Dollar Tree 2006 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2006 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Operating Income. Due to the reasons discussed

above, operating income margin decreased to 8.3%

in 2005 compared to 9.4% for 2004.

Interest Income. Interest income increased $2.2

million in 2005 compared to 2004 because of

higher investment balances in 2005 and increased

interest rates.

Interest Expense. Interest expense increased $4.8

million in 2005 as compared to 2004. This increase

is primarily due to increased rates on our revolver

in 2005.

Income Taxes. Our effective tax rate was 36.8% in

2005 compared to 37.5% in 2004. The decreased tax

rate for 2005 was due primarily to the resolution of

DOLLAR TREE STORES, INC. • 2006 ANNUAL REPORT 19

coolers to certain stores in the current year.

The $32.6 million increase in cash used in financ-

ing activities in 2006 compared to 2005 primarily

resulted from $248.2 million in stock repurchases in

the current year compared to $180.4 million in the

prior year. This increase was partially offset by

increased proceeds from stock option exercises in

the current year resulting from our higher stock prices

in 2006 as compared to 2005.

The $88.6 million increase in cash provided by

operating activities in 2005 was primarily due to an

approximate 12% decrease in inventory per store at

January 28, 2006 compared to January 29, 2005.

The inventory per store decrease is the result of an

initiative to lower backroom inventory levels and

increase inventory turns through a reduction in 2005

purchases. The aforementioned net cash provided by

operating activities was partially offset by a decrease

in deferred tax liabilities chiefly as a result of the

elimination of bonus depreciation.

The $47.7 million increase in cash provided by

operating activities in 2006 was primarily due to

increased earnings before depreciation in the current

year and better payables management in the current

year, partially offset by approximately $20.0 million

of rent payments for February 2007 made prior to the

end of fiscal 2006.

The $44.8 million decrease in cash used in invest-

ing activities in 2006 compared to 2005 was the

result of a $114.9 million increase in net proceeds

from short-term investments which were used to help

fund stock repurchases and the Deal$ acquisition in

the current year. In the current year, we purchased an

additional $9.3 million of investments in a restricted

account to collateralize certain long-term insurance

obligations. Additional uses of cash for investing

activities consisted of $54.1 million for the Deal$

acquisition in the current year and an increase of

$36.1 million in capital expenditures due primarily to

new store growth and the installation of freezers and

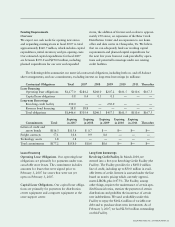

Year Ended Year Ended Year Ended

(in millions) February 3, 2007 January 28, 2006 January 29, 2005

Net cash provided by (used in):

Operating activities $412.8 $365.1 $276.5

Investing activities (190.7) (235.5) (315.4)

Financing activities (202.9) (170.3) 61.2

tax uncertainties in 2005 and increased tax-exempt

interest on certain of our investments.

Liquidity and Capital Resources

Our business requires capital to build and open new

stores, expand our distribution network and operate

existing stores. Our working capital requirements for

existing stores are seasonal and usually reach their

peak in September and October. Historically, we have

satisfied our seasonal working capital requirements

for existing stores and have funded our store opening

and distribution network expansion programs from

internally generated funds and borrowings under our

credit facilities.

The following table compares cash-related infor-

mation for the years ended February 3, 2007, January

28, 2006, and January 29, 2005: