Porsche 2010 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2010 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Group management report

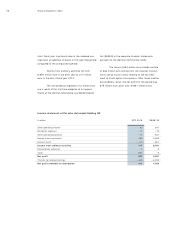

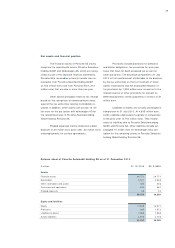

Compared to 31 July 2010 cash funds fell by

131 million euro to 406 million euro.

Gross liquidity, i.e., cash and cash equiva-

lents, fell from 898 million euro one year earlier to

622 million euro. Liabilities to banks rose slightly

from a total of 6,945 million euro as of 31 July 2010

to 6,964 million euro as of 31 December 2010.

The net liquidity of the Porsche SE group, i.e.,

cash and cash equivalents less liabilities to banks,

came to minus 6,342 million euro as of 31 December

2010 (31 July 2010: minus 6,047 million euro).

Results of operations

At the end of the short fiscal year 2010, the

Porsche SE group reports a profit after tax of 1,286

million euro, following a loss after tax of 454 million

euro recorded for the prior year.

Over the period from 1 August 2010 to

31 December 2010 other operating income fell by

709 million euro in relation to the comparative period

to 269 million euro. In the short fiscal year this item

mainly contains effects from the valuation of the put

option relating to the remaining shares held by Por-

sche SE in Porsche Zwischenholding GmbH at a fair

value of 158 million euro and an amount of 102 mil-

lion euro from the cash-settled options relating to

shares in Volkswagen AG, which were disposed of in

full in the short fiscal year.

Other operating expenses decreased from

956 million euro to 590 million euro. In the short

fiscal year 2010 they mainly contain the effect from

the valuation of the call option for the shares in Por-

sche Zwischenholding GmbH remaining with Porsche

SE at a fair value of minus 547 million euro. In addi-

tion, expenses arose from the valuation of the cash-

settled options relating to Volkswagen AG shares at

10 million euro; they were disposed of in full in the

short fiscal year.

Personnel expenses came to 11 million euro

in the Porsche SE group (2009/ 10: 17 million euro).

The profit from investments accounted for at

equity amounts to 1,075 million euro (2009/ 10:

6,792 million euro); an amount of 106 million euro

thereof stems from the Porsche Zwischenholding

GmbH group and 969 million euro from the Volks-

wagen group. As a result of the change in Porsche

SE’s fiscal year in the short fiscal year 2010, the

Volkswagen group is now included as of the same

reporting date in the reporting period, whereas it had

previously been included with a delay of one month.

Accordingly, the Volkswagen group has been included

in the profit from investments accounted for at equity

with the figures for a period of six months (1 July to

31 December 2010) in the short fiscal year 2010.

The contributions to profit also include effects of

amortization of the purchase price allocations per-

formed at the time of inclusion of Porsche Zwischen-

holding GmbH as a joint venture and Volkswagen AG

as an associate. The profit/ loss from investments

accounted for at equity – and therefore the Porsche

SE group’s profit after tax – was reduced by 206

million euro in total by the subsequent effects of the

purchase price allocations for the Porsche Zwischen-

holding GmbH and Volkswagen groups, i.e., the amor-

tization of hidden reserves and liabilities identified in

the process. The purchase price allocations required

for the purpose of accounting for the entities at equity

was completed in early December 2010. No restate-

ments had to be made to the figures contained in the

consolidated financial statements for the fiscal year

2009/ 10.

In the comparative period the profit/ loss from

investments accounted for at equity included above

all non-recurring effects, income of 7,841 million euro

from the first-time inclusion of the investment in Volks-

wagen AG at equity, as well as a dilutive effect of

1,440 million euro from the capital increase per-

formed at Volkswagen AG in March 2010, in which

Porsche SE did not participate.

Over the reporting period, the financial re-

sult improved from minus 673 million euro to minus

104 million euro. The reasons include not only the

different period covered by the comparative periods,

but also lower interest payments to banks, attribut-

able to the reduction of the average level of bank

liabilities in the reporting period in relation to the

54