Dollar Tree 2006 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2006 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR TREE STORES, INC. • 2006 ANNUAL REPORT 37

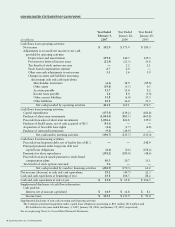

A reconciliation of the statutory federal income tax rate and the effective rate follows:

Year Ended Year Ended Year Ended

February 3, January 28, January 29,

2007 2006 2005

Statutory tax rate 35.0% 35.0% 35.0%

Effect of:

State and local income taxes,

net of federal income tax benefit 3.3 3.4 3.6

Other, net (1.7) (1.6) (1.1)

Effective tax rate 36.6% 36.8% 37.5%

The rate reduction in “other, net” in the above

table consists primarily of benefits from the resolution

of tax uncertainties, federal jobs credits and tax

exempt interest in 2006, 2005 and 2004.

Deferred income taxes reflect the net tax effects

of temporary differences between the carrying

amounts of assets and liabilities for financial report-

ing purposes and the amounts used for income tax

purposes. Deferred tax assets and liabilities are classi-

fied on the accompanying consolidated balance sheets

based on the classification of the underlying asset or

liability. Significant components of the Company’s net

deferred tax assets (liabilities) follows:

February 3, January 28,

2007 2006

Deferred tax assets:

Accrued expenses $ 33.5 $ 30.6

State tax net operating

losses and credit

carryforwards, net of

federal tax benefit 1.3 —

Accrued compensation

expense 9.3 1.0

Valuation allowance (1.3) —

Total deferred tax assets 42.8 31.6

Deferred tax liabilities:

Intangible assets (9.2) (8.0)

Property and equipment (14.3) (34.9)

Prepaids (9.0) (1.2)

Other (1.1) (0.2)

Total deferred tax

liabilities (33.6) (44.3)

Net deferred tax asset

(liability) $ 9.2 $(12.7)

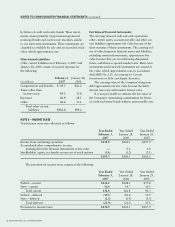

A valuation allowance of $1.3 million, net of

federal tax benefits, has been provided principally

for certain state net operating losses and credit carry-

forwards. In assessing the realizability of deferred tax

assets, management considers whether it is more likely

than not that some portion or all of the deferred taxes

will not be realized. Based upon the availability of

carrybacks of future deductible amounts to the past

two years’ taxable income and management’s projec-

tions for future taxable income over the periods in

which the deferred tax assets are deductible, manage-

ment believes it is more likely than not the remaining

existing deductible temporary differences will reverse

during periods in which carrybacks are available or

in which the Company generates net taxable income.

During 2006, the Company concluded an exami-

nation with the Internal Revenue Service (IRS) for

calendar year 1999 through fiscal year 2003. The

results of the examination were immaterial to the

financial statements. Fiscal year 2004 and forward

are open for examination by the IRS. In addition,

several years are open to state income tax audits.

Management believes that adequate provisions have

been made for any additional taxes and interest there-

on that might arise as a result of future IRS and state

examinations related to these open years.