Qantas 2011 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2011 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15 ANNUAL REPORT 2011

for the year ended 30 June 2011

Information on Qantas continued

Network

The Qantas Group is the eleventh largest airline group in the world

based on passenger numbers and distance own.

The Group’s network comprises destinations in countries,

including Australia and those served by codeshare partner airlines.

Domestically, Qantas, QantasLink and Jetstar operate more than

, ights per week. Jetstar also operates more than domestic

ights per week in New Zealand.

Internationally, Qantas and Jetstar operate more than ights

per week.

In / the Group carried a total of . million passengers.

Fleet

At June the Group, including Jetstar Asia and Network Aviation,

operated a eet of passenger aircraft and ve dedicated

freighter aircraft.

In /:

— Qantas took delivery of four Airbus As, one A-,

ve Boeing B-s and one Bombardier Q

— Jetstar, including Jetstar Asia, took delivery of A-s

and two A-s

— Qantas Freight took delivery of one B-

— The acquisition of the Network Aviation Group added two Fokker

Fs and seven Embraer Brasilia aircraft to the eet

— The Group retired one B-, one B-ER and

two B-s

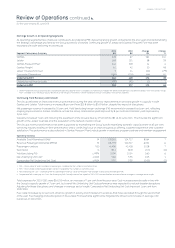

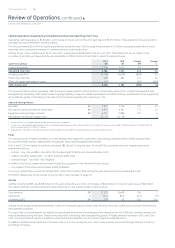

Qantas Group Aircraft in Service

Aircraft Type

Number

Number Change

Qantas A-

B- ()

B-ER -

A-

A- -

B-ER ()

B- ()

B-NG

B- -

Q/Q -

Q

Fokker F -

EMB -

Total

JetstarA-

A- -

A-

Total

Qantas Freight B-SF -

B- -

Total

Total Group

. Jetstar eet includes Jetstar Asia and excludes Jetstar Pacic.

The Group has a comprehensive eet renewal plan focused on

enhancing customer service, fuel efciency and operational

performance.

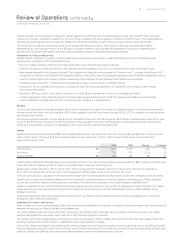

STRATEGIC DIRECTION

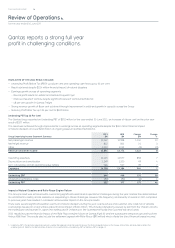

In / the Qantas Group delivered its strongest result since

the global economic downturn and continued to invest in product,

service, infrastructure and growth.

While trading conditions remain challenging – characterised by

high fuel prices and a volatile global economy – the Group is

well-placed to maintain its leading position domestically and

compete strongly in international markets.

Qantas and Jetstar maintained a prot-maximising per cent share

of the domestic air travel market. The Group retains the exibility to

adjust planned capacity growth and capital expenditure to match

demand. A review of Qantas’ international operations was carried

out and established a new ve-year plan to restore the business’s

protability and competitiveness. This strategy is focused on opening

gateways to the world, growing with Asia, being best for global

travellers and building a strong, viable business.

Jetstar continues to pursue its successful pan-Asian strategy,

participating fully in the growth of low-cost leisure travel in the

world’s fastest-growing region.

Qantas Frequent Flyer and Qantas Freight, both protable and

successful businesses add strength and depth to the Group’s

portfolio and enable it to withstand economic cycles.

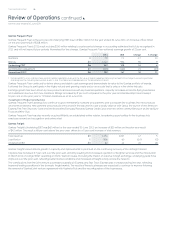

QFuture

QFuture is a three-year business transformation program aimed

at equipping Qantas for sustainable growth in the increasingly

competitive global aviation market. The program is targeting

$. billion in margin improvements over the three years from

July , with $ billion delivered after two years.

It is focused on business transformation across a wide range of

business areas, including aircraft utilisation and scheduling, alliances,

procurement, information technology and workplace transformation.

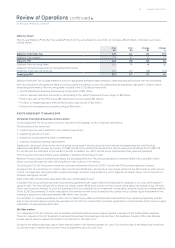

Product, Service and Technology

The Group remains committed to introducing new products and

technology that enhance the customer experience.

In / faster, smarter check-in technology was installed across

the domestic network, featuring smart-chip Frequent Flyer cards,

permanent bag tags and automated bag drop facilities. Customer

feedback on the new system has been tremendous.

New aircraft continued to join the Qantas eet. Four more As were

added to Qantas’ long-haul eet, B and A capacity increased

on long-haul routes and next-generation B-s were deployed

on trans-Tasman services.

In late the rst Qantas B to be recongured with A-

standard on-board product will enter service, part of a program

that will ensure a consistently world-class customer experience

across all Qantas long-haul services.

With the introduction of SMS check-in for customers in Australia and

New Zealand, continued investment in self-serve check-in facilities

and the launch of a simplied fare structure, Jetstar also underlined

its commitment to streamlined travel for its customers.

The Group will acquire up to A aircraft to support eet renewal

and growth for the next to years.