Dollar Tree 2006 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2006 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR TREE STORES, INC. • 2006 ANNUAL REPORT 41

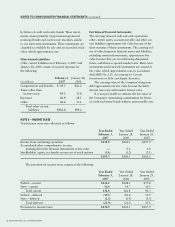

variable-interest rate, as calculated under the swap agreement, is greater than the “knock-out rate.” The

following table summarizes the terms of the interest rate swap:

Derivative Origination Expiration Pay Fixed Knock-out

Instrument Date Date Rate Rate

$18.8 million swap 4/1/99 4/1/09 4.88% 7.75%

variable-interest rate to a fixed-rate. Under this agree-

ment, the Company paid interest to a financial insti-

tution at a fixed-rate of 5.43%. In exchange, the

financial institution paid the Company at a variable-

interest rate, which approximated the floating rate on

the debt, excluding the credit spread. The interest rate

on the swap was subject to adjustment monthly con-

sistent with the interest rate adjustment on the debt.

The swap expired in March 2006.

NOTE 7 – SHAREHOLDERS’ EQUITY

Preferred Stock

The Company is authorized to issue 10,000,000

shares of Preferred Stock, $0.01 par value per share.

No preferred shares are issued and outstanding at

February 3, 2007 and January 28, 2006.

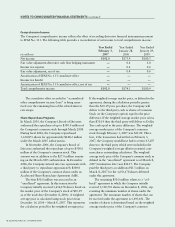

Net Income Per Share

The following table sets forth the calculation of basic

and diluted net income per share:

This swap reduces the Company’s exposure to

the variable-interest rate related to the Demand

Revenue Bonds (see Note 5).

Hedging Derivative

The Company was party to one derivative instrument

in the form of an interest rate swap that qualified for

hedge accounting treatment pursuant to the provi-

sions of SFAS No. 133.

In 2001, the Company entered into a $25.0 mil-

lion interest rate swap agreement (swap) to manage

the risk associated with interest rate fluctuations on a

portion of the Company’s variable interest entity debt.

In March 2004, the Company repaid all of the vari-

able interest entity debt with borrowings from the

Facility (see Note 5). The Company redesignated this

swap to borrowings under the Facility. This redesig-

nation does not affect the accounting treatment used

for this interest rate swap. The swap created the eco-

nomic equivalent of fixed-rate debt by converting the

Year Ended Year Ended Year Ended

February 3, January 28, January 29,

(in millions, except per share data) 2007 2006 2005

Basic net income per share:

Net income $192.0 $173.9 $180.3

Weighted average number of shares outstanding 103.2 108.3 113.3

Basic net income per share $ 1.86 $ 1.61 $ 1.59

Diluted net income per share:

Net income $192.0 $173.9 $180.3

Weighted average number of shares outstanding 103.2 108.3 113.3

Dilutive effect of stock options and restricted stock

(as determined by applying the treasury stock method) 0.6 0.4 0.7

Weighted average number of shares and dilutive

potential shares outstanding 103.8 108.7 114.0

Diluted net income per share $ 1.85 $ 1.60 $ 1.58

At February 3, 2007, January 28, 2006 and January 29, 2005, respectively, 1.5 million, 3.4 million and

1.5 million stock options are not included in the calculation of the weighted average number of shares and

dilutive potential shares outstanding because their effect would be anti-dilutive.