Porsche 2010 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2010 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239

|

|

Financials

146

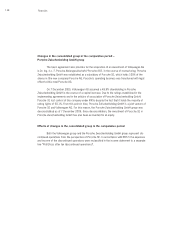

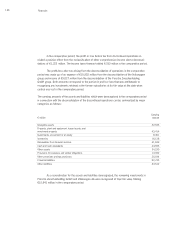

An impairment test was carried out in the reporting period for both the investment in

Volkswagen AG and the investment in Porsche Zwischenholding GmbH. Value in use was determined

for both investments using the discounted cash flow method. The most recent five-year plan ap-

proved by the management of the equity investments was used as a basis. A growth rate of 1% was

used to extrapolate the cash flow beyond the detailed planning phase. The sustainable EBIT margin

was determined conservatively, taking into account the EBIT margins generated in the last two

reporting years. A weighted average cost of capital of 6.6% or 7.2% (prior year: 6.5% or 7.3%) was

used to discount cash flows. This was derived from a specific group of comparable entities (peer

group) for each equity investment to reflect a return on capital that is appropriate for the risks

involved in the respective business operations. When selecting the two peer groups, the special

aspects of the multi-brand strategy pursued by VW as well as of those of the sports car business of

the Porsche Zwischenholding GmbH group were taken into consideration.

Even an isolated decrease in the EBIT margin by 20% or a growth rate of 0%, or an isolated

increase in the WACC by 20% would not lead to an impairment of either equity investment.

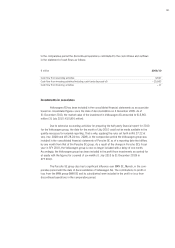

Currency translation

Foreign currency items in the financial statements of the entities included in the consoli-

dated financial statements are measured at the spot exchange rates on the date of the transaction.

Monetary assets and liabilities denominated in foreign currencies are translated into the functional

currency at the closing rate. Non-monetary items denominated in a foreign currency measured at

historical cost are translated using the exchange rate on the date of the initial transaction. Non-

monetary items measured at fair value in a foreign currency are translated using the exchange rate

prevailing on the date when the fair value was determined. Exchange rate gains and losses as of the

reporting date are recorded in profit or loss.

Goodwill and adjustments to recognize assets and liabilities arising from business combina-

tions at their fair value are expressed in the functional currency of the subsidiary.

The financial statements of consolidated subsidiaries prepared in a foreign currency are translated

to the euro in accordance with IAS 21. The functional currency of the company included in consolidation is

the currency of the primary economic environment in which it operates.