Lululemon 2014 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2014 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

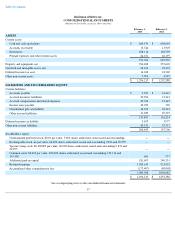

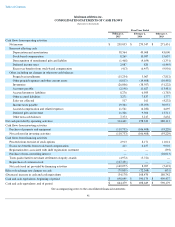

Table of Contents

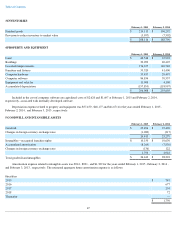

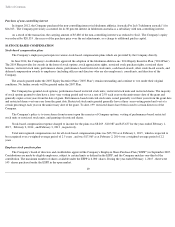

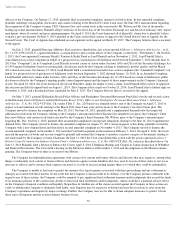

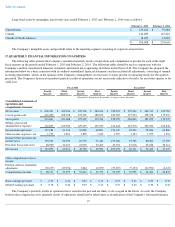

3 INVENTORIES

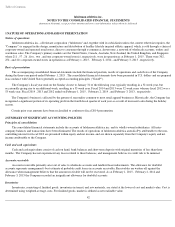

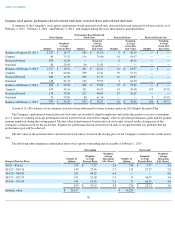

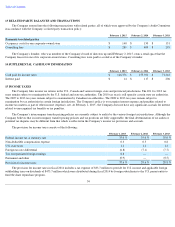

4 PROPERTY AND EQUIPMENT

Included in the cost of computer software are capitalized costs of $2,620 and $1,697 at February 1, 2015 and February 2, 2014 ,

respectively, associated with internally developed software.

Depreciation expense related to property and equipment was $57,450 , $48,177 and $41,671 for the years ended February 1, 2015 ,

February 2, 2014 , and February 3, 2013 , respectively.

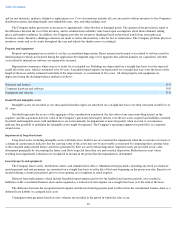

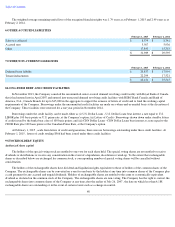

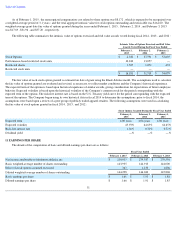

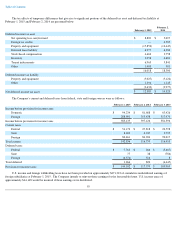

5 GOODWILL AND INTANGIBLE ASSETS

Amortization expense related to intangible assets was $914 , $891 , and $1,329 for the years ended February 1, 2015 , February 2, 2014 ,

and February 3, 2013 , respectively. The estimated aggregate future amortization expense is as follows:

47

February 1, 2015

February 2, 2014

Finished goods

$

214,113

$

196,292

Provision to reduce inventory to market value

(5,997

)

(7,502

)

$

208,116

$

188,790

February 1, 2015

February 2, 2014

Land

$

60,548

$

67,903

Buildings

29,099

20,407

Leasehold improvements

176,677

140,748

Furniture and fixtures

55,320

41,400

Computer hardware

35,457

29,497

Computer software

84,854

70,537

Equipment and vehicles

11,908

4,108

Accumulated depreciation

(157,855

)

(118,997

)

$

296,008

$

255,603

February 1, 2015

February 2, 2014

Goodwill

$

25,496

$

25,496

Changes in foreign currency exchange rates

(1,083

)

(217

)

24,413

25,279

Intangibles—reacquired franchise rights

$

10,150

$

10,630

Accumulated amortization

(8,264

)

(7,830

)

Changes in foreign currency exchange rates

(136

)

122

1,750

2,922

Total goodwill and intangibles

$

26,163

$

28,201

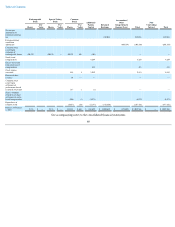

Fiscal Year

2015

$

747

2016

677

2017

254

2018

72

Thereafter

—

$

1,750