Dollar Tree 2006 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2006 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

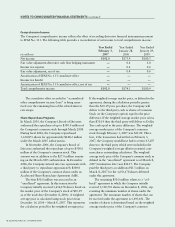

First Second Third Fourth

Quarter(1) Quarter Quarter Quarter(2)

Fiscal 2006:

Net sales $856.5 $883.6 $910.4 $1,318.9

Gross profit 286.1 293.3 307.5 470.3

Operating income 53.5 48.2 53.5 155.6

Net income 32.9 29.0 32.5 97.6

Diluted net income per share 0.31 0.28 0.32 0.96

Stores open at end of quarter 3,119 3,156 3,192 3,219

Comparable store net sales change 4.0% 4.2% 4.0% 5.5%

Fiscal 2005:

Net sales $749.1 $769.0 $796.8 $1,079.0

Gross profit 254.2 261.5 276.3 380.4

Operating income 48.2 46.8 52.3 136.6

Net income 29.0 27.3 31.1 86.5

Diluted net income per share 0.26 0.25 0.29 0.81

Stores open at end of quarter 2,791 2,856 2,899 2,914

Comparable store net sales change (3.7%) (1.5%) (1.0%) 1.0%

(1) Easter was observed on April 16, 2006 and March 27, 2005.

(2) Fiscal 2006 contains 14 weeks ended February 3, 2007 while Fiscal 2005 contains 13 weeks ended January 28, 2006.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

48 DOLLAR TREE STORES, INC. • 2006 ANNUAL REPORT

of SKM Equity. John Megrue is also a principal mem-

ber of Apax Partners, L.P., which serves as the general

partner for SKM Investment. The $4.0 million invest-

ment in Ollie’s is accounted for under the cost method

of accounting and is included in “other assets” in the

accompanying consolidated balance sheets.

NOTE 12 – SUBSEQUENT EVENT

On March 29, 2007, the Company entered into an

agreement with a third party to repurchase approxi-

mately $150.0 million of the Company’s common

shares under an Accelerated Share Repurchase

Agreement. The entire $150.0 million was executed

under a “collared” agreement. Within two weeks of

the March 29, 2007 execution date, the Company

will receive the minimum number of shares. Up to

four months after the initial execution date, the

Company will receive additional shares from the third

party depending on the volume weighted average

price of the Company’s common shares during that

period, subject to the maximum share delivery

provisions of the agreement.

NOTE 13 – QUARTERLY FINANCIAL INFORMATION

(Unaudited)

The following table sets forth certain items from the

Company’s unaudited Consolidated Statements of

Operations for each quarter of fiscal year 2006 and

2005. The unaudited information has been prepared

on the same basis as the audited consolidated finan-

cial statements appearing elsewhere in this report and

includes all adjustments, consisting only of normal

recurring adjustments, which management considers

necessary for a fair presentation of the financial data

shown. The operating results for any quarter are not

necessarily indicative of results for a full year or for

any future period.