Lululemon 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

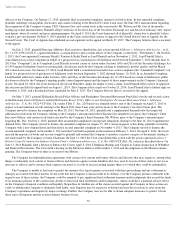

Table of Contents

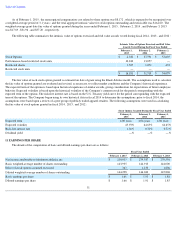

As of February 1, 2015 , the unrecognized compensation cost related to these options was $8,172

, which is expected to be recognized over

a weighted-average period of 3.1 years ; and the total aggregate intrinsic value for stock options outstanding and exercisable was $16,220 . The

weighted-average grant date fair value of options granted during the years ended February 1, 2015 , February 2, 2014 , and February 3, 2013

was $17.69 , $31.96 , and $37.20 , respectively.

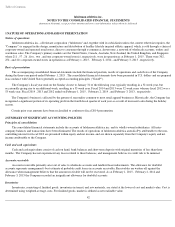

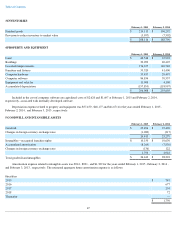

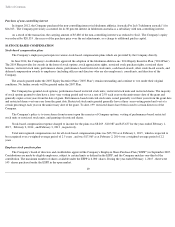

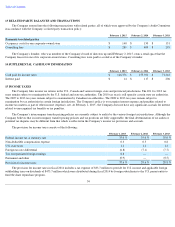

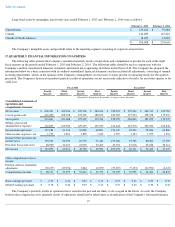

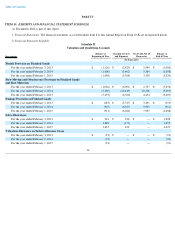

The following table summarizes the intrinsic value of options exercised and full value awards vested during fiscal 2014 , 2013 , and 2012 :

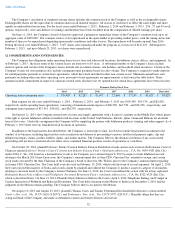

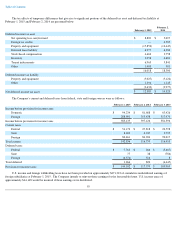

The fair value of each stock option granted is estimated on date of grant using the Black-

Scholes model. The assumptions used to calculate

the fair value of options granted are evaluated and revised, as necessary, to reflect market conditions and the Company's historical experience.

The expected term of the options is based upon historical experience of similar awards, giving consideration for expectations of future employee

behavior. Expected volatility is based upon the historical volatility of the Company's common stock for the period corresponding with the

expected term of the options. The risk-free interest rate is based on the U.S. Treasury yield curve for the period corresponding with the expected

term of the options. The Company began using its own historical data in fiscal 2014 to determine the assumptions; prior to fiscal 2014, the

assumptions were based upon a review of a peer group of publicly traded apparel retailers. The following assumptions were used in calculating

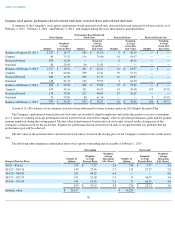

the fair value of stock options granted in fiscal 2014 , 2013 , and 2012 :

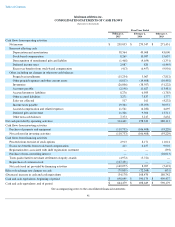

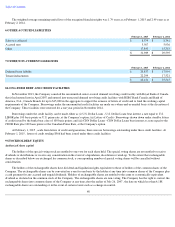

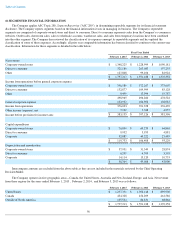

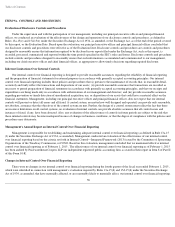

11 EARNINGS PER SHARE

The details of the computation of basic and diluted earnings per share are as follows:

51

Intrinsic Value of Options Exercised and Full Value

Awards Vested During the Fiscal Year Ended

February 1,

2015

February 2,

2014

February 3,

2013

Stock Options

$

4,382

$

37,591

$

53,605

Performance-based restricted stock units

10,242

13,057

—

Restricted shares

1,567

1,070

474

Restricted stock units

—

—

—

$

16,191

$

51,718

$

54,079

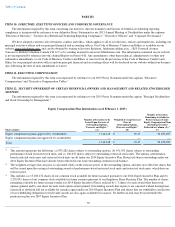

Stock Options Granted During the Fiscal Year Ended

February 1,

2015

February 2,

2014

February 3,

2013

Expected term

4.00 years

4.06 years

4.06 years

Expected volatility

45.93

%

64.65

%

64.65

%

Risk-free interest rate

1.04

%

0.72

%

0.72

%

Dividend yield

—

%

—

%

—

%

Fiscal Year Ended

February 1, 2015

February 2, 2014

February 3, 2013

Net income attributable to lululemon athletica inc

$

239,033

$

279,547

$

270,556

Basic weighted-average number of shares outstanding

143,935

144,913

144,000

Effect of stock options assumed exercised

363

1,130

1,806

Diluted weighted-average number of shares outstanding

144,298

146,043

145,806

Basic earnings per share

$

1.66

$

1.93

$

1.88

Diluted earnings per share

$

1.66

$

1.91

$

1.85