Lululemon 2014 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2014 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

The information required by this item concerning our directors, director nominees and Section 16 beneficial ownership reporting

compliance is incorporated by reference to our definitive Proxy Statement for our 2015 Annual Meeting of Stockholders under the captions

"Election of Directors," "Section 16(a) Beneficial Ownership Reporting Compliance," "Executive Officers" and "Corporate Governance."

We have adopted a written code of business conduct and ethics, which applies to all of our directors, officers and employees, including our

principal executive officer and our principal financial and accounting officer. Our Code of Business Conduct and Ethics is available on our

website, www.lululemon.com , and can be obtained by writing to Investor Relations, lululemon athletica inc., 1818 Cornwall Avenue,

Vancouver, British Columbia, Canada V6J 1C7 or by sending an email to investors@lululemon.com. The information contained on our website

is not incorporated by reference into this Annual Report on Form 10-K. Any amendments, other than technical, administrative or other non-

substantive amendments, to our Code of Business Conduct and Ethics or waivers from the provisions of the Code of Business Conduct and

Ethics for our principal executive officer and our principal financial and accounting officer will be disclosed on our website within four business

days following the date of such amendment or waiver.

ITEM 11. EXECUTIVE COMPENSATION

The information required by this item is incorporated by reference to our 2015 Proxy Statement under the captions "Executive

Compensation" and "Executive Compensation Tables."

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER

MATTERS

The information required by this item is incorporated by reference to our 2015 Proxy Statement under the caption "Principal Stockholders

and Stock Ownership by Management."

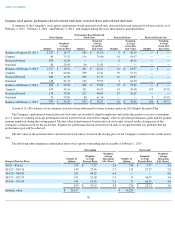

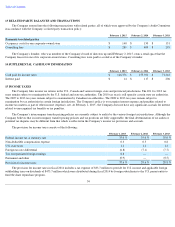

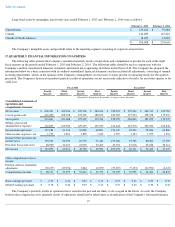

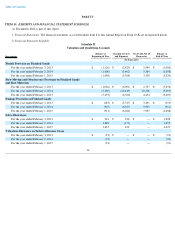

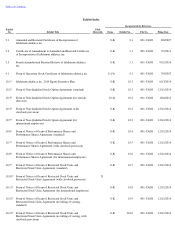

Equity Compensation Plan Information (as of February 1, 2015 )

__________

59

Plan Category

Number of Securities to be

Issued Upon Exercise of

Outstanding Options,

Warrants and Rights

(1)

(A)

Weighted-Average Exercise

Price of

Outstanding Options,

Warrants and Rights

(2)

(B)

Number of Securities

Remaining Available for

Future Issuance Under

Equity Compensation Plans

(Excluding Securities

Reflected in Column (A))

(3)

(C)

Equity compensation plans approved by stockholders

1,516,818

$

39.25

20,458,987

Equity compensation plans not approved by stockholders

—

—

—

Total

1,516,818

$

39.25

20,458,987

(1)

This amount represents the following: (a) 879,282 shares subject to outstanding options, (b) 451,503 shares subject to outstanding

performance-based restricted stock units, and (c) 186,033 shares subject to outstanding restricted stock units. The options, performance-

based restricted stock units and restricted stock units are all under our 2014 Equity Incentive Plan. Restricted shares outstanding under our

2014 Equity Incentive Plan have already been reflected in our total outstanding common stock balance.

(2)

The weighted-

average exercise price is calculated solely on the exercise prices of the outstanding options and does not reflect the shares that

will be issued upon the vesting of outstanding awards of performance-based restricted stock units and restricted stock units, which have no

exercise price.

(3)

This includes (a) 15,180,132 shares of our common stock available for future issuance pursuant to our 2014 Equity Incentive Plan and (b)

5,278,855 shares of our common stock available for future issuance pursuant to our Employee Share Purchase Plan. The number of shares

remaining available for future issuance under our 2014 Equity Incentive Plan is reduced by 1.7 shares for each award other than stock

options granted and by one share for each stock option award granted. Outstanding awards that expire or are canceled without having been

exercised or settled in full are available for issuance again under our 2014 Equity Incentive Plan and shares that are withheld in satisfaction

of tax withholding obligations for full value awards are also again available for issuance. No further awards may be issued under the

predecessor plan, our 2007 Equity Incentive Plan.