Dollar Tree 2006 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2006 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Operating and corporate expenses decreased 10

basis points primarily as the result of payments

received for early lease terminations in the

current year.

Operating Income. Due to the reasons discussed

above, operating income margin decreased to 7.8%

in 2006 compared to 8.4% in 2005.

Income Taxes. Our effective tax rate was 36.6% in

2006 compared to 36.8% in 2005. The decreased

tax rate for 2006 was due primarily to increased

tax-exempt interest on certain of our investments

in the current year.

FISCAL YEAR ENDED JANUARY 28, 2006 COMPARED TO

FISCAL YEAR ENDED JANUARY 29, 2005

Net Sales. Net sales increased 8.6% in 2005 com-

pared to 2004. We attribute this $267.9 million

increase in net sales primarily to new stores in 2005

and 2004 (which are not included in our comparable

store net sales calculation) partially offset by a slight

decrease in comparable store net sales of 0.8% in

2005. Our comparable store net sales are positively

affected by our expanded and relocated stores, which

we include in the calculation, and, to a lesser extent,

are negatively affected when we open new stores or

expand stores near existing stores.

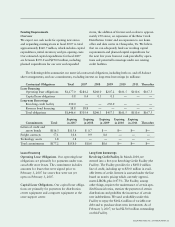

The following table summarizes the components

of the changes in our store count for fiscal years

ended January 28, 2006 and January 29, 2005.

January 28, January 29,

2006 2005

New stores 197 209

Acquired leases 35 42

Expanded or relocated stores 93 129

Closed stores (53) (29)

Of the 2.6 million selling square foot increase in

2005, approximately 0.5 million in selling square feet

was added by expanding existing stores.

MANAGEMENT’S DISCUSSION & ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Gross Profit. Gross profit margin decreased to 34.5%

in 2005 compared to 35.6% in 2004. The decrease is

primarily due to the following:

• Merchandise cost, including inbound freight,

increased approximately 55 basis points, due to

a slight shift in mix to more consumables, which

have a lower margin and increased inbound

freight costs due to higher fuel costs.

• Occupancy costs increased approximately 45

basis points due primarily to deleveraging associ-

ated with the negative comparable store net sales

for the year.

Selling, General and Administrative Expenses. Selling,

general and administrative expenses, as a percentage

of net sales, were 26.2% for 2005 and 2004.

However, several components had increases or

decreases as noted below:

• Operating and corporate expenses decreased

approximately 25 basis points primarily due to

decreased store supplies expense as a result of

better pricing, decreased professional fees and

the receipt of insurance proceeds resulting from

a fire at one of our locations, partially offset by

increased interchange fees resulting from the

rollout of debit card acceptance in 2005.

• Payroll related costs decreased approximately

10 basis points due to a reduction in incentive

compensation accruals that are based on lower

than budgeted 2005 earnings and lower workers’

compensation and health care claims in 2005.

• These decreases were partially offset by an

approximate 25 basis point increase in store oper-

ating costs primarily due to higher utility costs

due to higher rates and consumption in 2005.

• Depreciation expense for stores also increased

10 basis points primarily due to the deleveraging

associated with negative comparable store net

sales for 2005.

18 DOLLAR TREE STORES, INC. • 2006 ANNUAL REPORT