Qantas 2011 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2011 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE QANTAS GROUP 40

for the year ended 30 June 2011

Directors’ Report continued

Remuneration Report (Audited) continued

— Further expansion by Jetstar in Asia, including the growth in its presence in China to nine key ports

— Increase in membership of the Qantas Frequent Flyer program to . million members, plus successful implementation of a key loyalty

partnership with Optus

— Successful achievement of the two year savings target of $ billion from the QFuture initiatives aimed at long-term and sustainable

efciency improvements

— Prompt negotiation of a commercial settlement for $ million with Rolls-Royce in relation to engine failure without needing to engage

in costly and time consuming litigation

Also, despite the difculties faced in the Qantas International business, an extension to the Joint Services Agreement with British Airways

on the key Sydney to London route was implemented for a further ve years. A plan was also developed and approved to provide Qantas

with a breakthrough approach and to provide a platform for protable growth in its International business.

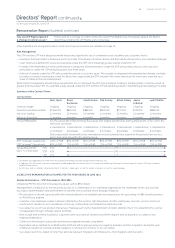

As discussed above, this Underlying PBT result of $ million was achieved in spite of a number of major challenges outside the control

of Qantas Management. It exceeded the threshold set by the Board at the commencement of the year for the payment of cash bonuses

and the granting of awards under the / STIP.

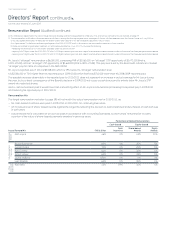

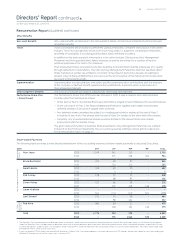

In August the Board considered the nancial performance together with performance against the other key business measures that

make up the STIP Performance Scorecard and approved a STIP scorecard result for / for Mr Joyce, Mr Evans, Ms Hrdlicka and

Mr Kella of . per cent, for Mr Buchanan of . percent, for Mr Gurney and Mr Strambi of . per cent and for Mr Hickey of . per cent.

The differential results reect the fact that while all KMP were assessed against the Group’s nancial performance, the other scorecard

measures were tailored to their specic segment, or Group measures for those in Corporate roles.

As it did last year, the Board has again taken the decision to defer the payment of bonuses to the CEO and the Senior Executives. In doing this,

the Board recognises that this year’s result represents a signicant improvement in performance versus the prior year, and compares strongly

with the results achieved by other companies in the airline industry. However, the Board considers this treatment to be appropriate in view of

the challenging trading conditions that Qantas continues to face, and given the measures that are currently being taken on a number of

important growth projects.

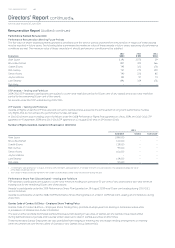

— The component of the STIP award that would normally be awarded in cash and paid immediately will be deferred until the end of

February . As part of the deferral, the awards (calculated in August based on the approved STIP outcome) will, subject to

regulatory approval, be linked to the Qantas share price up until the date of vesting with their value being exposed to share price risk

through the period that the “Building a Stronger Qantas” initiatives are being launched

— The component of the STIP award that would normally be awarded in deferred shares will be awarded as deferred shares, with a year

restriction period

This decision to defer both elements of the STIP Award is also intended as a retention initiative through this period of considerable challenge

and change initiatives, as any awards that have not yet vested are forfeited if the executive resigns.

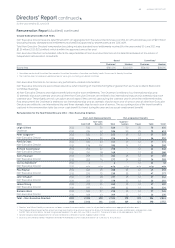

Awards linked to share price in this way are classied for Accounting purposes as Share-based Payments, and Accounting Standards require

that such payments are expensed over the required service period. Accordingly, the value of these / STIP awards do not appear in the

remuneration tables for the current year. Their value will be disclosed as a Share-based Payment in future periods. On the other hand, the value

of deferred shares issued last year in respect of the / STIP are reported in this year’s remuneration tables as a Share-based Payment.

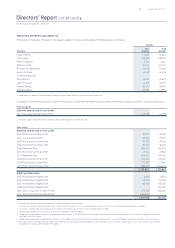

Qantas Performance – LTIP Outcomes in /

LTIP awards under the Performance Rights Plan award were tested as at June . As detailed on page , the performance

hurdles were:

— Qantas TSR performance relative to the S&P/ASX Index for half of the award

— An EPS growth hurdle for the other half of the award

The performance hurdles were not achieved and therefore all Rights lapsed and no shares were awarded.

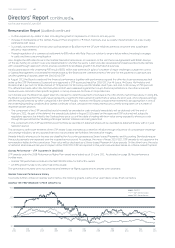

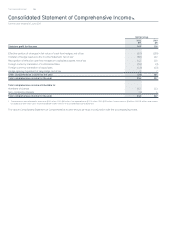

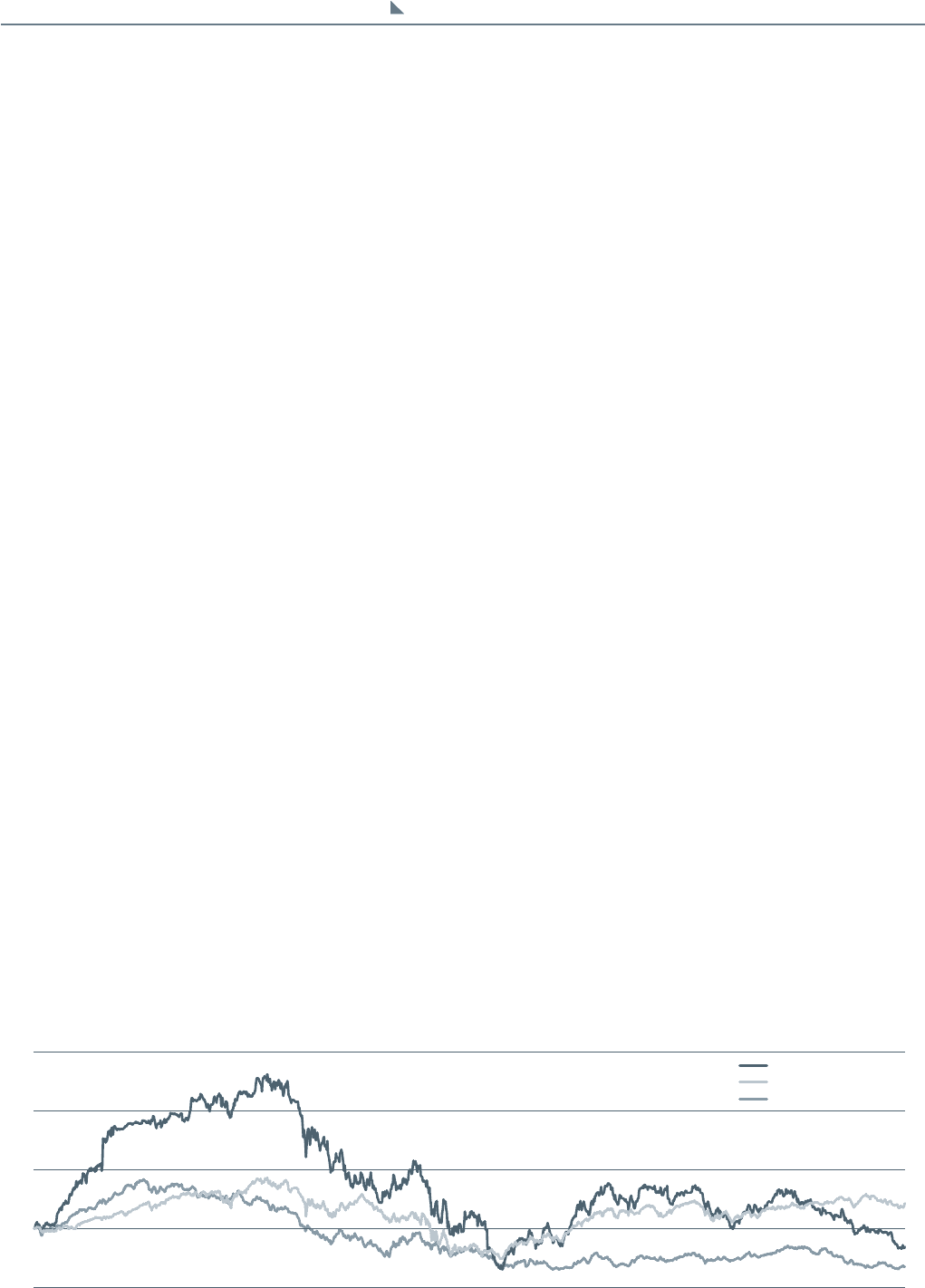

Qantas Financial Performance History

To provide further context on Qantas’ performance, the following graphs outline a ve-year history of key nancial metrics.

Jun

2006

Dec

2006

Jun

2007

Dec

2007

Jun

2008

Dec

2008

Jun

2009

Jun

2010

Dec

2009

Dec

2010

-50

0

50

100

150

Qantas

S&P/ASX100 Index

MSCI World Airlines

Jun

2011

QANTAS TSR PERFORMANCE V PEER GROUPS %