Holiday Inn 2014 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2014 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

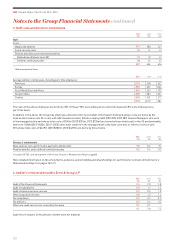

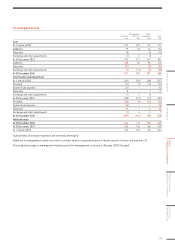

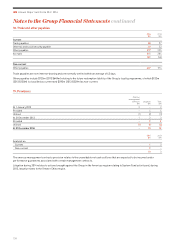

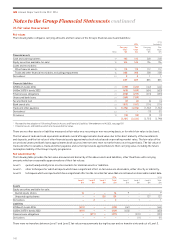

14. Investment in associates and joint ventures

Associates

$m

Joint

ventures

$m

Total

$m

Cost

At 1 January 2013 59 28 87

Additions 8 2 10

Capital returns –(3) (3)

Share of profits 2–2

Dividends (5) –(5)

Exchange and other adjustments (3) –(3)

At 31 December 2013 61 27 88

Initial retained interest in Barclay associate (note 11) 22 –22

Additions 15 –15

Share of (losses)/profits (4) –(4)

Dividends (2) –(2)

At 31 December 2014 92 27 119

Impairment

At 1 January 2013, 31 December 2013 and 31 December 2014 (3) –(3)

Net book value

At 31 December 2014 89 27 116

At 31 December 2013 58 27 85

At 1 January 2013 56 28 84

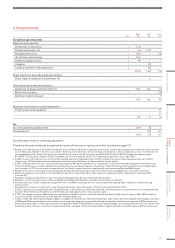

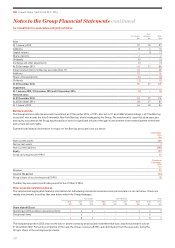

Barclay associate

The Group held one material associate investment at 31 December 2014, a 19.9% interest in 111 East 48th Street Holdings, LLC (‘the Barclay

associate’) which owns the InterContinental New York Barclay, a hotel managed by the Group. The investment is classified as an associate

and equity accounted as the Group has the ability to exercise significant influence through its involvement in the redevelopment of the hotel

and certain decision rights.

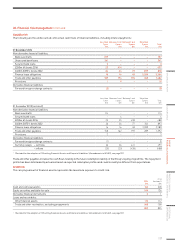

Summarised financial information in respect of the Barclay associate is set out below:

31 December

2014

$m

Non-current assets 339

Net current assets 2

Non-current liabilities (182)

Equity 159

Group carrying amount (19.9%) 32

9 months to

31 December

2014

$m

Revenue 24

Loss for the period (26)

Group’s share of loss for the period (19.9%) (5)

The Barclay associate classification was effective 31 March 2014.

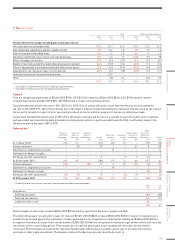

Other associates and joint ventures

The summarised aggregated financial information for individually immaterial associates and joint ventures is set out below. These are

mainly investments in entities that own hotels which the Group manages.

Associates Joint ventures Total

2014

$m

2013

$m

2012

$m

2014

$m

2013

$m

2012

$m

2014

$m

2013

$m

2012

$m

Share of profit/(loss)

Operating profit/(loss) before exceptional items 12 3 –– – 12 3

Exceptional items –6 – –– – –6 –

18 3 –– – 18 3

The exceptional profit in 2013 arose on the sale of a hotel owned by an associate investment that was classified as held for sale at

31December 2012. Followingcompletion of the sale, the Group received a $17m cash distribution from the associate, being the

Group’s share of the net disposal proceeds.

continuedNotes to the Group Financial Statements

IHG Annual Report and Form 20-F 2014

130