Lululemon 2014 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2014 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

We believe that the following critical accounting policies affect our more significant estimates and judgments used in the preparation of

our consolidated financial statements:

Revenue Recognition. Net revenue is recognized net of sales taxes, discounts, and an estimated allowance for sales returns. Sales to

customers through corporate-owned stores and other physical locations are recognized at the point of sale, net of an estimated allowance for

sales returns. Direct to consumer sales are recognized when goods are shipped and collection is reasonably assured, net of an estimated

allowance for sales returns. Other net revenue includes outlet sales, showroom sales, sales to wholesale accounts, warehouse sales, and sales

from temporary locations. Revenue is recognized when these sales occur and amounts billed to customers for shipping and handling are

recognized at the time of shipment.

Our estimated allowance for sales returns is a subjective critical estimate that has a direct impact on reported net revenue. This allowance

is calculated based on a history of actual returns, estimated future returns and any significant future known or anticipated events. Consideration

of these factors results in an estimated allowance for sales returns. Our standard terms for retail sales limit returns to approximately 14 days after

the sale of the merchandise, however we accept returns after 14 days where the product fails to meet our guests' quality expectations. For our

wholesale sales, we allow returns from our wholesale accounts if properly requested and approved. Employee discounts are classified as a

reduction of net revenue.

Revenue from our gift cards is recognized when tendered for payment, or upon redemption. Outstanding customer balances are included in

"Unredeemed gift card liability" on the consolidated balance sheets. There are no expiration dates on our gift cards, and we do not charge any

service fees that cause a decrement to customer balances.

While we will continue to honor all gift cards presented for payment, we may determine the likelihood of redemption to be remote for

certain card balances due to, among other things, long periods of inactivity. In these circumstances, to the extent we determine there is no

requirement for remitting card balances to government agencies under unclaimed property laws, card balances may be recognized in the

consolidated statements of operations in net revenue. The amount to be recognized is an estimate, based on historical customer redemption rates.

Inventory. Inventory is valued at the lower of cost and market. We periodically review our inventories and make provisions as necessary

to appropriately value obsolete and damaged goods. The amount of the provision is equal to the difference between the cost of the inventory and

its net realizable value based upon assumptions about future demands, selling prices and market conditions. If changes in market conditions

result in reductions in the estimated net realizable value of our inventory below our previous estimate, we would increase our reserve in the

period in which we made such a determination. In addition, we provide for inventory shrinkage as a percentage of sales, based on historical

trends from actual physical inventories. Inventory shrinkage estimates are made to reduce the inventory value for lost or stolen items. We

perform physical inventory counts throughout the year and adjust the shrink provision accordingly. In fiscal 2014 , we wrote-off $12.4 million

of

inventory, and in fiscal 2013 we wrote-off $28.1 million of inventory, including $17.5 million related to the pull-back of black Luon pants.

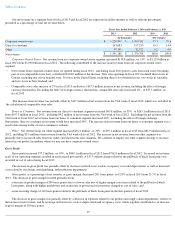

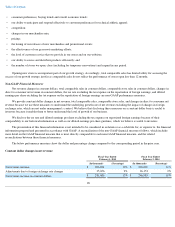

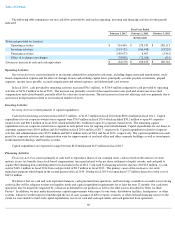

Property and Equipment. Property and equipment are recorded at cost less accumulated depreciation. Buildings are depreciated on a

straight-line basis over the expected useful life of the asset, which we estimate to be 20 years. Leasehold improvements are depreciated on a

straight-line basis over the lesser of the length of the lease and the estimated useful life of the assets, up to a maximum of five years. All other

property and equipment is depreciated using the declining balance method as follows:

Changes in circumstances (such as technological advances) can result in differences between the actual and estimated useful lives. In those

cases where we determine that the useful life of a long-lived asset should be shortened, we increase depreciation expense over the remaining

useful life to depreciate the asset’s net book value to its salvage value.

Long-Lived Assets. Long-lived assets, including intangible assets with finite useful lives are evaluated for impairment when the

occurrence of events or changes in circumstances indicates that the carrying value of the assets may not be recoverable as measured by

comparing their net book value to the undiscounted estimated future cash flows generated by their use and eventual disposition. Impaired assets

are recorded at fair value, determined principally by the present value of the estimated future cash flows expected from their use and eventual

disposition.

Income Taxes. Deferred income tax assets are reduced by a valuation allowance, if based on the weight of available positive and negative

evidence, it is more likely than not that some portion or all of the deferred tax assets will not be realized.

32

Furniture and fixtures

20

%

Computer hardware and software

30

%

Equipment and vehicles

30

%