Dollar Tree 2006 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2006 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Net Income Per Share

Basic net income per share has been computed by

dividing net income by the weighted average number

of shares outstanding. Diluted net income per share

reflects the potential dilution that could occur assum-

ing the inclusion of dilutive potential shares and has

been computed by dividing net income by the weight-

ed average number of shares and dilutive potential

shares outstanding. Dilutive potential shares include

all outstanding stock options and unvested restricted

stock, excluding certain performance based restricted

stock grants, after applying the treasury stock method.

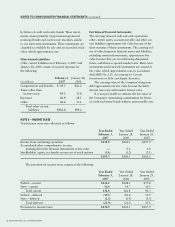

NOTE 2 – BALANCE SHEET COMPONENTS

Intangibles, Net

Intangibles, net, as of February 3, 2007 and January

28, 2006 consist of the following:

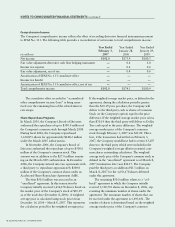

February 3, January 28,

(in millions) 2007 2006

Non-competition agreements $ 6.4 $ 6.4

Accumulated amortization (5.1) (4.3)

Non-competition

agreements, net 1.3 2.1

Favorable lease rights 19.0 12.6

Accumulated amortization (7.0) (4.1)

Favorable lease rights, net 12.0 8.5

Goodwill 144.9 130.3

Accumulated amortization (11.6) (11.6)

Goodwill, net 133.3 118.7

Total intangibles, net $146.6 $129.3

Non-Competition Agreements

The Company has entered into non-competition

agreements with certain former executives of certain

acquired entities. These assets are being amortized

over the legal term of the individual agreements,

ranging from five to ten years.

Favorable Lease Rights

In 2006 and 2005, the Company acquired favorable

lease rights for operating leases for retail locations

from third parties, including the acquired favorable

lease rights in its acquisition of 138 Deal$ stores (see

Note 10). The Company’s favorable lease rights are

amortized on a straight-line basis to rent expense

over the remaining initial lease terms, which expire

DOLLAR TREE STORES, INC. • 2006 ANNUAL REPORT 35

at various dates through 2016. The weighted average

life remaining on the favorable lease rights at

February 3, 2007 is 54 months.

Amortization expense related to the non-com-

petition agreements and favorable lease rights was

$4.4 million, $3.3 million and $1.6 million for the

years ended February 3, 2007, January 28, 2006 and

January 29, 2005, respectively. Estimated annual

amortization expense for the next five years follows:

2007 – $4.8 million; 2008 – $3.4 million; 2009 –

$1.8 million, 2010 – $1.2 million, and 2011 –

$0.7 million.

Goodwill

In accordance with SFAS No. 142, goodwill is no

longer being amortized, but is tested annually for

impairment. In addition, goodwill will be tested on an

interim basis if an event or circumstance indicates that

it is more likely than not that an impairment loss has

been incurred. The Company performed its annual

impairment testing in November 2006 and deter-

mined that no impairment loss existed.

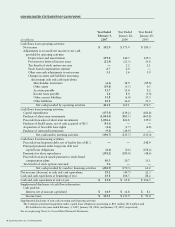

Property, Plant and Equipment, Net

Property, plant and equipment, net, as of February 3,

2007 and January 28, 2006 consists of the following:

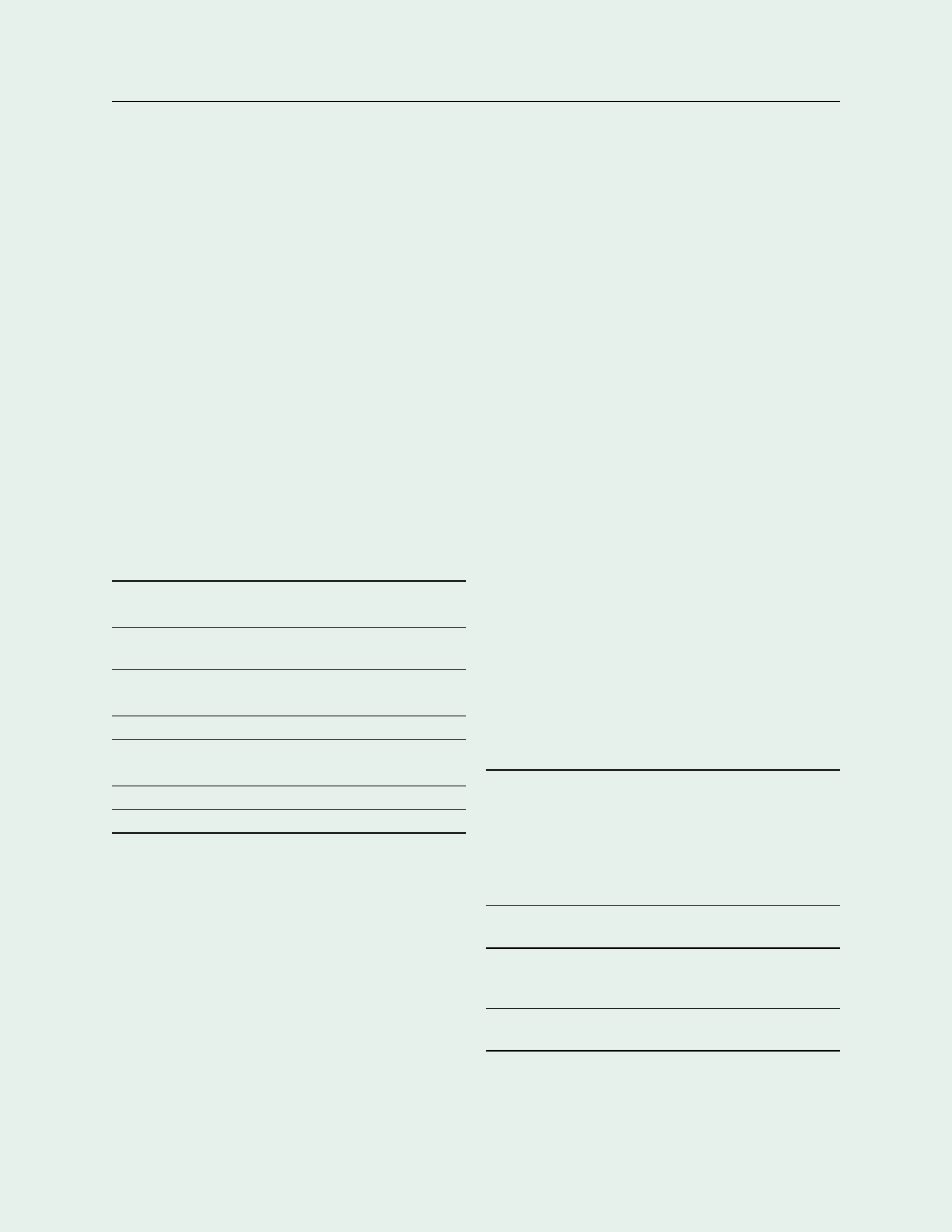

February 3, January 28,

(in millions) 2007 2006

Land $ 29.4 $ 29.4

Buildings 154.7 154.7

Improvements 482.3 418.1

Furniture, fixtures and

equipment 708.6 608.4

Construction in progress 38.3 29.3

Total property, plant

and equipment 1,413.3 1,239.9

Less: accumulated

depreciation and

amortization 698.0 558.1

Total property, plant

and equipment, net $ 715.3 $ 681.8

Other Assets, Net

Other assets, net includes $39.2 million of restricted

investments. The Company purchased these restricted

investments to collateralize long-term insurance obli-

gations. These investments replaced higher cost stand