Lululemon 2014 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2014 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

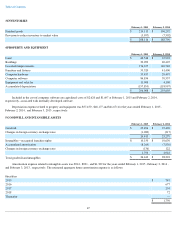

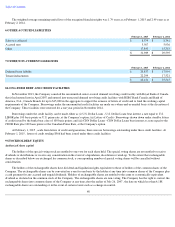

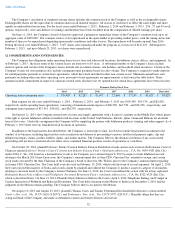

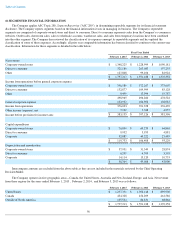

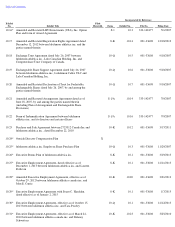

13 RELATED PARTY BALANCES AND TRANSACTIONS

The Company entered into the following transactions with related parties, all of which were approved by the Company's Audit Committee

in accordance with the Company’s related party transaction policy:

The Company's founder, who was member of the Company's board of directors up until February 2, 2015, owns a retail space that the

Company leases for one of its corporate-owned stores. Consulting fees were paid to a relative of the Company's founder.

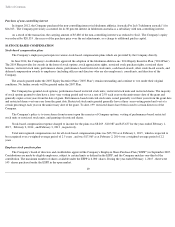

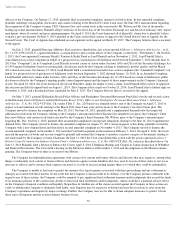

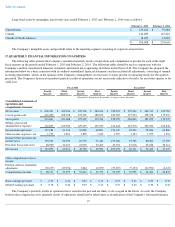

14 SUPPLEMENTAL CASH FLOW INFORMATION

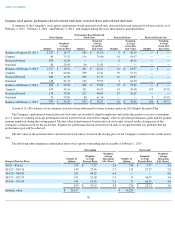

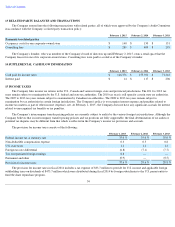

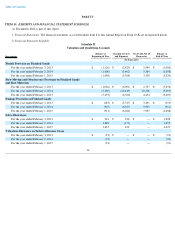

15 INCOME TAXES

The Company files income tax returns in the U.S., Canada and various foreign, state and provincial jurisdictions. The 2011 to 2013 tax

years remain subject to examination by the U.S. federal and state tax authorities. The 2010 tax year is still open for certain state tax authorities.

The 2007 to 2013 tax years remain subject to examination by Canadian tax authorities. The 2008 to 2013 tax years remain subject to

examination by tax authorities in certain foreign jurisdictions. The Company's policy is to recognize interest expense and penalties related to

income tax matters as part of other income (expense), net. At February 1, 2015 , the Company does not have any significant accruals for interest

related to unrecognized tax benefits or tax penalties.

The Company's intercompany transfer pricing policies are currently subject to audits by the various foreign tax jurisdictions. Although the

Company believes that its intercompany transfer pricing policies and tax positions are fully supportable, the final determination of tax audits or

potential tax disputes may be different from that which is reflected in the Company's income tax provisions and accruals.

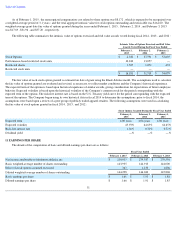

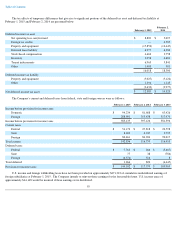

The provision for income taxes consists of the following:

The provision for income taxes in fiscal 2014 includes a tax expense of $33.7 million to provide for U.S. income and applicable foreign

withholding taxes on dividends of $473.7 million which were distributed during fiscal 2014 by foreign subsidiaries to the U.S. parent entity to

fund the share repurchase program.

54

February 1, 2015

February 2, 2014

February 3, 2013

Payments to related parties

Occupancy costs for one corporate-owned store

$

140

$

150

$

151

Consulting fees

$

289

$

409

$

295

February 1, 2015

February 2, 2014

February 3, 2013

Cash paid for income taxes

$

146,376

$

155,394

$

71,342

Interest paid

$

14

$

117

$

206

February 1, 2015

February 2, 2014

February 3, 2013

Federal income tax at statutory rate

35.0

%

35.0

%

35.0

%

Non-deductible compensation expense

0.3

0.5

0.8

U.S. state taxes

1.2

1.2

1.2

Foreign tax rate differential

(6.8

)

(7.1

)

(7.7

)

Tax on repatriated foreign earnings

8.8

—

—

Permanent and other

(0.9

)

—

(

0.5

)

Provision for income taxes

37.6

%

29.6

%

28.8

%