Holiday Inn 2014 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2014 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

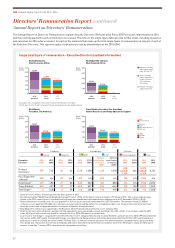

By focusing on both net rooms growth and RevPAR growth, we are rewarding the balanced approach to growth that will support the

long-term increase in shareholder value.

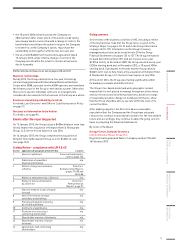

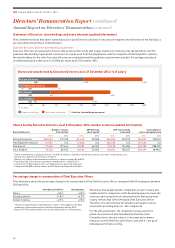

These performance measures are also used for the 2013/15 and 2014/16 LTIP cycles, granted in 2013 and 2014 respectively. Threshold,

target and maximum opportunity for the 2012/14 cycle is shown in the graph below, along with actual achievement for 2014.

Performance

measure Weighting

Maximum

opportunity

at grant as a

% of salary

Achievement relative to maximum

for that measure

% of

maximum

opportunity

vested Commentary

No

payout Threshold Target Maximum

Relative net

rooms growth 25% 51.25% 0% Outcome below average

of comparator group

Relative RevPAR

growth 25% 51.25% 6.1% Outcome slightly above average

of comparator group

Relative TSR 50% 102.5% 50.0% Outperformed index by 15.8%

Maximum as % salary at grant 205% % of maximum opportunity vested 56.1%

Actual No payout

Performance was below the average of the comparator group on the relative net rooms growth measure and therefore this element

will not vest.

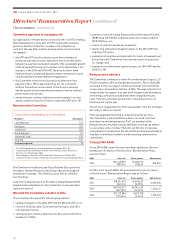

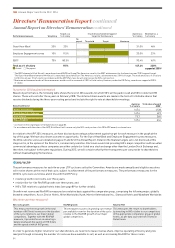

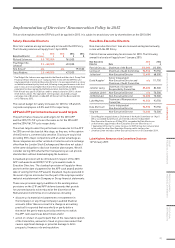

Outcome for 2012/14 cycle (audited information)

This cycle will vest on 18 February 2015, as follows:

Executive Director

Maximum opportunity at grant

(number of shares)

% of maximum opportunity

vested

Outcome (number of shares

awarded at vest)

Total value of award1

£000

Richard Solomons 103,722 56.1 58,188 1,425

Paul Edgecliffe-Johnson 29,322 56.1 16,449 403

Kirk Kinsell268,463 56.1 38,407 941

Tracy Robbins 59,270 56.1 33,250 814

Tom Singer377,684 56.1 29,053 712

1 As shown in the single figure of remuneration. Share price used of 2,449p is the average over the final quarter of 2014.

2 In line with the DR Policy, the Remuneration Committee determined that Kirk Kinsell would retain his 2012/14 LTIP award in accordance with and subject to

the terms of the LTIP Plan rules, as the performance period for this award was completed when Kirk Kinsell resigned effective as of 13 February 2015.

3 The Remuneration Committee determined that the 2012/14 LTIP award would vest in line with the terms of the LTIP Plan rules on a pro-rated basis for the

proportion of the performance period in which Tom Singer remained in employment. This award will be released on the normal vesting date and only to the extent

the performance conditions were fulfilled.

Net rooms and RevPAR growth were measured by reference to the three years ending 30 September 2014; TSR was measured by

reference to the three years ending 31 December 2014.

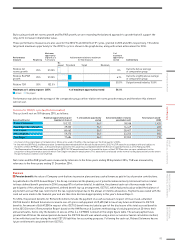

Pensions

Pension benefit: the value of Company contributions to pension plans and any cash allowances paid in lieu of pension contributions.

As published in the 2013 Annual Report, the Group commenced the phasing out of potential enhanced early retirement terms related

to those defined benefit pensions in 2014 (see page 87 for further details). In addition, the planned cash out offer was made to the

participants of the unfunded, unregistered, defined benefit top-up arrangement, ICETUS, which had previously provided the balance of

any benefit accrual that was restricted in the tax-registered plan due to the annual or lifetime allowances. Payments associated with the

cash out were made in the financial year and are therefore disclosed appropriately in this year’s Annual Report.

For 2014, the pension benefits for Richard Solomons include the payment of a cash out value in respect of his accrued, unfunded

ICETUS benefit. Richard Solomons received a one-off gross cash payment of £9,405,362 in lieu of any future entitlement to ICETUS

benefits. An amount of £6,447,000 in respect of his ICETUS benefit was included as part of the disclosure of his total accrued benefits

in the 2013 Directors’ Remuneration Report based on the HM Revenue & Customs methodology of valuing pensions at 20 times their

annual amounts, hence only the balance in excess of this (i.e. £2.958m) is shown in the single figure table. The actual payment was

greater than 20 times the annual pension because the ICETUS benefit was valued using a more accurate actuarial calculation method,

in line with that used for valuing the total ICETUS liabilities for accounting purposes. Following the cash out, Richard Solomons has no

future entitlement to any benefit from ICETUS.

85

STRATEGIC REPORT GOVERNANCE

GROUP

FINANCIAL STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS

ADDITIONAL

INFORMATION