Holiday Inn 2014 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2014 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

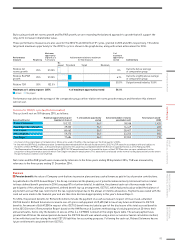

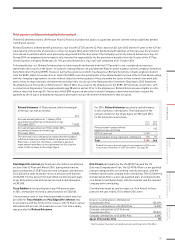

Dividends paid to Executive Directors

An interim dividend of 14.8p per ordinary share (25¢ per ADR)

was paid on 26 September 2014 to shareholders on the Register

of members at the close of business on 22 August 2014.

A special interim dividend of 174.9p per ordinary share (293¢ per

ADR) was paid on 14 July 2014 to shareholders on the Register of

members at the close of business on 30 June 2014.

The 2014 special dividend was accompanied by a share consolidation

to maintain comparability (as far as possible) of the share price

before and after the payment of the special dividend. Neither LTIP

award holders nor IHG Executive Share Option Plan holders were

entitled to receive the special dividend. Executive Directors holding

forfeitable shares under previous years’ annual incentive awards

received the special dividend, and their share awards were subject

to the share consolidation.

Kirk Kinsell’s deferred shares are held in the form of conditional

awards, which were not eligible to receive the special dividend,

rather than forfeitable shares. To ensure equity of treatment with

other Executive Committee members, a dividend equivalent was

paid in respect of these awards to Mr Kinsell, and his awards were

subject to the share consolidation.

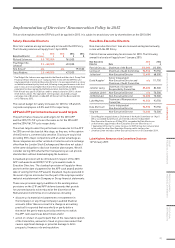

Payments for loss of office (audited information)

Tom Singer stepped down from the Board and his role as Group

Chief Financial Officer on 1 January 2014. In line with his contractual

agreement and the Remuneration Committee’s policy on termination

of employment, Mr Singer was not paid any salary or benefits

(or compensation in lieu) in respect of the period after 1 January

2014, and did not receive any compensation for loss of office.

The footnotes to the single total figure table on page 82 set out the

impact of Mr Singer’s resignation on his APP and LTIP awards.

Payments to past directors – benefits

(audited information)

Sir Ian Prosser, who retired as a Director on 31 December 2003,

had an ongoing healthcare benefit of £1,379 during the year.

Payments to past directors – ICETUS cash out

(audited information)

In 2014, the Company looked to reduce the risks and volatility from

the remaining unfunded ICETUS pension arrangement by offering

members an opportunity to cash out the ICETUS element of their

pension on a basis that is fair and reasonable, both to them and to

shareholders. This is part of the process of redrawing IHG’s pension

arrangements and minimising the future risks to the Company.

A number of past directors received one-off payments, following

which they will have no future entitlement to any benefit from

ICETUS:

Former Director

Value in 2014

£

Andrew Cosslett1No value to disclose

Richard Hartman274,968

Richard North33,386,296

Sir Ian Prosser 8,597

1 A gross cash payment of £5,114,920 was made in lieu of any future entitlement

to ICETUS benefits, in respect of which £5,266,788 had been disclosed in the

2011 Annual Report on Directors’ Remuneration based on the Cash Equivalent

Transfer Value methodology of valuing pensions applicable at the time.

2 A gross cash payment of £497,987 in lieu of any future entitlement to ICETUS

benefits, in respect of which £423,019 had been disclosed in the 2007 Annual

Report on Directors’ Remuneration based on the Cash Equivalent Transfer

Value methodology of valuing pensions applicable at the time.

3 A gross cash payment of £6,444,041 was made in lieu of any future entitlement

to ICETUS benefits, in respect of which £3,057,744 had been disclosed in the

2004 Annual Report on Directors’ Remuneration based on the Cash Equivalent

Transfer Value methodology of valuing pensions applicable at the time.

Share options

In 2013, the gain before tax, made by Richard Solomons on the

exercise of options was £4,663,884.

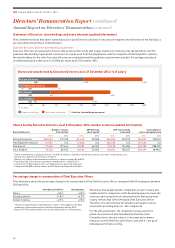

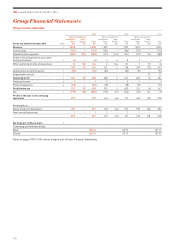

Fees (£000)

Taxable benefits2

(£000) Total (£000)

Non-Executive Director Committee appointments1Date of original appointment 2014 2013 2014 2013 2014 2013

Patrick Cescau N1 January 2013 412 400 15 14 427 414

Ian Dyson3A N R1 September 2013 88 23 2190 24

Jo Harlow4A N R1 September 2014 23 n/a 0n/a 23 n/a

David Kappler5A N R21 June 2004 47 109 1248 111

Jennifer Laing A C N25 August 2005 83 80 3286 82

Jonathan Linen6N R1 December 2005 71 69 81 90 152 159

Jill McDonald7A N1 June 2013 71 40 2373 43

Luke Mayhew C N R1 July 2011 94 91 3297 93

Dale Morrison8A C N1 June 2011 84 69 22 22 106 91

Ying Yeh C N R1 December 2007 71 69 72 72 143 141

1 See page 57 for Board Committee membership key.

2 Benefits include taxable travel and accommodation expenses to attend Boardmeetings away from home location; under concessionary HM Revenue & Customs

rules, non-UK based Non-Executive Directors are not subject to tax on travel expenses for the first five years. This is reflected in the taxable benefits figures for

Jonathan Linen, Dale Morrison and Ying Yeh.

3 Ian Dyson was appointed as a Non-Executive Director on 1 September 2013 and became Chairman of the Audit Committee on 1 April 2014. His fee increased

accordingly from that date.

4 Jo Harlow was appointed as a Non-Executive Director on 1 September 2014. Her fee was pro-rated accordingly from her start date.

5 David Kappler retired as a Non-Executive Director on 31 May 2014.

6 Jonathan Linen retired as a Non-Executive Director on 31 December 2014.

7 Jill McDonald was appointed as a Non-Executive Director on 1 June 2013. Her fee was pro-rated accordingly from her start date.

8 Dale Morrison became Senior Independent Non-Executive Director with effect from 31 May 2014 and his fee increased accordingly from that date.

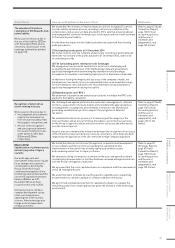

Annual Report on Directors’ Remuneration continued

Single total figure of remuneration: Non-Executive Directors (audited information)

IHG Annual Report and Form 20-F 2014

90

continuedDirectors’ Remuneration Report