Porsche 2010 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2010 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Financials

202

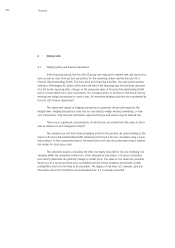

4.2.3 Risk from put and call options relating to the shares in Porsche Zwischenholding GmbH

remaining at Porsche SE

The market price risk is due to changes in the enterprise value of Porsche Zwischenholding

GmbH. It affects the measurement of the put and call option and, consequently, their measurement

in the balance sheet as well as the profit or loss reported in the income statement. The enterprise

value is determined on the basis of the key measurement parameters used in impairment testing of

the investments accounted for at equity (for the description of these parameters, please refer to

the section “Consolidated group”). The risk due to changes in the enterprise value is determined by

means of a sensitivity analysis.

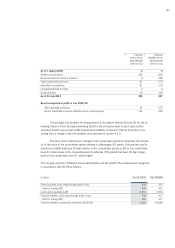

If the enterprise value of Porsche Zwischenholding GmbH as of 31 December 2010 had

been 10% higher, the group’s profit would have been €264 million (prior year: €132 million) lower. If

the enterprise value as of 31 December 2010 had been 10% lower, the group’s profit would have

been €265 million (prior year: €133 million) higher.

Since the options are subject to the condition that the merger fails as defined in the basic

agreement, their valuation is based on the theoretical probability to exercise them. All other meas-

urement parameters remaining equal, a change in the assessment of probability of exercise would

increase/reduce the carrying amount on a straight-line basis; any resulting change in the balance

sheet items is recognized in profit or loss and impacts the Porsche SE group’s results of operations

accordingly. Porsche SE’s executive board estimates the theoretical probability of exercise of the

options at 50% as of the reporting date (prior year: 30%). The merger would fail in accordance with

the terms of the basic agreement if the merger resolutions of annual general meetings of Porsche SE

and of Volkswagen AG are not adopted by 31 December 2011 or if claims are filed, including but not

limited to those filed after approval proceedings have taken place, that prevent entry of the merger in

the commercial register. Reference is made to explanations in the forecast report under the heading

“Anticipated development of the Porsche SE group” and in the risk report under “Risks arising from

financial instruments” in Porsche SE’s group management report.

If the theoretical probability of exercise of the options had been 70% as of 31 December

2010 instead of 50%, the group’s profit would have been €193 million lower. If the theoretical prob-

ability of exercise of the options had been 30% as of 31 December 2010 instead of 50%, the

group’s profit would have been €193 million higher. If the theoretical probability of exercise of the

options had been 50% as of 31 July 2010 instead of 30%, the group’s profit would have been €63

million lower. If the theoretical probability of exercise of the options had been 10% as of 31 July

2010 instead of 30%, the group’s profit would have been €63 million higher.

This is partially offset by the accounting for the investment in Volkswagen AG at equity, as

the accounting for the options at the level of Volkswagen AG has the opposite effect on the pro rata

profit/loss attributable to Porsche SE in accordance with its share in capital held in Volkswagen AG.