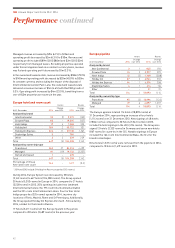

Holiday Inn 2014 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2014 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

IHG’s 2015 regional priorities

1. Further increase IHG System size, with deeper penetration in

tier 2 and 3 cities and strengthen the distribution of the Holiday

Inn and Holiday Inn Express brands to capture the growing

midscale segment opportunity.

2. Build a strong pipeline for the HUALUXE Hotels and Resorts

brand and support the subsequent hotel openings.

3. Continue to grow our talent and build a strong local talent

pipeline, particularly in tier 2 and 3 cities.

Maximise scale and strength and establish

multi-segment local operating expertise to drive

margin and expand our strong portfolio of brands

over the next three years.

Greater China

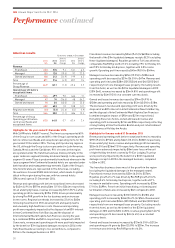

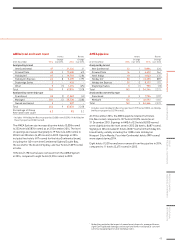

Greater China comparable RevPAR

movement on previous year 12 months ended

31December2014

Managed

All brands 1.3%

Owned and leased

InterContinental (1.0)%

Industry performance in 2014

The Chinese economy achieved GDP growth of 7.4% in 2014, a

slowdown against the average of 8.9% growth in the period from

2009 to 2013. This slowdown was attributable to several factors,

including lessening domestic demand and manufacturing output,

a correction in the real estate market and declining inflation.

Growth is expected to reduce further in 2015 and 2016.

Hotel industry RevPAR in Greater China decreased by 0.9% in the

year. Whilst overall occupancy increased by 1.9%, average daily

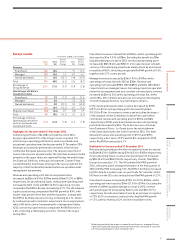

Progress against 2014 regional priorities

In line with our 2014 regional priorities, we:

IHG’s regional performance in 2014

IHG’s comparable RevPAR increased 1.6% in 2014, significantly

ahead of the overall industry. Trading was strongest in tier 1 cities,

whilst tier 2 and 3 cities were softer, impacted by new supply as

these markets develop. Our RevPAR growth was driven by

occupancy which increased by 2.4%, whilst rate decreased by 2.3%

– both ahead of the industry, reflecting our scale and management

strength in the region.

rates decreased by 2.8%. Much of this decrease in the region is due

to changes in the industry structure due to growth in tier 2 and 3

cities as well as from growth of economy brands.

RevPAR in the People’s Republic of China (excluding Taiwan)

decreased by 1.5%. Many major cities, such as Shanghai and

Guangzhou, experienced an increase in RevPAR driven by strong

occupancy gains. However, RevPAR in Beijing and surrounding

North China, East China and South China saw a decrease in

year-on-year RevPAR growth.

• grew distribution of our brands in the region with 34 hotel

openings and 64 hotels signed into our pipeline;

• opened 19 hotels during the year for the Holiday Inn brand family

(Holiday Inn and Holiday Inn Express), including the opening of

the 50th Holiday Inn Express hotel, and signed a further 45 hotels

into the pipeline for the Holiday Inn brand family;

• continued to make progress with the HUALUXE Hotels and

Resorts brand, with 24 hotels in the pipeline as at 31 December

2014 – one of which we opened in February 2015 (see page 19);

• continued to grow our talent (see page 23); and

• continued to localise IHG brands, systems, tools, processes

and responsible business practices to increase efficiency and

margin performance (see progress against KPIs set out on

pages 30 to 33).

Source: Smith Travel Research for all of the above industry facts.

46

IHG Annual Report and Form 20-F 2014

Performance continued