Qantas 2011 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2011 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE QANTAS GROUP 20

for the year ended 30 June 2011

Review of Operations continued

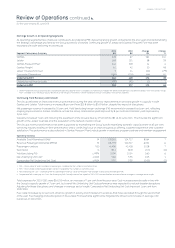

Qantas Frequent Flyer

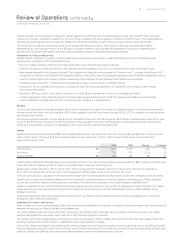

Qantas Frequent Flyer achieved a record Underlying EBIT result of $ million for the year ended June , an increase of $ million

on the prior year result of $ million.

Qantas Frequent Flyer’s result includes $ million relating to a prior period change in accounting estimates that is fully recognised in

and will not impact future periods. Normalised for this change, Qantas Frequent Flyer achieved earnings growth of per cent.

Change % Change

Members M. . .

Billings $M ,

Underlying EBIT $M

Normalisation adjustment $M () () ()

Normalised EBIT$M

. Normalised EBIT is a non-statutory measure which restates redemption revenue to the fair value of awards redeemed (removing the impact of the change in accounting estimate)

and recognises the marketing revenue when a point is sold. This creates a comparable basis for the presentation of results.

Qantas Frequent Flyer continued to deliver strong and stable cash earnings and demonstrate its value to the Qantas portfolio of brands.

It allowed the Group to participate in the highly valued and growing loyalty sector on a scale that is unique in the airline industry.

Earnings growth has been driven by new products and services with key business partners, capacity increases across the ying businesses

and additional revenue from new members. Billings increased by per cent compared to the prior year and membership has increased

per cent on the prior year to . million members as at June .

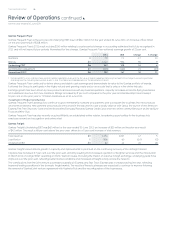

Investment in Product and Service

Qantas Frequent Flyer’s strategy is to continue to grow membership numbers and partners, and to broaden the business into new products

and revenue streams. New partners and products announced in the last year include a loyalty alliance with Optus, the launch of the American

Express Fee Free Discovery Card and the Woolworths Everyday Rewards Qantas Credit Card, and new online communities such as the epiQure

Food and Wine Club.

Qantas Frequent Flyer has also recently acquired Wishlist, an established online retailer, broadening opportunities for the business into

employee reward and recognition and online retail.

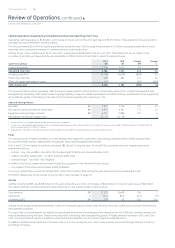

Qantas Freight

Qantas Freight’s Underlying EBIT was $ million for the year ended June , an increase of $ million on the prior year result

of $ million. The result is per cent above the prior year, driven by a per cent increase in total revenue.

Total revenue $M , ,

Load factor %. (.) ()

Underlying EBIT $M

Qantas Freight’s result reects growth in capacity and improvements in yield built on the continuing recovery of the airfreight market.

Capacity has increased . per cent over the prior year, primarily resulting from increased operation of freighter services and the introduction

in March of a larger B operating on trans-Tasman routes. Excluding the impact of adverse foreign exchange, underlying yields have

improved over the prior year, reecting better market conditions and increased airfreight activity across the network.

The contributions from the joint venture businesses Australia air Express and Star Track Express also increased during the year, reecting

improved trading conditions in the domestic freight market. The results of these businesses are expected to continue to improve following

the renewal of Qantas’ joint venture agreement with Australia Post and the reconguration of the businesses.