Holiday Inn 2014 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2014 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

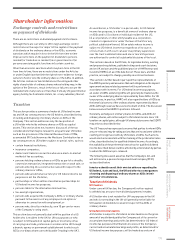

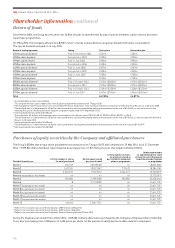

Fees and charges payable by a depositary

Direct payments

JPMorgan Chase Bank N.A. (JPMorgan or the ADR Depositary)

is the depositary for IHG’s ADR Programme. The ADR Depositary’s

principal executive office is at: J.P. Morgan Depositary Receipts,

4 New York Plaza, 12th Floor, New York, NY 10004 United States

of America. The ADR Depositary has agreed to reimburse certain

reasonable Company expenses related to the Company’s ADR

Programme and incurred by the Company in connection with the

ADR Programme. During the year ended 31 December 2014, the

Company received $490,478.87 from the ADR Depositary in

respect of legal, accounting and other fees incurred in connection

with preparation of the Annual Report and Form 20-F, ongoing

SEC compliance and listing requirements, investor relations

programmes, and advertising and public relations expenditure.

Indirect payments

As part of its service to the Company, the ADR Depositary has

agreed to waive fees for the standard costs associated with

the administration of the ADR Programme, associated operating

expenses and investor relations advice. In the year ended

31 December 2014, the ADR Depositary agreed to waive fees

and expenses amounting to $20,000.

Articles of Association

The Company’s articles of association (the Articles) were adopted

at the AGM held on 28 May 2010 and are available on the Company’s

website at www.ihgplc.com/investors under corporate governance.

The following summarises material rights of holders of the

Company’s ordinary shares under the material provisions

of the Articles and English law. This summary is qualified in

its entirety by reference to the Companies Act and the Articles.

The Company’s shares may be held in certificated or uncertificated

form. No holder of the Company’s shares will be required to make

additional contributions of capital in respect of the Company’s

shares in the future.

In the following description, a ‘shareholder’ is the person

registered in the Company’s register of members as the holder

of the relevant share.

Principal objects

The Company is incorporated under the name InterContinental

Hotels Group PLC and is registered in England and Wales with

registered number 5134420. The Articles do not restrict its

objects or purposes.

Directors

Under the Articles, a Director may have an interest in certain

matters (Permitted Interest) without the prior approval of the

Board provided he has declared the nature and extent of such

Permitted Interest at a meeting of the Directors or in the manner

set out in Section 184 or Section 185 of the Companies Act.

Any matter which does not comprise a Permitted Interest must

be authorised by the Board in accordance with the procedure and

requirements contained in the Articles, including the requirement

that a Director may not vote on a resolution to authorise a matter

in which he is interested, nor may he count in the quorum of the

meeting at which such business is transacted.

Further, a Director may not vote in respect of any proposal in

which he, or any person connected with him, has any material

interest other than by virtue of his interests in securities of, or

otherwise in or through, the Company, nor may he count in the

quorum of the meeting at which such business is transacted.

This is subject to certain exceptions, including in relation to

proposals: (a) indemnifying him in respect of obligations incurred

on behalf of the Company; (b) indemnifying a third party in respect

of obligations of the Company for which the Director has assumed

responsibility under an indemnity or guarantee; (c) relating to an

offer of securities in which he will be interested as an underwriter;

(d) concerning another body corporate in which the Director is

beneficially interested in less than one per cent of the issued

shares of any class of shares of such a body corporate; (e) relating

to an employee benefit in which the Director will share equally

with other employees; and (f) relating to liability insurance that

the Company is empowered to purchase for the benefit of

Directors of the Company in respect of actions undertaken

as Directors (or officers) of the Company.

The Directors have authority under the Articles to set their

own remuneration (provided certain criteria is met). While an

agreement to award remuneration to a Director is an arrangement

with the Company that comprises a Permitted Interest (and

therefore does not require authorisation by the Board in that

respect), it is nevertheless a matter that would be expected to give

rise to a conflict of interest between the Director concerned and

the Company, and such conflict must be authorised by a resolution

of the Board. The Director that is interested in such matter may

neither vote on the resolution to authorise such conflict, nor count

in the quorum of the meeting at which it was passed. Furthermore,

as noted above, the interested Director is not permitted to vote in

respect of any proposal in which he has any material interest

(except in respect of the limited exceptions outlined above) nor

may he count in the quorum of the meeting at which such

business is transacted.

As such, a Director has no power, in the absence of an independent

quorum, to vote on compensation to himself, but may vote on a

resolution (and may count in the quorum of the meeting at which

it was passed) to award compensation to Directors provided those

arrangements do not confer a benefit on him.

The Directors are empowered to exercise all the powers of the

Company to borrow money, subject to the limitation that the

aggregate amount of all monies borrowed by the Company and

its subsidiaries shall not exceed an amount equal to three times

the Company’s share capital and consolidated reserves, unless

sanctioned by an ordinary resolution of the Company.

Under the Articles, there are no age-limit requirements relating to

a person’s qualification to hold office as a Director of the Company.

Directors are not required to hold any shares of the Company

by way of qualification.

Rights attaching to shares

Dividend rights and rights to share in the Company’s profits

Under English law, dividends are payable on the Company’s

ordinary shares only out of profits available for distribution, as

determined in accordance with accounting principles generally

accepted in the UK and by the Companies Act. No dividend will

bear interest as against the Company.

167

STRATEGIC REPORT GOVERNANCE

GROUP

FINANCIAL STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS

ADDITIONAL

INFORMATION