Lululemon 2014 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2014 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

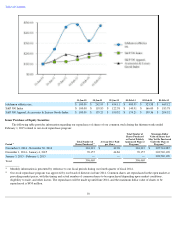

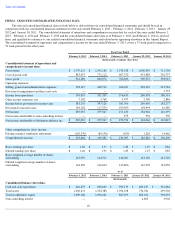

We currently generate a significant portion of our net revenue and incur a significant portion of our expenses in Canada. The reporting

currency for our consolidated financial statements is the U.S. dollar. The strengthening of the U.S. dollar against the Canadian dollar during

fiscal 2014 has resulted in:

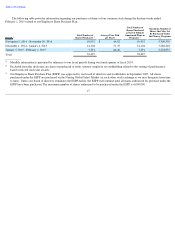

A 10% depreciation in the relative value of the Canadian dollar against the U.S. dollar compared to the exchange rates in effect for fiscal

2014 would have resulted in lost income from operations of approximately $2.2 million in fiscal 2014 . This assumes a consistent 10%

depreciation in the Canadian dollar against the U.S. dollar throughout the fiscal year. The timing of changes in the relative value of the Canadian

dollar combined with the seasonal nature of our business, can affect the magnitude of the impact that fluctuations in foreign exchange rates have

on our income from operations.

We have not historically hedged foreign currency fluctuations. However, in the future, in an effort to mitigate losses associated with these

risks, we may at times enter into derivative financial instruments, although we have not historically done so. We do not, and do not intend to,

engage in the practice of trading derivative securities for profit.

The operations of many of our suppliers are subject to additional risks that are beyond our control and that could harm our business,

financial condition and results of operations.

Almost all of our suppliers are located outside of North America. During fiscal 2014 , approximately 59% of our products were produced

in South East Asia, approximately 23% in South Asia, approximately 11% in China, approximately 1% in North America and the remainder in

other countries. As a result of our international suppliers, we are subject to risks associated with doing business abroad, including:

These and other factors beyond our control could interrupt our suppliers' production in offshore facilities, influence the ability of our

suppliers to export our products cost-effectively or at all and inhibit our suppliers' ability to procure certain materials, any of which could harm

our business, financial condition and results of operations.

Our ability to source our merchandise profitably or at all could be hurt if new trade restrictions are imposed or existing trade restrictions

become more burdensome.

The United States and the countries in which our products are produced or sold internationally have imposed and may impose additional

quotas, duties, tariffs, or other restrictions or regulations, or may adversely adjust prevailing quota, duty or tariff levels. We have expanded our

relationships with suppliers outside of China, which among other things has resulted in increased costs and shipping times for some products.

Countries impose, modify and remove tariffs and other trade restrictions in response to a diverse array of factors, including global and national

economic and political conditions, which make it impossible for us to predict future developments regarding tariffs and other trade restrictions.

Trade restrictions, including tariffs, quotas, embargoes, safeguards and customs restrictions, could increase the cost or reduce the supply of

products available to us or may require us to modify our supply chain organization or other current business practices, any of which could harm

our business, financial condition and results of operations.

Our trademarks and other proprietary rights could potentially conflict with the rights of others and we may be prevented from selling

some of our products.

Our success depends in large part on our brand image. We believe that our trademarks and other proprietary rights have significant value

and are important to identifying and differentiating our products from those of our competitors and creating

11

• a reduction in our net revenue upon translation of the sales made by our Canadian operations into U.S. dollars for the purposes of

consolidation;

• a reduction in our selling, general and administrative expenses incurred by our Canadian operations into U.S. dollars for the purposes of

consolidation; and

•

foreign exchange gains by our Canadian subsidiaries on U.S. dollar cash and receivables denominated in U.S. dollars.

• political unrest, terrorism, labor disputes and economic instability resulting in the disruption of trade from foreign countries in which our

products are manufactured;

• the imposition of new laws and regulations, including those relating to labor conditions, quality and safety standards, imports, duties, taxes

and other charges on imports, as well as trade restrictions and restrictions on currency exchange or the transfer of funds;

•

reduced protection for intellectual property rights, including trademark protection, in some countries, particularly China;

•

disruptions or delays in shipments; and

•

changes in local economic conditions in countries where our manufacturers, suppliers or guests are located.