Holiday Inn 2014 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2014 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

IHG’s 2015 regional priorities

1. Continue to build IHG System size through driving growth

in our priority markets of UK, Russia and the CIS, and Germany,

localising our brands as necessary.

2. Continue to improve guest experience and increase satisfaction

by focusing on quality and driving innovation to ensure our

brands are preferred.

3. Drive operational excellence and hotel outperformance by

delivering a focused and targeted hotel support model, and

best-in-class operational tools and training.

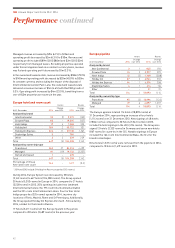

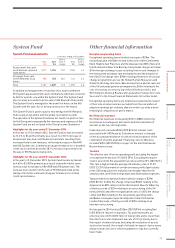

Europe comparable RevPAR

movement on previous year 12 months ended

31 December 2014

Franchised

All brands 5.3%

Managed

All brands 5.4%

Owned and leased

InterContinental (4.7)%

Continue to grow in priority markets and across

key cities, and improve underlying margin through

operational excellence over the next three years.

Europe

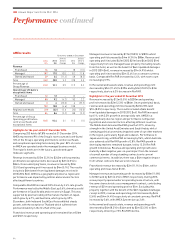

Industry performance in 2014

Europe is a diverse region and industry figures are driven by

the larger markets, in particular the UK and Germany. RevPAR

growth was 6.0%, average daily rate grew by 3.5% and demand

grew by 3.5%.

RevPAR growth in the UK reached 7.9% due to a 10.5% increase in

the UK provinces, which was driven by a 6.5% increase in average

daily rate and 4.9% increase in demand. However, RevPAR growth

in other European countries was more moderate, with RevPAR

Progress against 2014 regional priorities

In line with our 2014 regional priorities, we:

IHG’s regional performance in 2014

IHG’s comparable RevPAR increased by 5.1% with the UK

particularly strong at 8.9%. Germany was also strong at 4.1%.

IHG’s hotels in Russia and the Commonwealth of Independent

States (CIS) were, however, impacted by the geopolitical instability

in the region but our hotels outperformed the industry with a

RevPAR decline of 4.0%.

increasing in Germany by 3.8%. In contrast, the RevPAR in Russia

declined steeply by 14.8%, as growth was depressed by ongoing

conflict between Russia and the Ukraine and the resulting

geopolitical instability throughout this area. Although there was

a 5.1% decline in demand, supply continued to grow by 8.9%.

• grew in our priority markets and key gateway cities with the

signing of 48 hotels of which 17 were in the UK, 12 in Germany,

and seven in Russia and the CIS;

• continued to expand the Hotel Indigo brand across the region in

key gateway cities, opening four new properties in Paris, Madrid,

Rome and St Petersburg, and as at 31 December 2014, had 17

open hotels and a further 12 in the pipeline for the brand;

• launched the Holiday Inn Express brand in Russia and the

CIS (having localised the brand) with the opening of Holiday Inn

Express Voronezh - Kirova, a debut for the brand in Russia;

• continued to improve guest experience and increase satisfaction

at our hotels in the region by creating a culture focused on

quality, accelerating the rollout of innovation and building a suite

of tools that enables hotels to deliver operational excellence

(see progress against KPIs set out on pages 30 to 33); and

• embedded our revenue and sales tools at our hotels, driving

our commercial delivery and people platforms (see progress

against KPIs set out on pages 30 to 33), helping us to deliver

RevPAR outperformance in our three priority markets.

Source: Smith Travel Research for all of the above industry facts.

40

IHG Annual Report and Form 20-F 2014

Performance continued