Lululemon 2014 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2014 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

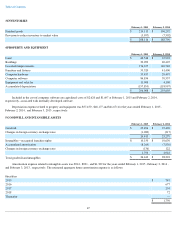

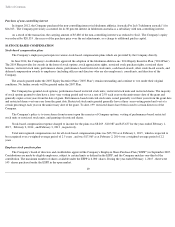

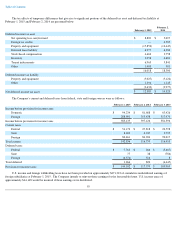

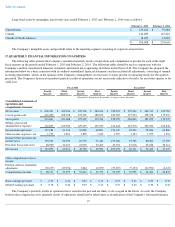

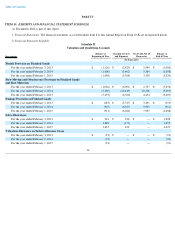

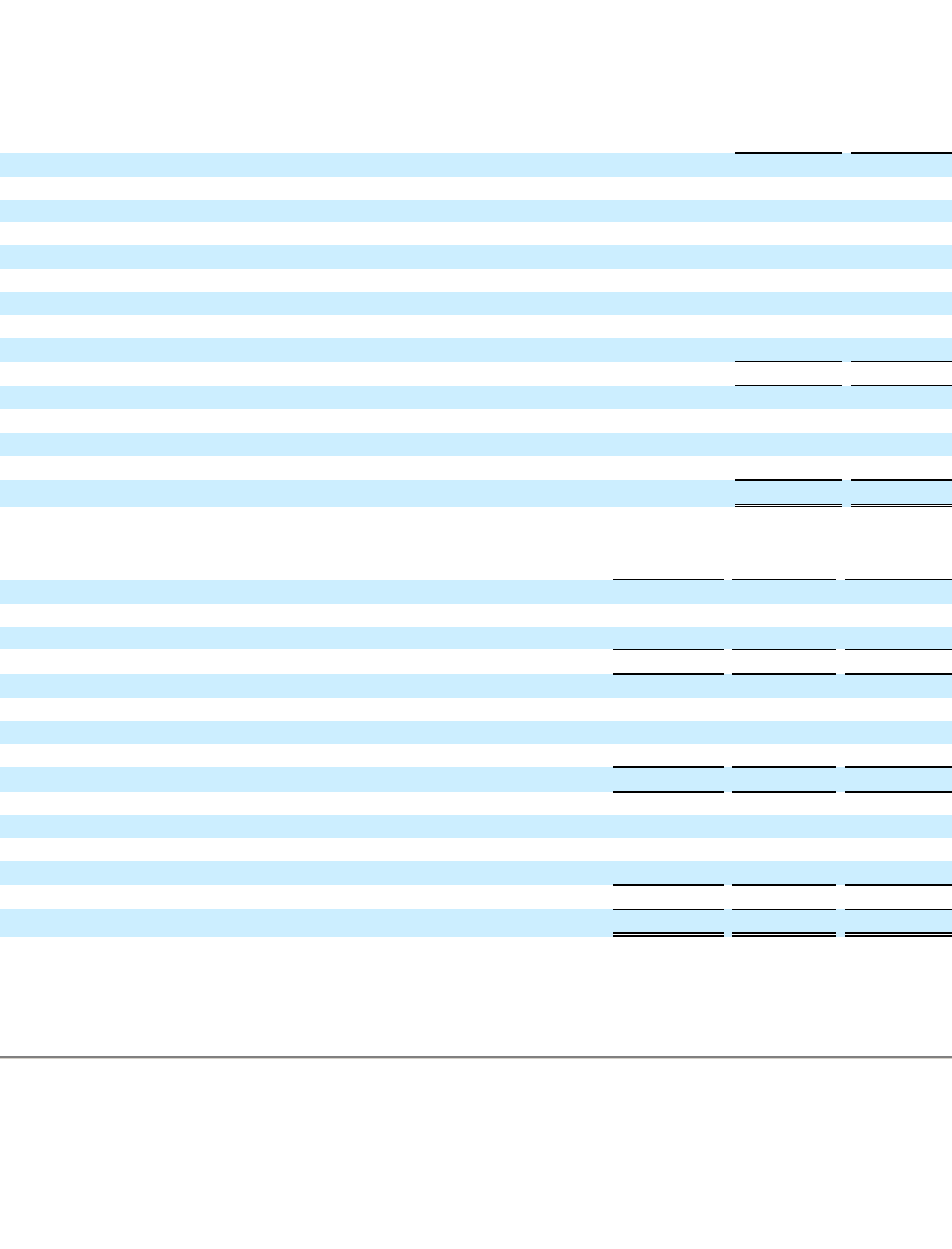

The tax effects of temporary differences that give rise to significant portions of the deferred tax asset and deferred tax liability at

February 1, 2015 and February 2, 2014 are presented below:

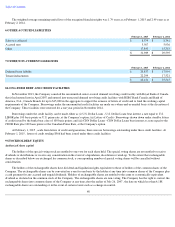

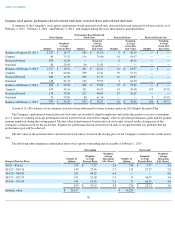

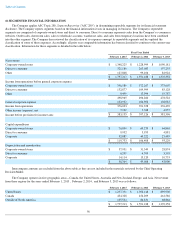

The Company's current and deferred taxes from federal, state and foreign sources were as follows:

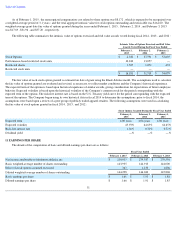

U.S. income and foreign withholding taxes have not been provided on approximately $471,322 of cumulative undistributed earnings of

foreign subsidiaries at February 1, 2015 . The Company intends to reinvest these earnings for the foreseeable future. U.S. income taxes of

approximately $44,148 would be incurred if these earnings were distributed.

55

February 1, 2015

February 2,

2014

Deferred income tax asset

Net operating loss carryforward

$

8,803

$

5,097

Foreign tax credits

—

4,585

Property and equipment

(15,850

)

(12,447

)

Deferred lease liability

6,977

6,284

Stock-based compensation

4,662

3,758

Inventory

3,058

4,681

Tenant inducements

6,965

5,841

Other

1,403

501

16,018

18,300

Deferred income tax liability

Property and equipment

(5,027

)

(5,122

)

Other

1,394

1,145

(3,633

)

(3,977

)

Net deferred income tax asset

$

12,385

$

14,323

February 1, 2015

February 2, 2014

February 3, 2013

Income before provision for income taxes

Domestic

$

94,234

$

81,688

$

63,426

Foreign

288,901

315,438

317,970

Income before provision for income taxes

383,135

397,126

381,396

Current taxes

Federal

$

54,172

$

27,818

$

22,598

State

8,203

4,017

3,795

Foreign

80,461

84,924

90,017

Total current

142,836

116,759

116,410

Deferred taxes

Federal

$

7,763

$

266

$

(5,667

)

State

77

38

(786

)

Foreign

(6,574

)

516

8

Total deferred

1,266

820

(6,445

)

Provision for income taxes

$

144,102

$

117,579

$

109,965