Dollar Tree 2006 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2006 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

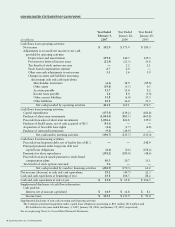

The $79.9 million decrease in cash used in

investing activities in 2005 compared to 2004 was

the result of a $34.2 million decrease in net purchases

of investments resulting from more cash used to

repurchase stock in 2005. The net purchases of

investments in 2005 include $29.9 million of invest-

ments that are in a restricted account to collateralize

certain long-term insurance obligations. These invest-

ments replaced higher cost stand-by letters of credit

and surety bonds. Capital expenditures also

decreased $42.5 million in 2005 after two distribu-

tion center projects and point-of-sale installations

were completed in 2004.

The $231.5 million change in cash used in financ-

ing activities in 2005 compared to 2004 primarily

resulted from $180.4 million in stock repurchases in

2005 compared to $48.6 million in 2004. Also in

2004, we entered into a five-year $450.0 million

Revolving Credit Facility, under which we received

net proceeds of $248.9 million. We used a portion

of these proceeds to repay $142.6 million of variable

rate debt for our distribution centers and invested the

balance in short-term tax exempt municipal bonds.

At February 3, 2007, our long-term borrowings

were $268.8 million and our capital lease commit-

ments were $0.7 million. We also have $125.0 million

and $50.0 million Letter of Credit Reimbursement

and Security Agreements, under which approximately

$84.8 million were committed to letters of credit

issued for routine purchases of imported merchandise

at February 3, 2007.

In March 2005, our Board of Directors author-

ized the repurchase of up to $300.0 million of our

common stock through March 2008. During fiscal

2006, we repurchased 5,650,871 shares for approxi-

mately $148.2 million under the March 2005

authorization.

In November 2006, our Board of Directors

authorized the repurchase of up to $500.0 million

of our common stock. This amount was in addition

to the $27.0 million remaining on the March 2005

authorization. In December 2006, we entered into

two agreements with a third party to repurchase

approximately $100.0 million of the Company’s

common shares under an Accelerated Share

Repurchase Agreement (ASR).

MANAGEMENT’S DISCUSSION & ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The first $50.0 million was executed in an

“uncollared” agreement. In this transaction, we ini-

tially received 1,656,178 shares based on the market

price of our stock of $30.19 as of the trade date

(December 8, 2006). A weighted average price was

calculated using stock prices from December 16, 2006

– March 8, 2007. This represents the calculation peri-

od and based on the weighted average price during

this period, a settlement took place in March 2007

resulting in additional funding of $3.3 million.

The remaining $50.0 million relates to a “col-

lared” agreement in which we initially received

1,500,703 shares representing the minimum number

of shares under the agreement. The maximum num-

ber of shares that can be repurchased under the agree-

ment is 1,693,101. The number of shares was deter-

mined based on the weighted average market price of

our common stock during the same calculation period

as defined in the “uncollared” agreement. The

weighted average market price as of February 3, 2007

as defined in the “collared” agreement was $30.80.

Therefore, as of February 3, 2007, we would receive

an additional 122,742 shares under the “collared”

agreement. Based on the applicable accounting litera-

ture, these additional shares were not included in the

weighted average diluted earnings per share calcula-

tion because their effect would be antidilutive. The

weighted average stock price of our common stock as

defined in the “collared” agreement as of March 8,

2007 (termination date) was $31.97. We received an

additional 63,325 shares on March 8, 2007 under

this agreement.

On March 29, 2007, we entered into an agree-

ment with a third party to repurchase approximately

$150.0 million of our common shares under another

ASR. The entire $150.0 million was executed under

a “collared” agreement. Within two weeks of the

March 29, 2007 execution date, we will receive the

minimum number of shares. Up to four months after

the initial execution date, we will receive additional

shares from the third party depending on the volume

weighted average price of our common shares during

that period, subject to the maximum share delivery

provisions of the agreement.

20 DOLLAR TREE STORES, INC. • 2006 ANNUAL REPORT