Dollar Tree 2006 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2006 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

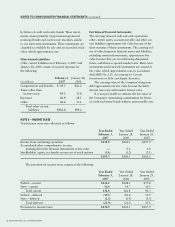

NOTE 4 – COMMITMENTS AND CONTINGENCIES

Operating Lease Commitments

Future minimum lease payments under noncancelable

stores and distribution center operating leases are

as follows:

2007 $284.2

2008 246.0

2009 207.2

2010 161.5

2011 110.6

Thereafter 167.5

Total minimum lease payments $1,177.0

The above future minimum lease payments

include amounts for leases that were signed prior to

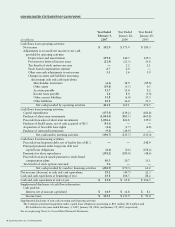

Year Ended Year Ended Year Ended

February 3, 2007 January 28, 2006 January 29, 2005

Minimum rentals $261.8 $225.8 $200.7

Contingent rentals 0.9 0.7 0.9

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

38 DOLLAR TREE STORES, INC. • 2006 ANNUAL REPORT

February 3, 2007 for stores that were not open as of

February 3, 2007.

Minimum rental payments for operating leases

do not include contingent rentals that may be paid

under certain store leases based on a percentage of

sales in excess of stipulated amounts. Future mini-

mum lease payments have not been reduced by

expected future minimum sublease rentals of $2.3

million under operating leases.

Minimum and Contingent Rentals

Rental expense for store and distribution center

operating leases (including payments to related

parties) included in the accompanying Consolidated

Statements of Operations are as follows:

January 28, 2006, and January 29, 2005, respectively.

Total future commitments under related party leases

are $1.4 million.

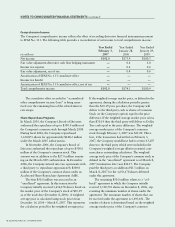

Freight Services

The Company has contracted outbound freight

services from various contract carriers with contracts

expiring through January 2010. The total amount of

these commitments is approximately $57.1 million,

of which approximately $38.6 million is committed

in 2007, $9.9 million is committed in 2008 and $8.6

million is committed in 2009.

Technology Assets

The Company has commitments totaling approxi-

mately $3.8 million to purchase store technology

assets for its stores during 2007.

Letters of Credit

In March 2001, the Company entered into a Letter

of Credit Reimbursement and Security Agreement.

The agreement provides $125.0 million for letters of

credit. In December 2004, the Company entered into

an additional Letter of Credit Reimbursement and

Non-Operating Facilities

The Company is responsible for payments under leases

for certain closed stores. The Company was also

responsible for payments under leases for two former

distribution centers whose leases expired in June 2005

and September 2005. The Company accounts for

abandoned lease facilities in accordance with SFAS

No. 146, Accounting for Costs Associated with Exit

or Disposal Activities. A facility is considered aban-

doned on the date that the Company ceases to use it.

On this date, the Company records an expense for

the present value of the total remaining costs for the

abandoned facility reduced by any actual or probable

sublease income. Due to the uncertainty regarding

the ultimate recovery of the future lease and related

payments, the Company recorded charges of $0.1

million, $0.3 million and $1.5 million in 2006, 2005

and 2004, respectively.

Related Parties

The Company also leases properties for six of its

stores from partnerships owned by related parties. The

total rental payments related to these leases were $0.5

million for each of the years ended February 3, 2007,