Lululemon 2014 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2014 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This discussion summarizes our consolidated operating results, financial condition and liquidity during the three-year period ending

February 1, 2015 . Our fiscal year ends on the Sunday closest to January 31 of the following year, typically resulting in a 52 week year, but

occasionally giving rise to an additional week, resulting in a 53 week year.

Fiscal 2014 and fiscal 2013 were 52 week years whereas fiscal 2012 was a 53 week year. Net revenue numbers for fiscal 2012 include

results from the 53rd week; however, total comparable sales and comparable stores sales calculations exclude the 53rd week. The following

discussion and analysis should be read in conjunction with our consolidated financial statements and the related notes included elsewhere in this

Annual Report on Form 10-K.

This discussion and analysis contains forward-looking statements based on current expectations that involve risks, uncertainties and

assumptions, such as our plans, objectives, expectations and intentions set forth in the "Special Note Regarding Forward-Looking Statements."

Our actual results and the timing of events may differ materially from those anticipated in these forward looking statements as a result of various

factors, including those set forth in the "Item 1A. Risk Factors" section and elsewhere in this Annual Report on Form 10-K.

Overview

Fiscal 2014 was a year in which we continued to make investments we believe will help us to drive growth and expand our business. We

have strengthened the foundation of our business through continued investments in product quality and supply chain and these investments will

continue through fiscal 2015.

Throughout fiscal 2014 we also focused on our product assortment, guest experience, and our go-to-market process for our products. Our

improved product assortment helped to enhance our guest experience and contributed to the improved total comparative sales performance we

saw in the second half of fiscal 2014. The opening of our new distribution center in Columbus, Ohio in fiscal 2014 has also helped improve

guest experience through a reduction in our average transit times for online orders and will also benefit retail distribution to our corporate owned

stores in the United States.

We opened 48 net new corporate-owned stores in fiscal 2014, of which 40 were in the United States. In addition to our plans for further

new store openings in the United States, we are focused on accelerating our international expansion. During fiscal 2014 we opened corporate-

owned stores for the first time in the United Kingdom and Singapore and opened showrooms for the first time in China. We will continue to

utilize a community-based approach to building brand awareness and guest loyalty in new countries but will look to do so over a shorter period

of time than previously, so that we can accelerate our international growth.

We see potential for further expansion for our men’s category and our ivivva athletica brand. In the men's category we expanded both in-

store and online product assortment and we opened our first standalone men’s store in Soho, New York. For ivivva, we opened 10 new stores

during fiscal 2014 and will continue to invest in this brand and open further stores through fiscal 2015.

In fiscal 2015, we expect to substantially complete this foundational work and accelerate our investments in innovation to drive sustainable

global growth.

Financial Highlights

19

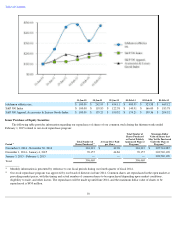

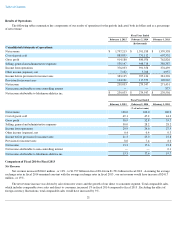

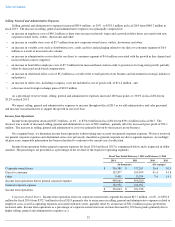

• Our net revenue increased from $1.6 billion in fiscal 2013 to $1.8 billion in fiscal 2014 , representing an annual growth rate of 13% . Our

increase in net revenue from fiscal 2013 to fiscal 2014 resulted from the addition of 48 net new corporate-

owned stores and increased direct

to consumer net revenue.

• Total comparable sales, which includes comparable store sales and direct to consumer, increased 1% in fiscal 2014 and increased by 3%

on

a constant dollar basis.

• Our direct to consumer segment is an increasingly substantial part of our growth strategy, and now represents 17.9% of our net revenue

compared to 16.5% in fiscal 2013 and 14.4% in fiscal 2012 . Direct to consumer net revenue increased 24% on a constant dollar basis

primarily as the result of increased traffic on our e-commerce websites.

• Corporate-owned stores accounted for 75.0% of total net revenue in fiscal 2014 , 77.3% of total net revenue in fiscal 2013 and 79.6% of

total net revenue in fiscal 2012 . Comparable store sales decreased by 1% on a constant dollar basis for fiscal 2014

primarily as the result of

lower conversion rates and lower units purchased per transaction.