Lululemon 2014 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2014 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

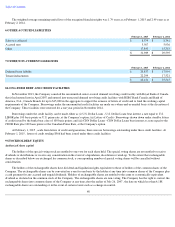

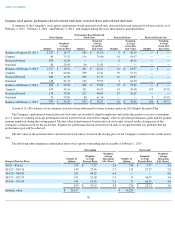

The Company's calculation of weighted-average shares includes the common stock of the Company as well as the exchangeable shares.

Exchangeable shares are the equivalent of common shares in all material respects. All classes of stock have in effect the same rights and share

equally in undistributed net income. For the fiscal years ended February 1, 2015 , February 2, 2014 and February 3, 2013 , 296 , 57 and 45 stock

options, respectively, were anti-dilutive to earnings and therefore have been excluded from the computation of diluted earnings per share.

On June 11, 2014, the Company's board of directors approved a program to repurchase shares of the Company's common stock up to an

aggregate value of $450,000 . The common stock is to be repurchased in the open market at prevailing market prices, with the timing and actual

number of shares to be repurchased depending upon market conditions and other factors. The repurchases will be made up until June 2016.

During the fiscal year ended February 1, 2015 , 3,657 shares were repurchased under the program at a total cost of $147,431 . Subsequent to

February 1, 2015 , and up to March 23, 2015 , no shares were repurchased.

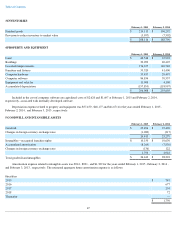

12 COMMITMENTS AND CONTINGENCIES

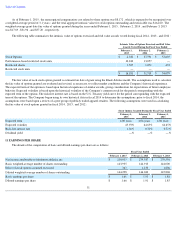

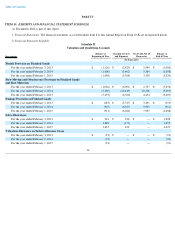

The Company has obligations under operating leases for its store and other retail locations, distribution centers, offices, and equipment. As

of February 1, 2015 , the lease terms of the various leases are from two to 10 years . A substantial number of the Company's leases include

renewal options and certain of the Company's leases include rent escalation clauses, rent holidays and leasehold rental incentives. Certain of the

Company's leases for store premises also include contingent rental payments based on sales volume. The Company is required to make deposits

for rental payments pursuant to certain lease agreements, which have been included in other non-current assets. Minimum annual basic rent

payments excluding other executory operating costs, pursuant to lease agreements are approximately as laid out in the table below. These

amounts include commitment in respect of corporate-owned stores that have not yet opened but for which lease agreements have been executed.

Rent expense for the years ended February 1, 2015 , February 2, 2014 , and February 3, 2013 was $105,989 , $95,574 , and $82,428 ,

respectively, under operating lease agreements, consisting of minimum rental expense of $68,598 , $61,552 , and $54,050 , respectively, and

contingent rental amounts of $37,391 , $34,022 , and $28,378 , respectively.

On January 11, 2015, the Company entered into a license and supply agreement with a license to a partner in the Middle East which grants

it the right to operate lululemon athletica branded retail locations in the United Arab Emirates, Kuwait, Qatar, Oman and Bahrain for an initial

term of five years

. Under this arrangement the Company will be supplying the partner with lululemon products, training and other support. As at

February 1, 2015 there were no franchised retail locations in operation.

In addition to the legal matters described below, the Company is, from time to time, involved in routine legal matters incidental to the

conduct of its business, including legal matters such as initiation and defense of proceedings to protect intellectual property rights, slip and

fall/personal injury claims, product liability claims, and similar matters. The Company believes the ultimate resolution of any such current

proceeding will not have a material adverse effect on its continued financial position, results of operations or cash flows.

On October 25, 2013, plaintiff Laborers' District Council Industry Pension Fund filed a books-and-records action in the Delaware Court of

Chancery entitled Laborers' District Council Construction Industry Pension Fund v. lululemon athletica inc., C.A. No. 9039-VCP (Del. Ch.)

under 8 Del. C. Sec. 220 based on a demand letter it sent to the Company on or around August 8, 2013 to request certain lululemon records

relating to the March 2013 sheer Luon issue, the Company's announcement that its then CEO, Christine Day, intended to resign, and certain

stock trades executed by the then-Chairman of the Company's board of directors, Mr. Wilson, prior to the Company's announcement regarding

its former CEO, Christine Day. The Court held a one-

day trial on February 19, 2014, which took the form of an oral argument. On April 2, 2014,

the Court rejected the majority of books and records sought by plaintiff and ordered the Company to produce a narrow category of documents

relating to one trade made by the Company's former Chairman. On June 11, 2014, the Court consolidated this action with the action captioned

Hallandale Beach Police Officers and Firefighters' Personnel Retirement Fund v. lululemon athletica inc.

, C.A. No. 8522-VCP (Del. Ch.),

which is described below. On June 13, 2014, Plaintiffs filed a Motion to Enforce the Court's April 2, 2014 Telephonic Rulings and Compel in

Camera Inspection of Withheld and Redacted Documents. The Court held a hearing on the Motion to Enforce on December 1, 2014 and the

judgment on the Motion remains pending. The Company believes there is no merit to the Motion.

On August 12, 2013 and August 23, 2013, plaintiffs Thomas Canty and Tammy Federman filed shareholder derivative actions entitled

Canty v. Day, et al. , No. 13-CV-5629 (S.D.N.Y.) and Federman v. Day, et al. , No. 13-CV-5977 (S.D.N.Y.). Plaintiffs allege that they are

acting on behalf of the Company and name as defendants current and former directors and certain

52

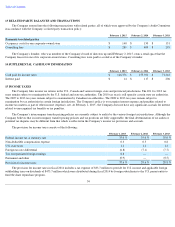

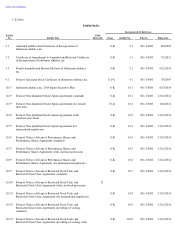

Payments Due by Fiscal Year

Total

2015

2016

2017

2018

2019

Thereafter

Operating leases (minimum rent)

$

395,483

$

82,282

$

81,697

$

72,660

$

57,190

$

43,625

$

58,029