Dollar Tree 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

January 29, 2006. In accordance with the modified

prospective method of implementation, prior period

financial statements have not been restated to reflect

the impact of SFAS 123R. During 2006, the Company

recognized $1.8 million of stock-based compensation

expense as a result of the adoption of SFAS 123R.

Total stock-based compensation expense for 2006

and 2005 was $6.7 million and $2.4 million, respec-

tively. There was no stock-based compensation

expense for 2004. Through January 28, 2006, the

Company applied the intrinsic value recognition and

measurement principles of APB Opinion 25 and related

Interpretations in accounting for its stock-based

employee compensation plans. Prior to the adoption

of SFAS 123R, the Company reported all tax benefits

resulting from the exercise of stock options as

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

operating cash flows in the Consolidated Statements of

Cash Flows. SFAS 123R requires cash flows resulting

from the tax deductions in excess of the tax benefits

of the related compensation cost recognized in the

financial statements (excess tax benefits) to be classi-

fied as financing cash flows. Thus, the Company has

classified the $5.6 million of excess tax benefits recog-

nized in 2006 as financing cash flows. Excess tax

benefits of $1.2 million and $2.1 million recognized

in 2005 and 2004, respectively, prior to the adoption

of SFAS 123R, are classified as operating cash flows.

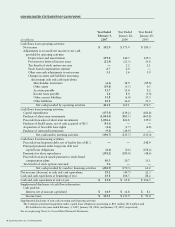

If the accounting provisions of SFAS 123 had

been applied to 2005 and 2004, the Company’s net

income and net income per share would have been

reduced to the pro forma amounts indicated in the

following table:

34 DOLLAR TREE STORES, INC. • 2006 ANNUAL REPORT

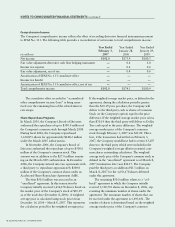

Year Ended Year Ended

January 28, January 29,

(in millions, except per share data) 2006 2005

Net income as reported $173.9 $180.3

Add: Total stock-based employee compensation expense included

in net income, net of related tax effects 1.5 —

Deduct: Total stock-based employee compensation expense determined

under fair value based method, net of related tax effects (18.2) (13.0)

$157.2 $167.3

Net income per share:

Basic, as reported $ 1.61 $ 1.59

Basic, pro forma under FAS 123 1.45 1.48

Diluted, as reported $ 1.60 $ 1.58

Diluted, pro forma under FAS 123 1.44 1.47

On December 15, 2005, the Compensation

Committee of the Board of Directors of the Company

approved the acceleration of the vesting date of all

previously issued, outstanding and unvested options

under all current stock option plans, including the

1995 Stock Incentive Plan, the 2003 Equity Incentive

Plan and the 2004 Executive Officer Equity Incentive

Plan (EOEP), effective as of December 15, 2005. At

the effective date, almost all of these options had

exercise prices higher than the actual stock price. The

Company made the decision to accelerate vesting of

these options to give employees increased perform-

ance incentives and to enhance current retention.

This decision also eliminated non-cash compensation

expense that would have been recorded in future

periods following the Company’s adoption of SFAS

123R on January 29, 2006. Compensation expense,

as determined at the time of the accelerated vesting,

has been reduced by $14.9 million, over a period of

four years during which the options would have

vested, as a result of the option acceleration program.

This amount is net of compensation expense of $0.1

million recognized in fiscal 2005 for estimated forfei-

ture of certain (in the money) options.

The Company recognizes expense related to the

fair value of restricted stock units (RSUs) over the

requisite service period. The fair value of the RSUs is

determined using the closing price of the Company’s

common stock on the date of grant.

On March 30, 2007, the Board of Directors

granted approximately 0.3 million restricted stock

units and options to purchase 0.4 million shares of

the Company’s common stock under the Company’s

Equity Incentive Plan and the EOEP.