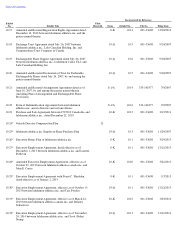

Lululemon 2014 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2014 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3.2 No Monetary Payment Required . The Participant is not required to make any monetary payment (other than

applicable tax withholding, if any) as a condition to receiving the Units or Stock issued upon settlement of the Units, the

consideration for which shall be past Services actually rendered and/or future Services to be rendered a Participating Company.

Notwithstanding the foregoing, if required by applicable law, the Participant shall furnish consideration in the form of cash or past

Services having a value not less than the par value of the Stock issued upon settlement of the Units.

3.3 Dividend Equivalent Units. This Agreement also constitutes the award of a Dividend Equivalent Right to the

Participant. On the date that the Company pays a cash dividend to holders of Stock generally, the Participant shall be credited with

a number of additional whole Dividend Equivalent Units determined by dividing (a) the product of (i) the dollar amount of the cash

dividend paid per share of Stock such date and (ii) the sum of the Total Number of Units and the number of Dividend Equivalent

Units previously credited to the Participant pursuant to the Award and which have not been settled or forfeited as of such date, by

(b) the Fair Market Value per share of Stock on such date. Any resulting fractional Dividend Equivalent Units shall be rounded

down to the nearest whole number. Such additional Dividend Equivalent Units shall be subject to the same terms and conditions

and shall be settled or forfeited in the same manner and at the same time as the Units originally subject to the Award with respect to

which they have been credited.

4. VESTING OF UNITS.

4.1 In General. Except as provided by this Section 4 and Section 7, the Units shall vest and become Vested Units as

provided in the Grant Notice.

4.2 Effect of Leave of Absence. Unless otherwise required by law, in the event that the Participant has taken in excess

of thirty (30) days in a leave or leaves of absence during the period beginning on the Grant Date and ending on the applicable Unit

Vesting Date, the applicable Unit Vesting Date will be deferred for a period of time equal to the duration of such leave or leaves of

absence.

4.3 Termination for Any Reason Other Than Death or Disability. In the event of the termination of the Participant’s

Service for any reason other than death or Disability (whether voluntary or involuntary and with or without Cause) prior to a Unit

Vesting Date, the Participant shall forfeit and the Company shall automatically reacquire all of the unvested Units subject to the

Award. The Participant shall not be entitled to any payment for such forfeited Units.

4.4 Termination by Reason of Death. In the event of the death prior to any Unit Vesting Date, then on the date of such

death unvested Units shall become Vested Units.

4.5 Termination by Reason of Disability . In the event of the termination of the Participant’s Service by reason of

Disability prior to any Unit Vesting Date, then on the date of such termination all unvested Units shall become Vested Units.

4.6 Forfeiture For Violations of Non-Compete and/or Non-Solicitation Agreements. Notwithstanding anything

above to the contrary, if, during the Participant’s Service, or following the Participant’s termination of Service, the Participant

violates any provision contained in a written service or other agreement applicable to the Participant (or any other written policy of

the Participating Company Group of general application) relating to the prohibition of the Participant from engaging in activities

which would violate any legally enforceable non-compete or non-solicitation clause or rule prior to any Unit Vesting Date, then all

of the Units shall be treated as unvested and forfeited as of the date on which such violation occurs. In addition, effective upon any

violation described above, any Units which have become Vested Units during the Participant’s Service, or following the

Participant’s termination of Service shall be forfeited by the Participant and any shares of Stock retained by such Participant shall

be returned to the Company or, if the Participant no longer retains such shares because the Participant has disposed of the shares

(including, but not limited to shares subject to Section 6.2), then the Participant shall remit the Fair Market Value of the shares on

the date the Participant disposed of them.