Dollar Tree 2006 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2006 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR TREE STORES, INC. • 2006 ANNUAL REPORT 5

We firmly believe our responsibility, as a publicly-held company,

is driving shareholder value through solid financial performance

and prudent capital management, with an unwavering commitment to

financial integrity. We also pride ourselves on having a sound frame-

work of financial reporting controls allowing us to provide the public

markets and our shareholders honest, transparent and complete finan-

cial information in a timely fashion. These values are the foundation

on which our business was built, and to which we remain committed.

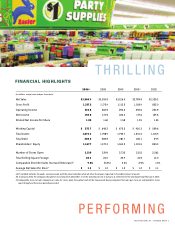

2006 FINANCIAL PERFORMANCE

We experienced improved financial performance in 2006. Sales

increased 16.9% to a record $3.97 billion. Earnings per share grew

15.6% to $1.85. Our operating margin was 7.8%, among the highest of

retailers in the value sector, but lower than previous years and less

than we would like. Therefore, we are keenly focused on this

opportunity for improvement.

We continue to generate significant Cash Flow through improved

asset management. For example, our total inventory investment grew

only 4.9% over last year, to $605 million, despite increasing our store

base 10%. Thus, inventory per store declined by 5%, and inventory

turns increased from 3.1 to 3.6. Further, our ratio of accounts payable

to inventory at year-end increased to 31.3% from 23.5% at the end of

2005, representing nearly a $50 million positive impact on cash flow.

Cash and Investments at year-end totaled $307 million, a surprisingly high number after spending

$54 million on the Deal$ acquisition and $248 million for share repurchases. In November 2006, the

Board approved a new $500 million Share Repurchase Program, reflecting confidence in our ability

to generate significant cash flow and our commitment to building shareholder value. We continued

to repurchase shares under this authorization, facilitated by $250 million of Accelerated Buyback

Programs starting in December 2006 and continuing through the first half of 2007. As of April 2007,

we have $273 million available for repurchase against this authorization.

Also, we self-funded our $175 million capital expenditures in 2006. We are planning $170-$190

million for 2007 capital expenditures including expansions of our Briar Creek Distribution Center

and home office in Chesapeake, Virginia. All of this will be funded from internally generated cash

with significant free cash flow remaining after these investments.

For 2006, we once again earned a “clean bill of health” with no material weakness noted in our

assessment of controls supporting the accounting and reporting processes, in compliance with the

requirements of Sarbanes-Oxley legislation. You can be assured that, in 2007, we will continue to

operate our Company with a strong commitment to financial integrity and the related internal

controls while driving to a cost efficient infrastructure that delivers shareholder value.

2007 OUTLOOK

Looking ahead to the balance of 2007 and beyond, we are absolutely committed to improving our

operating margins facilitated by gross margin improvement and lower expense rates, in addition to

sales growth. We will also continue to build on our asset management performance and challenge

ourselves for the appropriate capital structure to build value for our shareholders. Therefore, we

believe 2007 will be another year of improved financial performance.

I look forward to serving you in 2007.

FROM THE CFO

Kent Kleeberger

Chief Financial Officer

Kent Kleeberger

Chief Financial Officer