Qantas 2011 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2011 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35 ANNUAL REPORT 2011

for the year ended 30 June 2011

Directors’ Report continued

Dear Shareholder

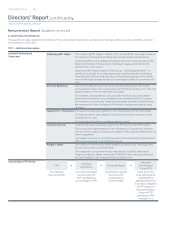

Qantas is pleased to present its Remuneration Report for /,

which sets out remuneration information for Non-Executive Directors,

the Chief Executive Ofcer (CEO) and Executive Committee.

The format and content of the Remuneration Report are reviewed

each year with a view to presenting the information concisely, while

still providing the detailed disclosure elements required under the law.

Based on shareholder feedback, additional information in some

areas has been provided this year. We have specically addressed

the issue of risk management in our remuneration framework – detail

is provided of the framework features that protect against unintended

and unjustied pay outcomes.

Following the introduction of the new Short Term Incentive Plan (STIP)

in / and the review of the Long Term Incentive Plan (LTIP)

last year, there were no signicant changes made to the Executive

Remuneration Framework during /.

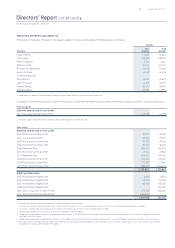

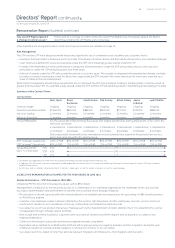

One of the key remuneration decisions made by the Board each

year is determining the outcome under the STIP. This primarily

involves the Board assessing the Qantas Group’s Underlying Prot

Before Tax (PBT) performance. The / Underlying PBT

result of $ million represented a signicant increase of per cent

on the / Underlying PBT result. This was achieved in spite of

a number of well-known challenges outside the control of Qantas

management such as weather events and natural disasters that

substantially affected operations during the year.

While this was a good result in those circumstances, it was below the

stretch target set by the Board for “at target” awards under the STIP.

It did however exceed the Underlying PBT threshold that was set at

the start of the year and accordingly a partial STIP award has been

made for /. For the Chief Executive Ofcer (CEO) (and other

Key Management Personnel (KMP) assessed against the Group

Scorecard), this resulted in a STIP scorecard outcome of .% of

target levels.

The other key decisions of the Board reected in this year’s

Remuneration disclosures are as follows:

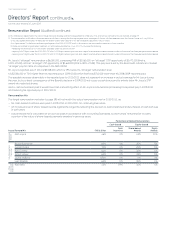

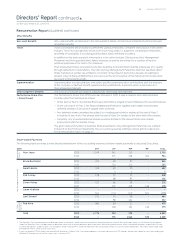

— The Fixed Annual Remuneration (FAR) of the CEO and KMP were

reviewed with regard to market pay movements and a material

increase in the scope of one of the KMP roles

A three per cent increase to FAR was approved for the CEO

— The “at target” pay levels for the CEO and KMP are set with

reference to other S&P/ASX companies. The total reported

pay level for the CEO for / is $,,, which is up

considerably from his reported pay level for the previous year,

but below his “at target” pay of $,,

— Last year the Board made a carefully considered decision not

to pay a cash bonus and instead make an award of restricted

shares under the STIP

The consequence of this decision, detailed in the /

Remuneration Report, is that the value of these deferred

STIP awards are accounted for primarily as remuneration

in / rather than in /. This is the key factor

behind the remuneration increases disclosed for the CEO

and some of the other KMP in the remuneration tables, and

an important element in understanding the context of this

year’s remuneration disclosures.

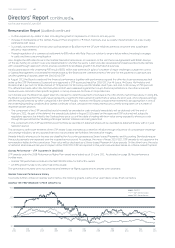

Because of potential confusion in interpreting remuneration table

values (which can involve multiple accounting periods and valuation

dates) Qantas has this year provided an additional “Supplemental

Information” disclosure. This disclosure provides information as to the

value of earnings, including share-based payments reported in prior

periods which have actually vested during the year. For example,

while the CEO’s total reported pay (under Accounting Standards) can

be seen as either % up on last year, or % below his “at target”

pay for the year, it can also be seen as % down against last year

when viewed on the basis of “Total Vested Remuneration”, or the

amount of pay realised during the year.

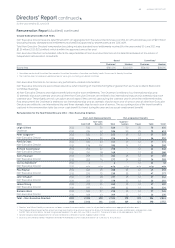

Again this year, the Board has decided to defer all awards to the

CEO and KMP under the / STIP. The Board considers that

this is appropriate in view of the challenging trading conditions that

Qantas continues to face, and in light of the measures currently

being taken on a number of important growth and change projects.

— The component of the STIP award that would normally be

awarded in cash will be deferred until the end of February .

Up until the end of the deferral period, the award will, subject to

regulatory approval, be linked to the Qantas share price, and thus

its value will continue to be exposed to risk through the period that

the “Building a Stronger Qantas” initiatives are being launched

— The component of the STIP award that would normally be

awarded in deferred shares, will be awarded as deferred

shares, with a two year restriction period

This decision to defer both elements of the STIP Award is also

intended as a retention initiative through this period of considerable

challenge and change initiatives, as any awards that have not yet

vested are forfeited if the executive resigns.

The Performance Rights Plan, awarded in / for the

three year performance period to June has now been

nalised. Nil vesting was achieved under this plan as both the

Relative Total Shareholder Return (TSR) performance (in comparison

to S&P/ASX) and Earnings Per Share (EPS) performance were

below the performance thresholds set by the Board. All Rights lapsed

and no shares were awarded.

This has been a year where company performance has been good

relative to the challenges faced, and where a strong performance

by management has produced what is, in the circumstances, a

satisfactory prot outcome, exceeding the threshold performance

level set by the Board for the payment of incentives under the STIP.

The linking of the LTIP to shareholder returns and the exibility in the

operation of the STIP around the deferral of short term incentive

awards are key features of the Qantas Executive Reward framework.

These features support the Board’s aim of appropriate alignment

between business outcomes, pay outcomes and returns to

shareholders. In taking the decisions I have outlined around the pay

of its CEO and Executive Committee, the Board has used this exibility

to achieve what we believe is an appropriate mix of fair reward,

retention of key executives and alignment with the interests of the

shareholders of Qantas.

James Strong

Chairman, Remuneration Committee

Cover Letter to the Remuneration Report

. Underlying PBT is the primary reporting measure used by the Qantas Group for the

purpose of assessing the performance of the Group. Refer Note (D) of the Notes

to the Financial Statements.