Lululemon 2014 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2014 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

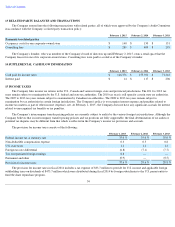

Table of Contents

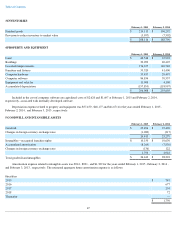

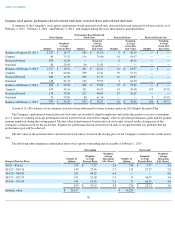

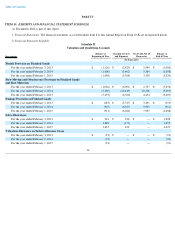

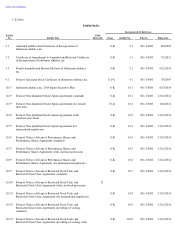

16 SEGMENTED FINANCIAL INFORMATION

The Company applies ASC Topic 280, Segment Reporting ("ASC 280"), in determining reportable segments for its financial statement

disclosure. The Company reports segments based on the financial information it uses in managing its business. The Company's reportable

segments are comprised of corporate-owned stores and direct to consumer. Direct to consumer represents sales from the Company's e-commerce

websites. Outlet sales, showroom sales, sales to wholesale accounts, warehouse sales, and sales from temporary locations have been combined

into the other segment. The Company has reviewed the classification of its expenses amongst its reportable segments and has updated the

classification of some of these expenses. Accordingly, all prior year comparable information has been reclassified to conform to the current year

classification. Information for these segments is detailed in the table below:

Intercompany amounts are excluded from the above table as they are not included in the materials reviewed by the Chief Operating

Decision Maker.

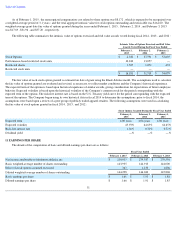

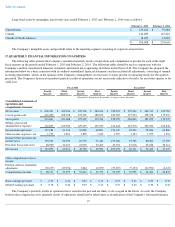

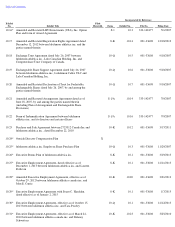

The Company operates in five geographic areas—Canada, the United States, Australia and New Zealand, Europe, and Asia. Net revenue

from these regions for the years ended February 1, 2015 , February 2, 2014 , and February 3, 2013 was as follows:

56

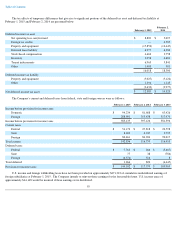

Fiscal Year Ended

February 1, 2015

February 2, 2014

February 3, 2013

Net revenue

Corporate-owned stores

$

1,348,225

$

1,228,999

$

1,090,181

Direct to consumer

321,180

263,083

197,255

Other

127,808

99,106

82,922

$

1,797,213

$

1,591,188

$

1,370,358

Income from operations before general corporate expense

Corporate-owned stores

$

356,589

$

372,267

$

373,607

Direct to consumer

132,877

109,999

85,128

Other

9,499

13,994

19,787

498,965

496,260

478,522

General corporate expense

122,932

104,902

102,083

Income from operations

376,033

391,358

376,439

Other income (expense), net

7,102

5,768

4,957

Income before provision for income taxes

$

383,135

$

397,126

$

381,396

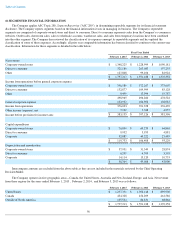

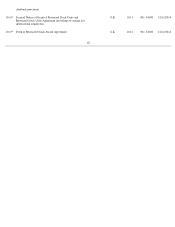

Capital expenditures

Corporate-owned stores

$

76,894

$

60,233

$

64,863

Direct to consumer

9,952

5,953

4,881

Corporate

32,887

40,222

23,485

$

119,733

$

106,408

$

93,229

Depreciation and amortization

Corporate-owned stores

$

37,951

$

31,349

$

28,874

Direct to consumer

6,299

4,599

3,393

Corporate

14,114

13,120

10,733

$

58,364

$

49,068

$

43,000

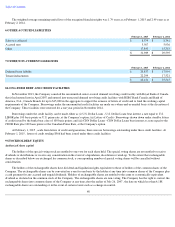

February 1, 2015

February 2, 2014

February 3, 2013

United States

$

1,257,351

$

1,052,148

$

839,908

Canada

434,328

454,209

461,586

Outside of North America

105,534

84,831

68,864

$

1,797,213

$

1,591,188

$

1,370,358