Porsche 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the legal proceedings, please see the section “Litiga-

tion risk” in risk report of Porsche SE and the section

“Forecast report and outlook” of this management

report). Since the end of the investigations can be

expected at the earliest at the beginning of 2012, the

legal and tax assessments of the merger of Porsche

SE into Volkswagen AG to be made under the basic

agreement will likely be delayed. From the executive

board’s view, this also reduces the probability that the

merger can be achieved under the timeline of the

basic agreement (which requires that the necessary

shareholder resolutions on the merger are made in

2011) from previously 70 percent to 50 percent.

In the view of the Porsche SE executive

board, the overall probability of the merger de-

creases in case of substantial delays in the merger

process compared to the timeline of the basic

agreement.

However, the executive board of Porsche SE

is currently of the opinion that the assessments can

be finalized so timely, that the merger can be

achieved even after 2011.

Measures to secure liquidity and steps to

reduce liabilities

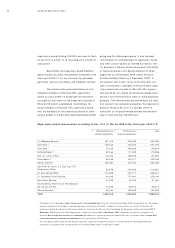

To secure liquidity beyond 30 June 2011, it

will be necessary for the planned capital increase of

Porsche SE to be performed by 30 May 2011, with

an issue volume of at least 2.5 billion euro. For more

details on the capital measures approved by the

annual general meeting on 30 November 2010, we

refer to our statements in the section “Capital meas-

ures planned by Porsche SE” of this management

report. The proceeds from the planned capital in-

crease must be used to repay the first tranche of the

syndicated loan of 2.5 billion euro. Any proceeds

exceeding this figure must be used to further reduce

liabilities to banks.

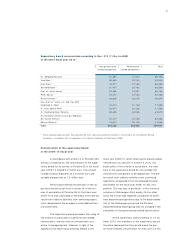

Since December 2009, the total loan facility

available to Porsche SE has amounted to a total of

8.5 billion euro, of which 7.0 billion euro had been

drawn as of 31 December 2010. The collateral for

the loan has been provided primarily by pledging all of

Porsche SE’s shares in Volkswagen AG.

The lending banks support the proposed

capital measures and have expressed their willingness

to extend the first tranche of the credit line of 2.5

billion euro, which is due on 30 June 2011, by up to

four months, in the event of certain legal obstacles to

the implementation of the capital increase.

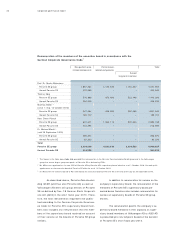

Change in Porsche SE’s fiscal year

With regard to the creation of the integrated

automotive group with Volkswagen, the annual gen-

eral meeting of Porsche SE decided on 29 January

2010 that the fiscal year of the company, which ran

from 1 August to 31 July of the following year,

should be changed to run concurrently with the cal-

endar year effective 1 January 2011. A short fiscal

year was created for the period from 1 August 2010

to 31 December 2010 and this is the reporting pe-

riod covered by the accompanying financial state-

ments. Unless otherwise stated, the comparative

period is the fiscal year 2009/ 10 which covered a

period of twelve months. Corresponding resolutions

were passed by the annual general meeting of Por-

sche Zwischenholding GmbH as well as by the annual

general meeting of Porsche AG for the Porsche

Zwischenholding GmbH group.

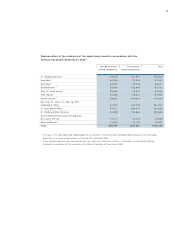

Disposal of cash-settled stock options

In the prior years, the increases in the

shareholding in Volkswagen were hedged to a large

extent by means of cash-settled options for Volks-

wagen AG shares. The remaining cash-settled op-

tions held by Porsche SE as of the prior-year report-

ing date (31 July 2010) relating to about two per-

cent of Volkswagen AG’s ordinary shares were dis-

posed of in full.

41