuneration Mix

The target remuneration mix (refer to page ) will not match the actual remuneration mix for /, as:

— No cash-based incentives were paid in / or / for continuing Executives

— An increased level of share-based awards against the target mix reecting the decision to award restricted shares instead of cash bonuses

in both years

— Actual reward mix is calculated on an accrual basis in accordance with Accounting Standards, so each years’ remuneration includes

a portion of the value of share-based payments awarded in previous years

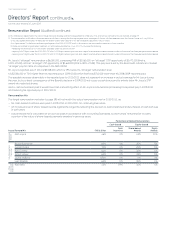

Performance Related Remuneration

Cash-based Equity-based

Actual Reward Mix FAR & Other

Cash

Incentives

Share-based

Awards

Rights

Awards

Executive

Director

Alan Joyce % % % %

Key Management

Personnel

Bruce Buchanan % % % %

Gareth Evans % % % %

Rob Gurney % % % %

Simon Hickey % % % %

Jayne Hrdlicka % % % %

Lyell Strambi % % % %

Other

Disclosed

Executive

Rob Kella % % % %

Directors’ Report continued

Remuneration Report (Audited) continued