Holiday Inn 2014 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2014 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

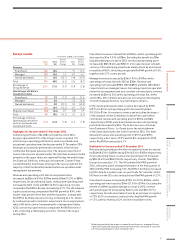

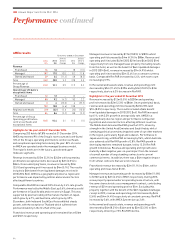

Greater China results

12 months ended 31 December

2014

$m

2013

$m

2014 vs

2013 %

change

2012

$m

2013 vs

2012 %

change

Revenue

Franchised 4333.3 3 –

Managed 99 92 7.6 89 3.4

Owned and leased 139 141 (1.4) 138 2.2

Total 242 236 2.5 230 2.6

Percentage of

Group Revenue 13.0 12.4 0.6 12.5 (0.1)

Operating profit before

exceptional items

Franchised 55– 4 25.0

Managed 63 51 23.5 51 –

Owned and leased 42 47 (10.6) 45 4.4

110 103 6.8 100 3.0

Regional overheads (21) (21) –(19) (10.5)

Total 89 82 8.5 81 1.2

Percentage of Group

Operating profit before

central overheads and

exceptional items

11.0 10.0 1.0 10.6 (0.6)

Highlights for the year ended 31December 2014

Comprising 241 hotels (78,194 rooms) at 31 December 2014,

Greater China represented 11% of the Group’s room count and

contributed 11% of the Group’s operating profit before central

overheads and exceptional operating items for the year ended

31 December 2014. 97% of rooms in Greater China are operated

under the managed business model. The region’s hotels are

in the luxury, upscale and upper midscale segments.

Revenue and operating profit before exceptional items increased

by $6m (2.5%) to $242m and by $7m (8.5%) to $89m respectively.

Overall, the region achieved comparable RevPAR growth of

1.6%, slightly stronger than the 1.0% growth achieved in 2013.

This performance was significantly ahead of the industry,

reflecting IHG’s scale and management strength in the region,

and was achieved in a challenging environment with slower

macro-economic conditions, government austerity measures

and protests in Hong Kong. Trading was strongest in tier 1 cities,

especially Shanghai and Guangzhou, with good levels of transient

and corporate business. Performance in tier 2 and 3 cities

continues to be impacted by new supply as these markets develop.

Total RevPAR in the region decreased by 3.4% as hotels opened

in these lower RevPAR markets.

Franchised revenue increased by $1m (33.3%) to $4m whilst

operating profit was flat at $5m. Operating profit was higher than

revenue in both 2014 and 2013 due to joint venture dividend income

received from a hotel in Hong Kong.

Managed revenue increased by $7m (7.6%) to $99m, whilst

operating profit increased by $12m (23.5%) to $63m, reflecting

improvements in operating margin, net rooms growth, and a

small number of one-off items that contributed approximately $5m

to the result. Comparable RevPAR increased by 1.3%, whilst the

Greater China System size grew by 14.7%, driving a 8.5% increase

in total gross revenue derived from rooms business. Total gross

revenue derived from non-rooms business increased by 7.8%.

Owned and leased revenue decreased by $2m (1.4%) to $139m,

driven by a RevPAR decrease of 1.0% at InterContinental Hong

Kong. Operating profit decreased by $5m (10.6%) to $42m.

The decrease in revenue and operating profit at the hotel was

driven primarily by the ongoing development of the area adjacent

to the hotel and protests in central Hong Kong.

Highlights for the year ended 31December 2013

Revenue and operating profit before exceptional items increased

by$6m (2.6%) to $236m and by $1m (1.2%) to $82m respectively.

On an underlying basis, revenue and operating profit increased

by $6m (2.6%) and $2m (2.5%) respectively.

Franchised revenue was flat at $3m and operating profit increased

by $1m (25.0%) to $5m.

Managed revenue increased by $3m (3.4%) to $92m and operating

profit was flat at $51m. RevPAR increased by 0.6%, whilst the

Greater China System size grew by 11.8%, driving a 9.2% increase

in total gross revenue derived from rooms business. Total gross

revenue derived from non-rooms business increased by 3.0%.

Operating profit was partly offset by increased investment to

drive future growth.

Owned and leased revenue at InterContinental Hong Kong

increased by $3m (2.2%) to $141m, driven by a 4.5% increase in

total gross revenue derived from non-rooms business, although

this was partly offset by a RevPAR decline of 0.1%. Operating profit

increased by $2m (4.4%) to $47m.

47

STRATEGIC REPORT GOVERNANCE

GROUP

FINANCIAL STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS

ADDITIONAL

INFORMATION