Qantas 2011 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2011 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37 ANNUAL REPORT 2011

for the year ended 30 June 2011

Directors’ Report continued

Remuneration Report (Audited) continued

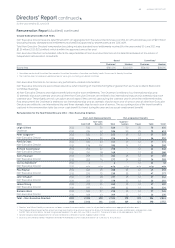

Short Term Incentive Plan (STIP)

What is the STIP? The STIP is the annual “at risk” incentive plan for senior Executives at Qantas. Each year Executives may

receive an award that is a combination of cash and restricted shares if the plan’s performance conditions

are achieved.

How are the STIP performance

conditions chosen and how

is performance assessed?

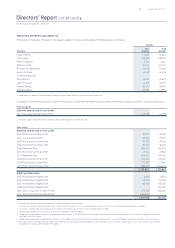

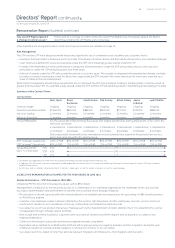

At the start of the year the Board sets a “scorecard” of performance conditions for the STIP as follows:

Performance Condition Scorecard Weighting

Group Underlying Prot Before Tax (PBT) %

Other nancial and non-nancial measures, tailored for each business segment %

Underlying PBT is the key budgetary and nancial performance measure for the Qantas Group.

Other performance measures are selected to support the strategic agenda of the Qantas Group,

either at a Group or business segment level. These measures vary by business segment, however

each Scorecard includes a measure related to cost or revenue performance.

A threshold, target and maximum level of performance is set each year for each scorecard measure.

At the conclusion of the year, the Board assesses performance against Group and Segment Scorecard

targets. The hypothetical maximum scorecard outcome under the STIP is per cent of “at target”,

which could only be achieved if the maximum overdrive level of performance is achieved on every STIP

performance measure. The minimum outcome is per cent, which would occur if the threshold level

of performance is missed on every STIP measure.

An example Performance Scorecard and a description of how a STIP award is calculated is included

on page .

The Board retains absolute discretion over all awards made under incentive reward plans at Qantas,

including the STIP.

For example, circumstances may occur where scorecard measures have been achieved or exceeded,

but in the view of the Board it is inappropriate to make a cash award under the STIP. The Board may

determine that either no award will be made, or that any award will be fully deferred and/or delivered in

Qantas shares. On the other hand, there may be circumstances where performance is below an agreed

target, however the Board determines that it is appropriate to pay some STIP award.

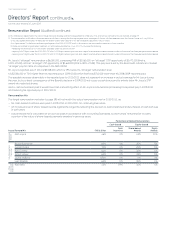

How are STIP awards delivered? Subject to Board discretion as described above, if the performance conditions are achieved and the

Qantas Group achieves the Underlying PBT threshold (determined by the Board), two-thirds of the STIP

reward is paid in cash, with the remaining one third deferred into Qantas shares. These shares transfer

to the Executive after a period of up to two years, subject to them remaining in employment.

STIP awards are disclosed in the remuneration tables either as a “Cash Incentive”, for any component

awarded immediately as cash or as a “Share-based Payment” for any deferred component awarded

either in deferred shares or deferred cash which is exposed to share price movements during the

restriction period.

Where STIP awards involve deferral over multiple reporting periods, they are reported against the

appropriate period in accordance with Accounting Standards.

Long Term Incentive Plan (LTIP)

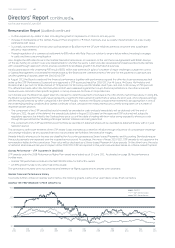

What is the LTIP? The LTIP involves the granting of Rights over Qantas shares. If performance conditions are satised the

Rights vest and convert to Qantas shares on a one-for-one basis. If performance conditions are not met,

the Rights lapse.

For the - LTIP the performance conditions are:

— The relative Total Shareholder Return (TSR) of Qantas compared to the S&P/ASX Index

— The relative TSR of Qantas compared to an airline peer group

The Board has approved a change to the LTIP target for the - LTIP – the airline peer group

has been expanded with the addition of Air Asia.

For the two previous LTIP grants that are still required to be disclosed in this Report, ie the

Performance Rights Plan and the - LTIP, the performance conditions were:

— An Earnings Per Share (EPS) target

— The relative TSR of Qantas compared to the S&P/ASX Index