Holiday Inn 2014 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2014 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

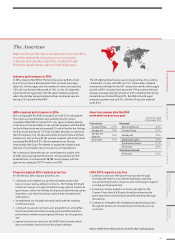

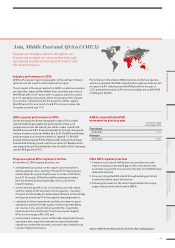

IHG’s regional performance in 2014

IHG’s comparable RevPAR increased 7.4% with 3.7% rate growth.

The region is predominantly represented by the US, where

comparable RevPAR increased 7.5%. Our upper midscale brands

in the US performed broadly in line with the segment, with RevPAR

for the Holiday Inn brand increasing 8.1% whilst that for the Holiday

Inn Express brand was at 7.2% due to higher absolute occupancies

than the industry. Our US upscale brands (Crowne Plaza and Hotel

Indigo) were also in line with the upscale segment with both brands

increasing RevPAR by 8.3%. We strengthened our 20-year

relationship with Grupo Presidente to expand the footprint and

diversity of our brands in key cities and resort destinations.

We continued to demonstrate our commitment to quality with

12,230 rooms leaving the IHG System. Strong demand for IHG

branded hotels continued with 38,108 rooms signed, with the

pipeline increasing by 10,177 rooms over 2013.

IHG’s 2015 regional priorities

1. Continue to increase IHG System size growth through

working with owners to accelerate openings, assisting

low-performing hotels to improve, and continuing to support

our high-performing hotels.

2. Continue to deliver against our multi-year plan for the

Crowne Plaza Hotels & Resorts brand by enhancing the

guest experience and driving brand differentiation through

innovations.

3. Continue to strengthen the Holiday Inn brand family position

through the delivery of innovations and consistency across

our hotels.

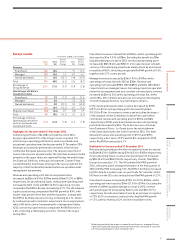

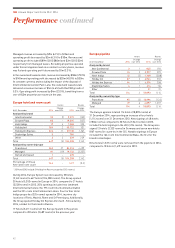

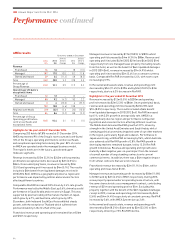

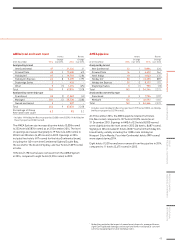

Americas comparable RevPAR

movement onprevious year 12 months ended

31 December 2014

Franchised Managed

Crowne Plaza 6.9% InterContinental 6.9%

Holiday Inn 7.9% Crowne Plaza 12.7%

Holiday Inn

Express 7.0% Holiday Inn 9.0%

All brands 7.2% Staybridge Suites 9.7%

Candlewood Suites 11.7%

All brands 8.9%

Owned and leased

All brands 11.2%

The Americas

Maximise the performance and growth of our portfolio

of preferred brands, focusing on our core upper

midscale and upscale segments, mostly through

franchise agreements, over the next three years.

Industry performance in 2014

In 2014, industry RevPAR in The Americas grew by 8.4% driven

by a 4.2% increase in demand and a 5.0% increase in average

daily rate. On the supply side, the number of rooms increased by

1.0%, the fourth year with growth of 1.0% or less. All segments

experienced strong growth, with the upper midscale segment,

where the Holiday Inn and Holiday Inn Express brands operate,

having a 7.5% growth in RevPAR.

Progress against 2014 regional priorities

In line with our 2014 regional priorities, we:

The US lodging industry also saw strong growth as the economy

continued to recover with GDP up 2.4%. In December, demand

reached record highs for the 46th consecutive month, while supply

growth of 0.9% remained well below the 1.9% per annum historic

average. Average daily rate growth of 4.6% combined with strong

demand drove US RevPAR up 8.3%. RevPAR in the US upper

midscale segment was up 8.2%, with the US upscale segment

up by 8.4%.

• continued to strengthen our preferred brands and provide

best-in-class revenue delivery to hotels – the Holiday Inn brand

rolled out revenue-driving food and beverage options to address

guest needs, whilst the Holiday Inn Express brand introduced an

innovative, cost effective design solution that resonated well

with owners;

• strengthened our Holiday Inn brand family with the opening

of 140 new hotels;

• continued to execute our multi-year programme to strengthen

the Crowne Plaza brand by focusing on brand differentiation,

performance initiatives and signing 10 hotels into the pipeline;

and

• opened our first two hotels for the EVEN Hotels brand, which

have consistently received excellent guest feedback.

Source: Smith Travel Research for all of the above industry facts.

37

STRATEGIC REPORT GOVERNANCE

GROUP

FINANCIAL STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS

ADDITIONAL

INFORMATION