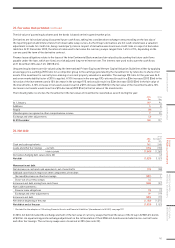

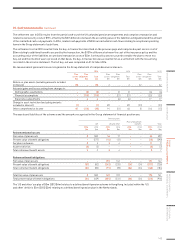

Holiday Inn 2014 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2014 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

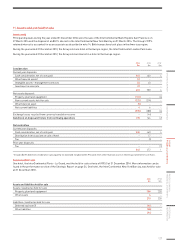

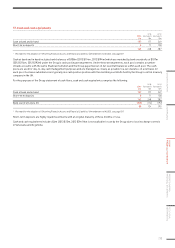

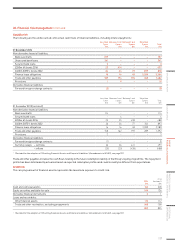

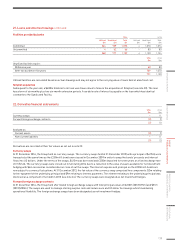

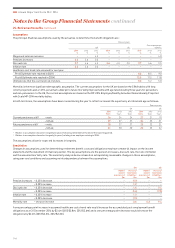

20. Financial risk management continued

Liquidity risk

The following are the undiscounted contractual cash flows of financial liabilities, including interest payments:

Less than

1 year

$m

Between 1 and

2 years

$m

Between 2 and

5 years

$m

More than

5 years

$m

Total

$m

31 December 2014

Non-derivative financial liabilities:

Bank overdrafts 107 –––107

Unsecured bank loans 361 –––361

Secured bank loans 3–––3

£250m 6% bonds 2016 23 414 – – 437

£400m 3.875% bonds 2022 24 24 73 697 818

Finance lease obligations 16 16 48 3,284 3,364

Trade and other payables 769 174 194 345 1,482

Provisions 19––10

Derivative financial liabilities:

Forward foreign exchange contracts (2) –––(2)

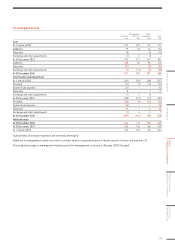

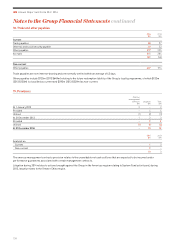

Less than

1 year

$m

Between 1 and

2 years

$m

Between 2 and

5 years

$m

More than

5 years

$m

Total

$m

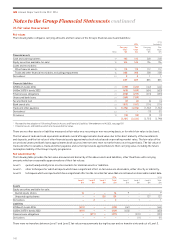

31 December 2013 (restated1)

Non-derivative financial liabilities:

Bank overdrafts 114 –––114

Secured bank loans –4––4

£250m 6% bonds 2016 25 25 438 –488

£400m 3.875% bonds 2022 26 26 77 764 893

Finance lease obligations 16 16 48 3,300 3,380

Trade and other payables 748 162 193 289 1,392

Provisions 3–––3

Derivative financial liabilities:

Forward foreign exchange contracts (1) –––(1)

Currency swaps – outflows 26 26 441 –493

– inflows (25) (25) (438) –(488)

1 Restated for the adoption of ‘Offsetting Financial Assets and Financial Liabilities’ (Amendments to IAS 32), see page 107.

Trade and other payables includes the cash flows relating to the future redemption liability of the Group’s loyalty programme. The repayment

profile has been determined by actuaries based on expected redemption profiles and could in reality be different from expectations.

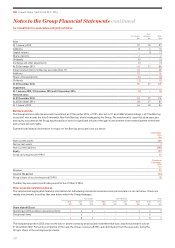

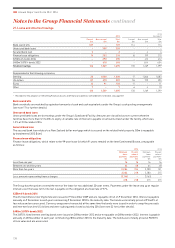

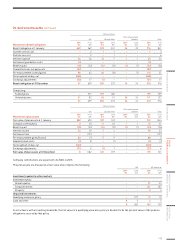

Credit risk

The carrying amount of financial assets represents the maximum exposure to credit risk.

2014

$m

2013

(restated1)

$m

Cash and cash equivalents 162 248

Equity securities available-for-sale 144 136

Derivative financial instruments 21

Loans and receivables:

Other financial assets 113 112

Trade and other receivables, excluding prepayments 388 358

809 855

1 Restated for the adoption of ‘Offsetting Financial Assets and Financial Liabilities’ (Amendments to IAS 32), see page 107.

STRATEGIC REPORT GOVERNANCE

GROUP

FINANCIAL STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS

ADDITIONAL

INFORMATION

137