Lululemon 2014 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2014 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Opening new stores is an important part of our growth strategy. Accordingly, total comparable sales has limited utility for assessing the

success of our growth strategy insofar as comparable sales do not reflect the performance of stores open less than 12 months.

Non

-GAAP Financial Measures

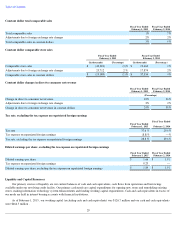

Net revenue changes in constant dollars, total comparable sales in constant dollars, comparable store sales in constant dollars, changes in

direct to consumer net revenue in constant dollars, the tax rate excluding the tax expense on the repatriation of foreign earnings, and diluted

earnings per share excluding the tax expense on the repatriation of foreign earnings are non-GAAP performance measures.

We provide constant dollar changes in net revenue, total comparable sales, comparable store sales, and changes in direct to consumer net

revenue because we use these measures to understand the underlying growth rate of net revenue excluding the impact of changes in foreign

exchange rates, which are not under management’s control. We believe that disclosing these measures on a constant dollar basis is useful to

investors because it enables them to better understand the level of growth of our business.

We disclose the tax rate and diluted earnings per share excluding the tax expense on repatriated foreign earnings because of their

comparability to our historical information as well as our diluted earnings per share guidance, which we believe is useful to investors.

The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial

information prepared and presented in accordance with GAAP. A reconciliation of the non-GAAP financial measures follows, which includes

more detail on the GAAP financial measure that is most directly comparable to each non-GAAP financial measure, and the related

reconciliations between these financial measures.

The below performance measures show the dollar and percentage change compared to the corresponding period in the prior year.

Constant dollar changes in net revenue

28

•

consumer preferences, buying trends and overall economic trends;

•

our ability to anticipate and respond effectively to customer preferences for technical athletic apparel;

•

competition;

•

changes in our merchandise mix;

•

pricing;

•

the timing of our releases of new merchandise and promotional events;

•

the effectiveness of our grassroots marketing efforts;

•

the level of customer service that we provide in our stores and on our websites;

•

our ability to source and distribute products efficiently; and

•

the number of stores we open, close (including for temporary renovations) and expand in any period.

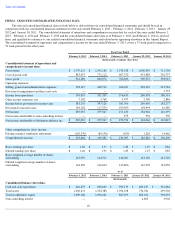

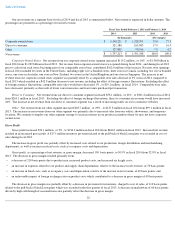

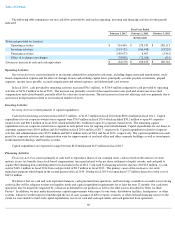

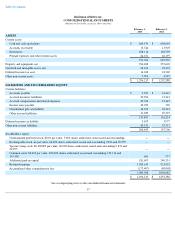

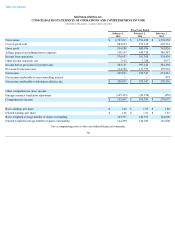

Fiscal Year Ended

February 1, 2015

Fiscal Year Ended

February 2, 2014

(In thousands)

(Percentage)

(In thousands)

(Percentage)

Net revenue increase

$

206,024

13

%

$

220,830

16

%

Adjustments due to foreign exchange rate changes

35,656

2

%

26,153

2

%

Net revenue increase in constant dollars

$

241,680

15

%

$

246,983

18

%