Porsche 2010 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2010 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Financials

166

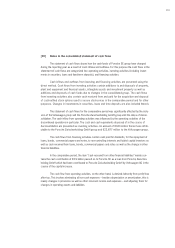

b) The following standards and interpretations, which have been published but whose

adoption is not yet mandatory or which are not yet applicable in the EU, have not

yet been applied

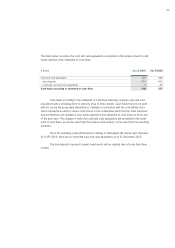

Amendments to IFRS 9 “Financial Instruments”

IFRS 9 revises the classification and measurement of financial instruments, providing for

only two measurement categories for financial assets in future: at amortized cost and at fair value.

The amendments add new chapters to IFRS 9 “Financial Instruments”, thereby completing the clas-

sification and measurement phase of the IASB project’s to replace IAS 39 “Financial Instruments:

Recognition and Measurement”. They were issued subsequently to IFRS 9 as published by the IASB

in November 2009, which addresses the classification and measurement of financial assets. The

amendments require entities having elected to use the fair value option in accounting for financial

liabilities to recognize the portion of the change in fair value resulting from a change in the entity’s

own credit risk within other comprehensive income instead of in profit or loss. IFRS 9 is applicable

for reporting periods beginning on or after 1 January 2013. Early adoption is permitted only if the

regulations contained in IFRS 9 for financial assets are simultaneously applied. IFRS 9 as a whole

has not yet been adopted by the EU. Porsche SE is in the process of analyzing the effects on the

presentation of its net assets, financial position and results of operations as well as on cash flows.

Amendments to IAS 12 “Income Taxes”

In accordance with IAS 12, the measurement of deferred taxes depends on whether an en-

tity expects to recover an asset’s carrying amount by using it or by selling it. The distinction may be

difficult and involve judgment in certain circumstances. The amendment introduces a rebuttable

presumption that the carrying amount will be recovered through sale. The scope of application of

this rebuttable presumption is limited to investment property measured at fair value and property,

plant and equipment or intangible assets measured using the revaluation model in IAS 16 or IAS 38.

As part of the amendments made, the regulations of SIC 21 were incorporated in IAS 12 and SIC

21 was withdrawn accordingly. The amendments are effective for reporting periods beginning on or

after 1 January 2012. They have yet to be endorsed by the EU as part of the comitology procedure.

These amendments are not expected to have any significant effect on the presentation of the Por-

sche SE group’s net assets, financial position and results of operations or on its cash flows.

In addition, a number of other changes were presented in the consolidated financial state-

ments for the fiscal year 2009/10 which had still not been applied in SFY 2010.

Voluntary early adoption of the changes before they become mandatory under the transi-

tional provisions of IASB is not planned.