Lululemon 2014 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2014 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

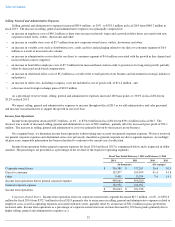

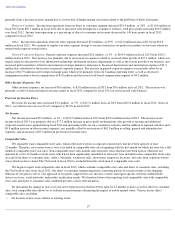

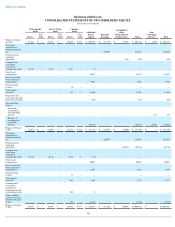

Constant dollar total comparable sales

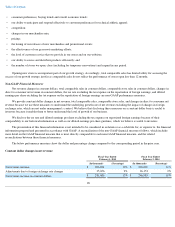

Constant dollar comparable store sales

Constant dollar changes in direct to consumer net revenue

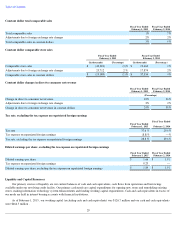

Tax rate, excluding the tax expense on repatriated foreign earnings

Diluted earnings per share, excluding the tax expense on repatriated foreign earnings

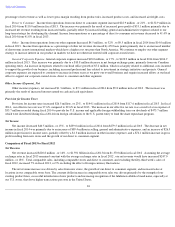

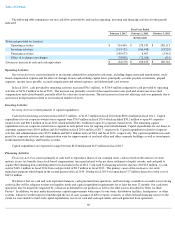

Liquidity and Capital Resources

Our primary sources of liquidity are our current balances of cash and cash equivalents, cash flows from operations and borrowings

available under our revolving credit facility. Our primary cash needs are capital expenditures for opening new stores and remodeling existing

stores, making information technology system enhancements and funding working capital requirements. Cash and cash equivalents in excess of

our needs are held in interest bearing accounts with financial institutions.

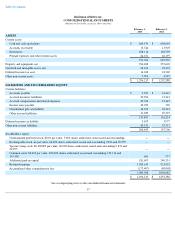

As of February 1, 2015 , our working capital (excluding cash and cash equivalents) was $126.7 million and our cash and cash equivalents

were $664.5 million .

29

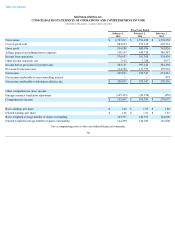

Fiscal Year Ended

February 1, 2015

Fiscal Year Ended

February 2, 2014

Total comparable sales

1

%

7

%

Adjustments due to foreign exchange rate changes

2

%

2

%

Total comparable sales in constant dollars

3

%

9

%

Fiscal Year Ended

February 1, 2015

Fiscal Year Ended

February 2, 2014

(In thousands)

(Percentage)

(In thousands)

(Percentage)

Comparable store sales

$

(42,801

)

(3

)%

$

19,460

2

%

Adjustments due to foreign exchange rate changes

23,712

2

%

17,874

2

%

Comparable store sales in constant dollars

$

(19,089

)

(1

)%

$

37,334

4

%

Fiscal Year Ended

February 1, 2015

Fiscal Year Ended

February 2, 2014

(Percentage)

Change in direct to consumer net revenue

22

%

36

%

Adjustments due to foreign exchange rate changes

2

%

2

%

Change in direct to consumer net revenue in constant dollars

24

%

38

%

Fiscal Year Ended

February 1, 2015

Fiscal Year Ended

February 2, 2014

Tax rate

37.6

%

29.6

%

Tax expense on repatriated foreign earnings

(8.8

)%

—

%

Tax rate, excluding the tax expense on repatriated foreign earnings

28.8

%

29.6

%

Fiscal Year Ended

February 1, 2015

Fiscal Year Ended

February 2, 2014

Diluted earnings per share

$

1.66

$

1.91

Tax expense on repatriated foreign earnings

0.23

—

Diluted earnings per share, excluding the tax expense on repatriated foreign earnings

$

1.89

$

1.91